This is another post in our Manufactured Monday series. We try to offer some insights into manufactured spend each Monday. You can view all posts in this series by clicking here.

Hide MS

Some people are worried about how manufacturing spend (MS) could affect a mortgage application or other loan. Because of this they look for ways to hide the MS so that it won’t show up on their credit report.

It’s usually assumed that it’s possible to hide MS from your credit report by paying down the balances before the statement closes. It’s also mentioned that there are some credit card issuers who will report mid-statement balances, but most will only report based on the balance at the statement closing date.

Thus, if you’re careful to pay off the balances before the statement closing, you’re credit report will be “clean”. Additionally, if you constantly keep your balances low by paying off the balance multiple times each month, you’ll never have high-dollar amounts showing up on your credit report.

But is that really true? My own credit report indicates that you are able to hide MS from the Amex and Discover reporting but not from Visa and Mastercard reporting.

My Findings

On the credit report there are numerous numbers which are reported:

- credit limit

- monthly account balance

- high credit (the highest amount ever owed)

- scheduled payment amount (the monthly amount of your required minimum payment)

- actual payment amount

The one that especially interests us here is the last one: actual payment amount. The actual payment amount is the amount that you actually paid to the credit card that month. I religiously pay off my balances before statement closing and I constantly strive to keep the balances low. In the “account balance” column it shows zero or close to it, but there are still big sums being showed in the “actual payment amount” column.

However, there seems to be a disparity here between Visa and Mastercard versus American Express and Discover. In the case of the former, the “actual payment amount” usually shows. However, Amex and Discover don’t report that information to the credit agencies. This is only true in regard to regular Amex accounts, however, bank-branded Amex cards – such as Fidelity American Express – do report the actual payment amounts.

Important: This does NOT mean that there’s no benefit in paying off your balances early. A whopping 30% of your FICO score is based off credit utilization. This utilization factors the actual amount that you owe, as a percentage of your total credit available. If your account balances are being reported as close to zero, then you’ll be doing great in the credit utilization category. Our discussion here is specifically as it relates to hiding MS from a credit report/mortgage lender.

Images

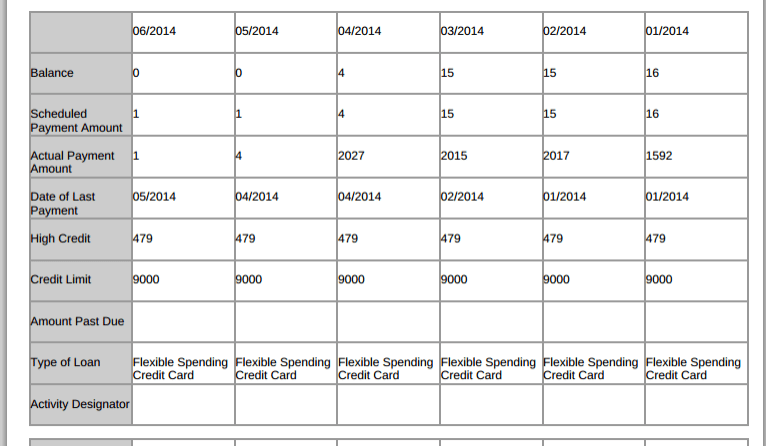

Here’s a look at Citi reporting my credit card info to Equifax (the info on my Experian report is exactly the same):

This is s snapshot of my Citi Dividend card. Citi Dividend had drugstores as a category bonus in Q1 2014. I spent $6,000 in drugstores between January and March 2014. As you can see, my “balance” is being reported as close to zero, yet my credit report still shows the $6,000 in “actual payment amount” on the card.

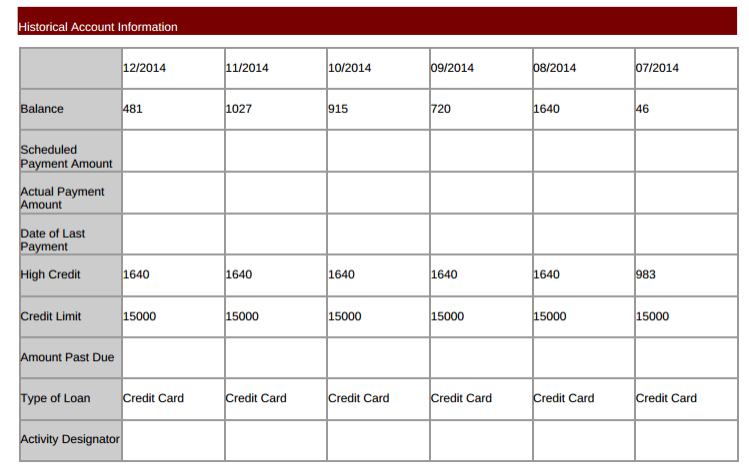

Now let’s take a look at Amex on my credit report:

Amex does not report the actual payment amount. If you keep your balances low and you pay them off before the end of the cycle, your MS will go completely unnoticed on the credit report. Discover, too, doesn’t seem to report the actual payment amount.

Note, that occasionally Visa and Mastercard credit cards also miss reporting the actual payment amount. Additionally, even when the actual payment amount is reported, it’s still less conspicuous on the credit report, since the high MS numbers are only mentioned once, under the “actual payment amount”, and not twice, under the “balance” and under the “actual payment amount”.

Conclusion

Just to recap:

- There’s good reason to be paying off your balances early in order to reduce your credit utilization. This is especially true for those who manufacture spend and would otherwise have high credit utilizations.

- Keeping balances low and paying them off early does apparently help hide the MS in the case of Amex and Discover.

- Even in the case of Visa and Mastercard, the actual payment amount is occasionally missing.

- If you pay off the balances early, the MS is less conspicuous on the credit report.