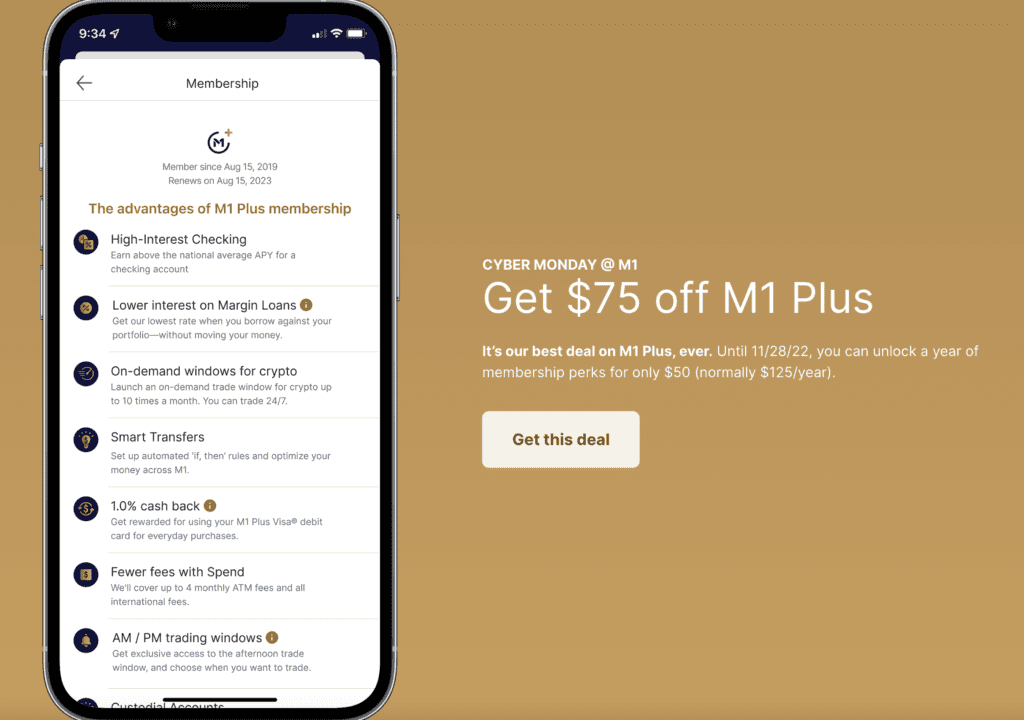

M1 Finance launched a sale today on their M1 Plus membership for just $50 instead of $125. The deal is available through 11/28/22 and works for existing members as well to get their renewal for just $50.

Having M1 Plus gets you access to special cashback rates on their debit card, more details on how that works can be found in this post. They are also slated to be launching in January a 4.50% APY savings account for M1 Plus members, but that’s not live yet.

If you are new to M1, you can get $10 by signing up with a referral link (thread to find a referral here), though honestly it’s not the biggest deal for new members since you can get 3 months of M1 Plus free.

Hat tip to readers Peek and Josef

Does anyone know if buying this adds 1 year to expiry date of the M1 plus if you are on a free trial or you lose the remaining days of the trial?

Well, I think some folks find some value in the benefits. I like the Smart Transfers feature for M1+. It makes it handy for me. I have a Smart Transfer rule set that allows a lot of ‘hands off’ flexibility.

For example, my rule set has a threshold amount for checking (M1 Spend) that gets deposited into my emergency savings, unless my emergency savings are already at the desired level (6 months of expenses for me) – then it gets deposited into my brokerage account. It is auto invested into my portfolio based on the percentages I’ve assigned to each of the ETFs.

It’s an easy set it and forget it approach to my investing. Other folks have rules that take out margin (M1 Borrow) and refill their checking account or invest more based on thresholds in their accounts.

I’m a buy and hold investor, so M1 appeals to me in general. There are better rates out there for HYSA, and even better would be to leverage treasury bills to get out of paying state/local tax on interest from t-bill earnings. There are certainly brokers that offer their own funds/ETFs that have lower expenses than M1 offers as well. If you’re out to be as low cost or want to jump ship often for better yield, then I think M1 isn’t right for you. On the whole for me, a long term guy that won’t trade often at all, it’s a good fit.

$50 (my first year was free – and I got a $100 bonus for signing up for M1 anyway) is palatable for me for the decent rates and the smart transfer features. Reimbursable ATM is nice, but other places offer that too. I’ve wasted far more money on other things than the fifty bucks it will cost me to keep investing simple and hands-free. I might be an outlier here, but a decent value in my view.

Not worth it even at free.

I was reading the benefits but have a hard time justifying even for $50. Or maybe I just don’t understand the value of the features.

Can someone enlighten me how it’s worth the annual fee? Although the checking earns high interest, you can still do better with an online savings account. Not sure what’s special about an afternoon trade window when most brokerages have some aftermarket hours. Not sure what an ‘on-demand’ crypto window is when crypto already trades 24/7.

The another “notable” thing is maybe the margin rate. But you could go to interactive brokers and get great rates too.

Yeah, it is free for the first year and I have not used it at all after getting the bonus. Time to close the account. Personally, I find this whole slice thingy weird.

M1+ is heavily YMMV.

– Discount on margin loans (competitive rates, but not necessarily the only option)

– High APY checking with ATM fee reimbursements (useful for a checking account’s revolving balances, but everyone has a HYSA too so it’s questionable)

– High APY savings (nice, but how much higher will it be in relation to other HYSAs by the time it rolls out?)

– More cash back on their credit card (YMMV on value and they removed the SUB)

– 1% cash back with the debit card instead of 0% (but most people use credit cards for cash back anyway)

The extra trading windows are useless for DCAing.

M1+ is theoretically valuable, but min-max people like DoC readers likely won’t get enough value from it to justify the annual fee. You’d need a big chunk of funds in their savings account AND probably use 1-2 other features on top of that.

1% back on debit card spend is great! It’s easy to make more than $50 off of this benefit alone.

Curious how you make money off the 1% back on debit cards? Consider the lowest cash back credit card is 2%, you’d be losing $50 if you swipe $5K worth of spend just to break even with the $50 AF.

In my world, there are plenty of transactions that allow debit cards but not credit cards.

I think you mean “special cash back rates on their CREDIT card” not debit. Although I find the 1% back on their debit card for M1 plus to be pretty useful.

It’s both credit/debit where special rates are concerned. Free M1 Checking doesn’t give cash back for the debit card.

Just a reminder that once you move your Investments in to M1 –

Note that there is $100 outgoing ACAT fee for all account types and additional $100 closing fee for retirement accounts. For example:

Transferring out your Individual Brokerage Account would incur a fee of $100.

Transferring out your Roth IRA would incur a fee of $200.

Damn I opened an account last year and didn’t realize. Any way to get around it?

ACAT to a brokerage that reimburses for the fees.

Also can apply the discount for current members, the renewal year will be $50.

Let me add a note

Any chance we can open up the referral thread again?