Deal has expired, view the best current savings bonuses by clicking here.

Keep in mind this now contains the new two year language.

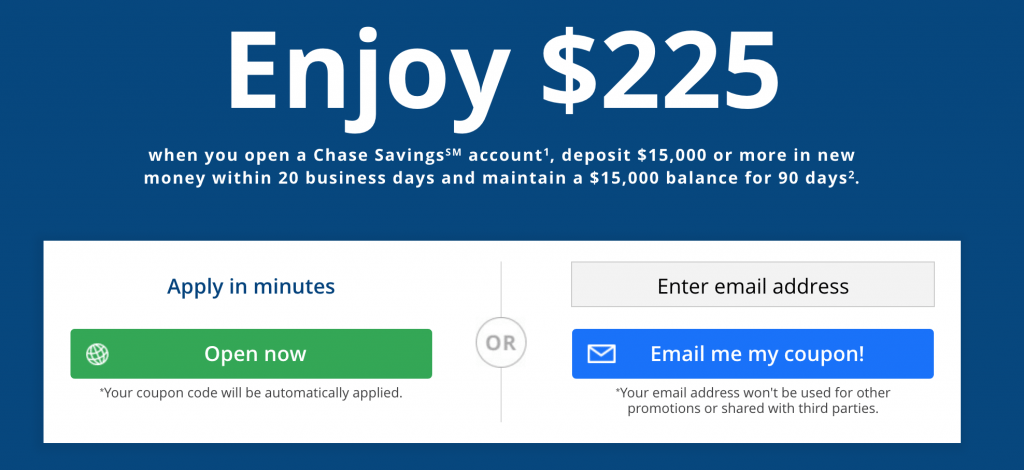

Offer at a glance

- Maximum bonus amount: $225

- Availability: Select areas (see data points at the top of this post for more exact locations – probably similar results here)

- Deposit required: $15,000

- Deposit length: 90 days

- APY: 0.01%

- Hard/soft pull: Soft

- ChexSystems: Unknown

- Credit card funding: up to $500 (seems like it’s debit card only now)

- Monthly fees: $5, avoidable

- Early account termination fee: Six months, bonus forfeit

- Household limit: None

- Expiration date:

August 6, 2018 September 27th, 2018 November 20th, 2018January 17th, 2019

The Offer

- Chase is offering a bonus of $225 when you open a new Chase Savings account and deposit $15,000 or more in new money within 20 business days of account opening and maintain that balance for 90 days.

The Fine Print

- Savings offer is not available to existing Chase savings customers, those with fiduciary accounts, or those whose accounts have been closed within 90 days or closed with a negative balance.

- To receive the bonus: 1) Open a new Chase SavingsSM account, which is subject to approval; 2) Deposit a total of $15,000 or more in new money within 20 business days of account opening; AND 3) Maintain at least a $15,000 balance for 90 days from the date of deposit.

- The new money cannot be funds held by Chase or its affiliates.

- After you have completed all the above requirements, we’ll deposit the bonus in your new account within 10 business days.

- You can only receive one new savings account opening related bonus every two years from the last enrollment date and only one bonus per account

- The bonus is considered interest and will be reported on IRS Form 1099-INT (or Form 1042-S, if applicable).

Avoiding Fees

This account has a $5 monthly fee that isw aived if you do any of the following:

- Maintain a daily balance of at least $300 or more

- Have at least one repeating automatic transfer of $25 or more from your Chase personal checking account

- Are under 18 years of age

- Have a linked Chase Premier Plus, Chase Premier Platinum Checking or Chase Private Client checking account.

Our Verdict

This deal turns the equivalent of a 6% APY by locking up $15k for 90 days. There are currently three other offers available as well (both expire soon):

- $150 savings bonus with $10,000 deposited for 90 days (in-branch only, turns out to a 6% APY return)

- $200 savings bonus with $15,000 deposited for 90 days (same as the offer posted here, just $25 less, no reason to do that one)

- $300 savings bonus with $25,000 deposited for 90 days (works onlin; turns out to a 4.8% APY return)

If you have an extra $10k on hand, you’ll earn the equivalent of a 3% APY rate on the extra $10k by doing the $300/$25k offer instead of doing the $225/$15k offer – up to you if it’s worth it. You can also do a $300 checking offer as well if you’re interested.

We’ll add this best savings bonuses, alongside the above-mentioned $300 savings offer.

Hat tip to jenncheer on r/churning

Useful posts regarding bank bonuses:

- A Beginners Guide To Bank Account Bonuses

- Bank Account Quick Reference Table (Spreadsheet) (very useful for sorting bonuses by different parameters)

- PSA: Don’t Call The Bank

- Introduction To ChexSystems

- Banks & Credit Unions That Are ChexSystems Inquiry Sensitive

- What Banks & Credit Unions Do/Don’t Pull ChexSystems?

- How To Use Our Direct Deposit Page For Bank Bonuses Page

- Common Bank Bonus Misconceptions + Why You Should Give Them A Go

- How Many Bank Accounts Can I Safely Open Within A Year For Bank Bonus Purposes?

- Affiliate Links & Bank Bonuses – We Won’t Be Using Them

- Complete List Of Ways To Close Bank Accounts At Each Bank

- Banks That Allow/Don’t Allow Out Of State Checking Applications

- Bank Bonus Posting Times

Does anyone know about the definition of “new money”? I deposit a check from another bank to my Chase checking, then transfer to saving immediately. Am I eligible for bonus?

225 bonus posted early in the “10 business day” window. They also didn’t play any games so I have no complaints (other than their tiny interest rate).

Please anyone know what to deal with my problem give me an advice, thank you in advance

I opened this account together with a checking. Deposited $15k within 5 days.

Due to my mistake, a credit card payment that I originally want to use my checking balalance ended up in this saving and reduce my balance below $15k. I fixed it after a week by transferring money from checking to saving

Will this make me ineligible for the bonus? Calling Chase rep but they have no idea.

I am sorry to tell you that yes, by dropping the balance below $15K, this will make you ineligible for the bonus. The same thing happened to me. To my horror, I found that I had accidentally dropped the balance below $15k.I re-read the rules and it says “Deposit a total of $15,000 or more in new money within 20 business days of account opening; AND 3) Maintain at least a $15,000 balance for 90 days from the date of deposit.” You have to keep the $15k balance from the day you first deposited. It can’t drop below that amount at any time. You can take a chance and let us all know if you get the bonus, but in my case, since it looked like I missed out on the bonus, I withdrew the funds and closed the account. I learned my lesson and it’s one of the reasons why I now keep a little bit over the minimum so this doesn’t happen to me again.

Edit: Actually, I was able to re-open an account under the one year terms, so I’m not positive my thinking is all together correct. Hope someone else can help clarify the terms for Michael.

Seems like offer withdrawn early, AND the coupon code mailed to me (via USPS) also is reported that it has expired, even though on the mailer it says it’s valid through today.

Was waiting until the last day to open the account so that the funding period would overlap with Ally funds coming available 🙁

So, the bad news first. Looks like the $225 bonus offer expired early – the link leads to a page that says “Oops….” The $200 offer also seems to be dead. The good news, the $150 offer is good now until 4/15/19.

926/18 opened account

10/18/18 increased funding to $15k

1/2/19 Bonus posted

9/27/18 account opened in Orange, CA. Can’t open online, HI resident

10/10/18 $15000 deposit posted

1/2/19 $225 bonus posted

See you in two years, chase…

I was able to use this today in MN.

I had opened a checking account in the fall and they told me savings account was NOT available in my location but it worked today and confirmed it had applied the $225 promo coupon.

Anyone know if Chase can do soft pulls if you have credit freeze in place? Was denied for this account and wondering if it’s because of the freeze.