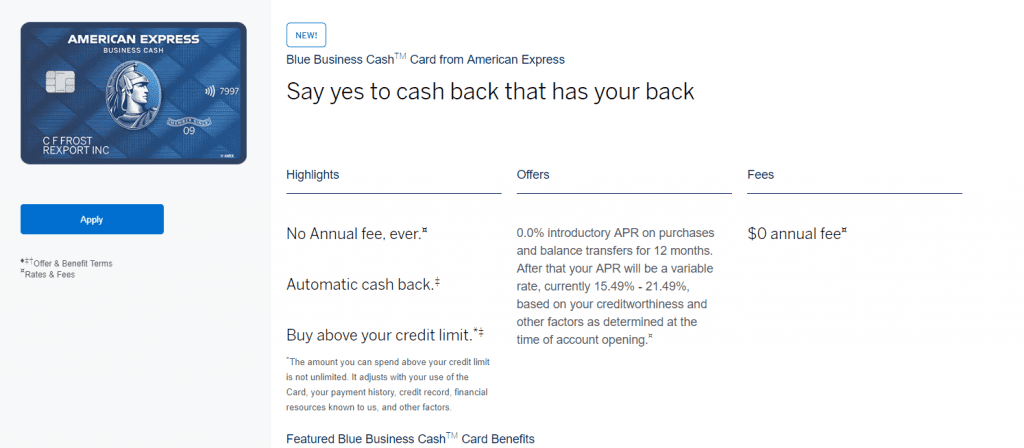

American Express has launched a new business credit card called ‘Blue Business Cash‘. Let’s take a look at this new card in this mini review.

Contents

Card Basics

- Card earns 2% cash back on all purchases for the first $50,000 in spend every year, then 1% cash back on all purchases

- No annual fee

- No sign up bonus

- 0% introductory APR on purchases and balance transfers for 12 months

Our Thoughts

If this cards structure looks familiar, it’s because it’s basically a carbon copy of the Blue Business Plus. The only difference is that card earns 2x Membership Rewards points on the first $50,000 in spend, rather than 2% in cash. This new cash card isn’t very appealing, due to the pure fact that there are a lot of cards that earn 2% cash back on all purchases (or more) with no caps. Often when cards are initially released there is no sign up bonus, but typically we see a launch bonus shortly after (usually from affiliate links). I’m hopeful that we will see a bonus of $200-$250 with a relatively low minimum spend requirement, but a bonus of only $150 is also bonus. Because of American Express’ one bonus per lifetime this card could be worth considering if it ever gets a sign up bonus for people that have already received the sign up bonus on the more generous cards.

Hat tip to reader Yet Another Redditor

Update: they apparently discontinued the SimplyCash 5% card as part of the launch of this new card.

How can 2% cash back possibly be bad on a business card with no AF? That’s crazy talk to me. Most of my business expenses don’t fall into bonus categories to begin with, so this AMEX sort of raises the CB bar from 1% to 2%. You can max out the credit limit and the utilization wouldn’t affect your credit score, it’s a business card!

Am I the crazy one here? This card is amazing! Just charge other cards if they get better bonus categories, easy peasy.

For people who currently have this card, are you seeing any AMEX offers on this one? It looks like every card I have contain offers except for this one.

The card has a bonus similar to the SimplyCash Plus now. $250 after $5K spend, and another $250 after another $10K spend.

Not every new card needs to be exciting. I got this card because it gets me 33% more cash back than my Cash Magnet. Some of us want all of our business with AmEx; now I’m even with the other 2% cards and I don’t need to deal with categories. Well done AmEx.

Sweet – direct competitor to the Capital One Spark Cash card, but this one has no AF. Well done Amex. Agreed that it’s not an exciting card, but with all the recent hikes in annual fees (e.g. Platinum, Gold, Bonvoy business), it’s nice to see a fee-free option from Amex.

There’s no need to pay the fee on the Spark card. If you actually use it, call them when the fee hits and they’ll credit it off. I’ve done this for the past couple of years.

That makes it an unlimited 2% back card with no fee. 🙂

Agreed, but after a few years of that I finally got tired of calling. IMHO Cap One is harder to deal with, particularly phone communication. When this Amex card gets a signup bonus, I will very likely apply.

I would slightly disagree with the statement “… due to the pure fact that there are a lot of cards that earn 2% cash back on all purchases (or more) with no caps”

How many of those are *business* cards? I can only think of one business card that gets 2% cash back and that’s the crapital one (3 hard inquiries-one for each credit bureau) card. Citi Double is personal card only.

What other business cards give 2% out of curiosity if there’s a lot of them out there?

And how many of those have no AF?

I mostly agree with you, but the real issue here is the max $50k/year cap. That’s max $1k back per year before it drops to 1%, not a huge difference vs the $750/75k points per year of the uncapped Ink Unlimited on $50k spend. If the card didn’t have the $50k cap, it would be a truly unique business card.

You can dedicate business spend to any credit card for tax purposes, it doesn’t have to be an official business card. You can use the Citi Double Cash or Fidelity Visa, both 2% back no limit, for business. The key is not to mix your personal and business spend.

But unless you pay it off before the statement closes, it’ll affect your personal credit report.

Blue business plus is a much better choice

Why? I have the BBP and never use it. If you don’t have a need/intent to transfer the MR points to airline partners, there’s no good way to get .01 value out of them. unless they’re hardcore travelers, I think most people are going to value cash back over MR points – I know I do…

I actually suspect you’re in the minority because I value cash but have the Schwab platinum which gets me 1.25cpp. So combined with the BBP I get 2.5% cash back.

Exactly !!!!!

Problem is you have to look at the cost of maintaining a platinum card and that hefty annual fee which is now harder to utilize the airline credits with as well. There isn’t a right or wrong answer, but it’s clear that there’s enough of a market for both cash and rewards points.

This is definitely way worse than the SimplyCash it is replacing. Surprised there’s no talks/rumors about this before.

It seems like Amex just wants me to get another bonus (later when it is available). Otherwise dont see a reson they came up with this.

Applied couple hours ago and was automatically denied, totally forgot about the 2-90 rule, oh well, ill apply again after Aug 5 lol, by the way the SimplyCash was removed, didn’t see it there, any update on this ??

I can see the Simply Cash card as an option on a referral.

Which card is allowing you to still refer to SCP?

I tried a lot of referral links and I can’t find SCP as an option in any of them. The public link also leads to this new card (BBC)

It was Blue Biz Plus. It was there last night, but when I checked again today that option is gone.

I’m not seeing the SimplyCash on the site or through my referral links either. Maybe it’s a thing of the past now?

Why would you apply for this without a signup bonus? AmEx takes two billing cycles to credit the points (at Capital One Venture, it takes merely a couple of days after making the purchase), it’s merely 2%, AmEx has a 5 card limit, and you won’t be eligible for a bonus once they do offer it — seems like a pretty bad idea to apply for this card right now.