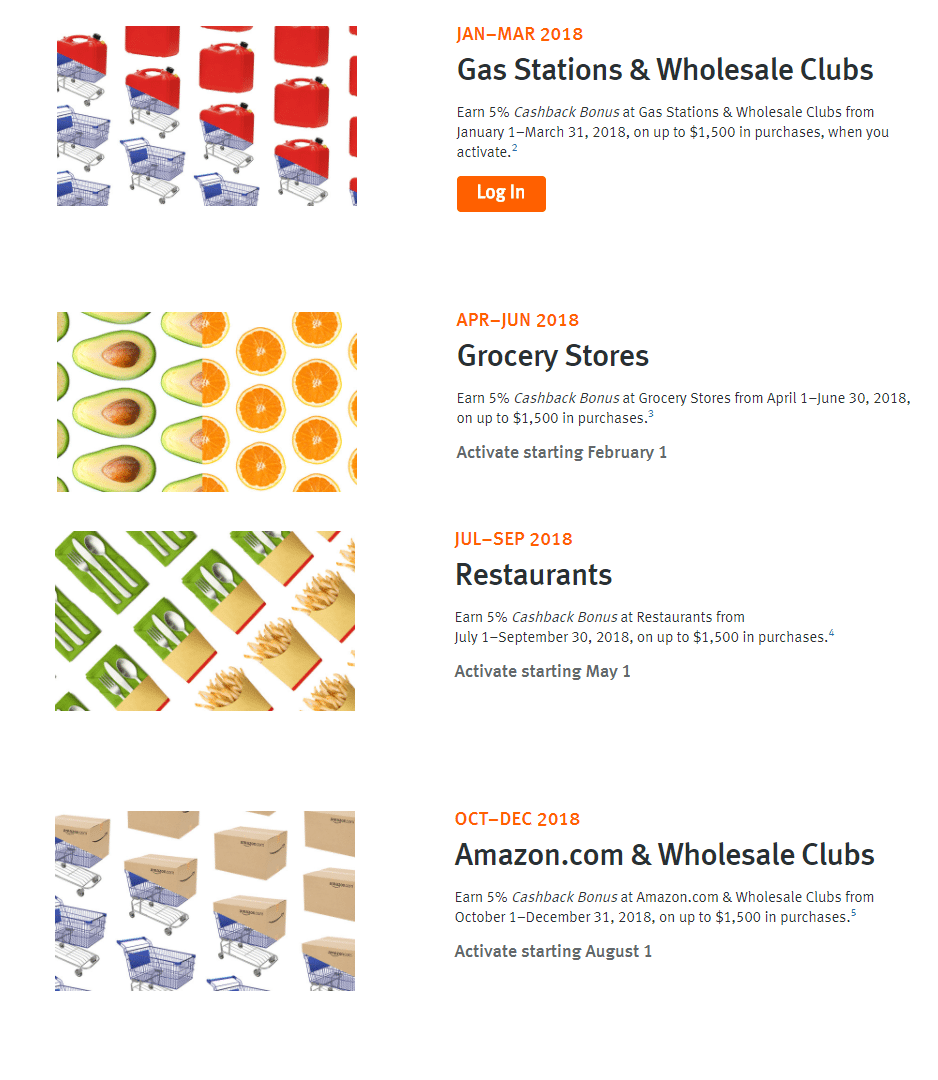

Discover has released their 5% categories for the Discover it for 2018.

- Q1 (Jan-Mar): Gas Stations & Wholesale Clubs

- Q2 (Apr-Jun): Grocery Stores

- Q3 (Jul-Sep): Restaurants

- Q4 (Oct-December): Amazon & Wholesale Clubs

Remember you’re limited to earning 5% cash back on $1,500 in those categories per quarter. Here is what they have offered in the past:

| Q1 | Q2 | Q3 | Q4 | |

|---|---|---|---|---|

| 2018 | Gas Stations & Wholesale Clubs | Grocery Stores | Restaurants | Amazon & Wholesale Clubs |

| 2017 | Gas Stations, Ground Transportation & Wholesale Clubs | Home Improvement & Wholesale Clubs | Restaurants. Some cardholders targeted for Amazon | Amazon and Target |

| 2016 | Gas and Ground Transportation | Restaurants & Movies | Amazon, Home Improvement | Sam’s Club, Amazon, and Department Stores |

| 2015 | Gas Stations & Ground Transportation | Summer Spruce Up? | Home Improvement Stores, Department Stores, and Amazon.com | Amazon, department stores, and clothing stores |

| 2014 | Restaurants and Movies | Home Improvement Stores, Furniture Stores and Bed Bath & Beyond | Gas stations | Department Stores and Online Shopping |

| 2013 | Restaurants and Movies | Home Improvement Stores | Gas stations | Online Shopping |

| 2012 | Gas stations, Movie theaters and Museums | Restaurants and Movies | Gas stations, Movies and Theme parks | Department Stores and Online Shopping |

| 2011 | Travel and Restaurants | Home and Fashion | Gas, Hotels, Movies and Theme Parks | Restaurants and Fashion |

Hat tip to reader Gus