A bunch of us sent out fax applications for the JP Morgan Reserve, a card almost identical to the Sapphire Reserve, due to a leaked application fax number and a story of a couple people who got approvals that way.

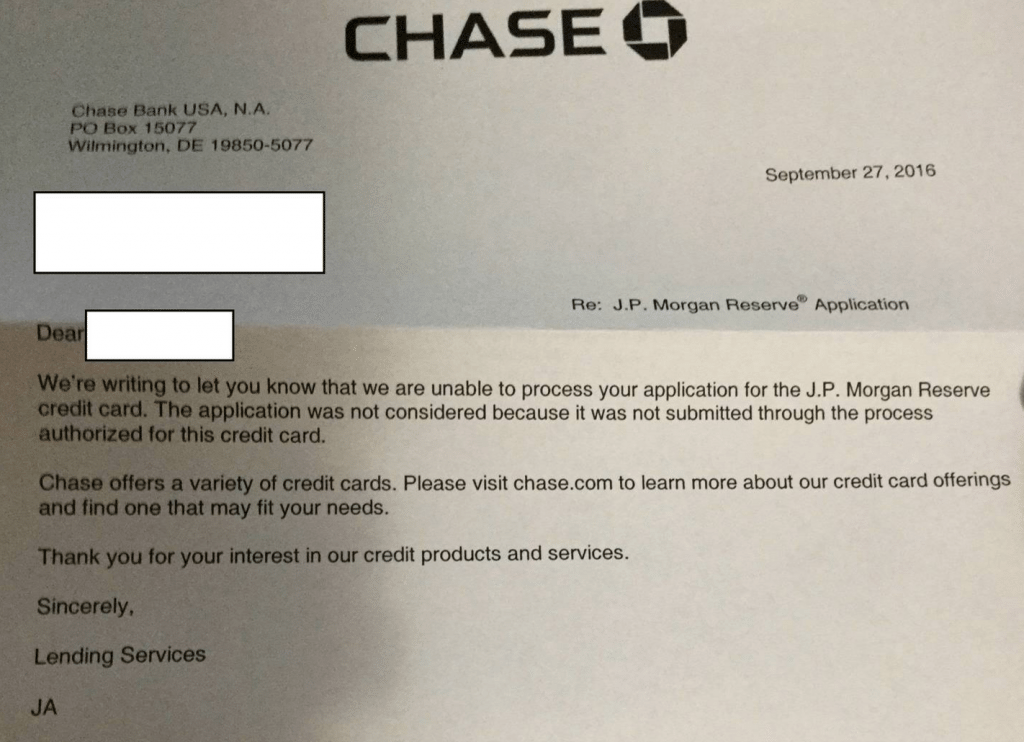

Not surprisingly, Chase never processed these applications, and they’ve now sent out letters confirming that, “we are unable to process your application for the J.P. Morgan Reserve credit card. The application was not considered because it was not submitted through the process authorized for this credit card.”

The main hope was that the first few people would get in the door before it slammed shut, though I haven’t yet heard any success stories.

Luckily, no hard pull was done for these applications.

If you have $5-10M in accounts with Chase, you can get this card by contacting your private banker. Our review on the J.P. Morgan Reserve can be found here.

Hat tip to r/churning for the image and to a friend and many readers who also mentioned this letter

Reports trickling in on RB blog about accounts getting completely shutdown with the “unsatisfactory relationship” wording. They faxed in JPMR apps and that seems to be the only common denominator. Uh oh…

I only see one DP?

Have you heard anymore in this? The only thing I’ve seen is on The Reward Boss blog and appears to be 2-3 people. Of course Flyer Talk had a single comment that there would be mass shutdowns on 12/7/16. I sure hope it isn’t true-Chase is my main banking relationship!

Sounds like people fear mongering to be honest.

I hope so! It caused a little fear for me! 😉

Sounds fishy. Would think there’s more behind that account closure, IF true, than an application for a credit card.

The logic is clear. You simply must draw a line somewhere, or the peasants will be simply everywhere. Faxing in these applications is an interesting way of staying under the radar, by the way.

Since you are talking about high net worth accounts: There was a rumor (and an article in Bloomberg: http://www.bloomberg.com/news/articles/2016-03-21/morgan-stanley-chases-millionaires-cash-with-free-platinum-amex) that Morgan Stanley was going to offer an AmEx Plat card with no annual fee for customers with high account balances. The details were not entirely clear, but I haven’t seen a peep after that March 2016 Bloomberg article. Has anything ever come of this? Are they still working on it? I would think AmEx might be anxious to proceed as one way of answering the Sapphire Reserve card.

Haven’t heard anything about this unfortunately.

Morgan Stanley now offers an annual “engagement bonus” of $450 for customers who hold a Morgan Stanley branded AmEx platinum and who use their premier cash management services. It essentially makes the card free. This requires a minimum of $1M in assets with MS and a $50,000 average daily cash balance across accounts. They are trying to become more of a one stop shop for banking and investing. The Platinum card for MS also comes with the benefit of a free additional card (normally $175/year). Not a bad deal if you already have an account that meets the requirements.

Doesn’t this card have a hefty annual fee of around $600? Were they offering a huge signup bonus?

Also, does anyone reading a finance blog have 5 to 10 mil liquid with any financial institution?

they were offering 100k sign up and people were getting approved without having nearly that much. i guess i wasnt lucky enough

It doesn’t have to be liquid… any funds “under management” count.

ok…

does anyone reading a finance blog have 5 to 10 mil liquid or NON liquid with any financial institution?

i hope not.

Plenty of wealthy people read personal finance blogs. Pay Bogleheads out White Coat Investor a visit sometime. Just because a person has significant assets doesn’t mean they need to stop learning or that they have everything figured out.

It takes time, but anyone can build up some serious funds. You start by saving early and max out retirement accounts to federally allowed limits.

I should mention that owing your own business helps massively in this regard.

I would think someone with 5 to 10 million at a financial institution would probably have the Amex Centurion card, wouldn’t be interested in churning a card, chase 5/24 rules, and also a signup bonus wouldn’t be a deciding factor on whether to get any credit card or not.