An interesting note from AlbinoAlex on r/churning regarding downgrading Capital One cards that I hadn’t been aware of:

- Capital One waits 60 days to assess the annual fee status of a card. If your annual fee posts and then you downgrade to a no-fee card, you’ll end up paying the full annual fee and get a year of a no-fee card. That’s a lose-lose situation.

- There are no partial-fee refunds; you’ll end up paying for the full year.

- You CAN close the card down after the annual posts (presumably within 30 days) and get the annual fee refunded. Only downgrading the card has the delayed reaction issue.

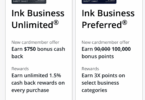

Be sure to downgrade 60 days before your card anniversary in order to avoid the annual fee. Keep this in mind for the Venture X card, which has a $395 annual fee, if it’s a card you don’t plan on keeping long term.

The downside to downgrading early is that waiting for the annual fee to post might possibly increase the chances of there being some sort of retention offer which won’t be showing yet two months in advance. Also, in the past Capital One has been known to waive the annual fee upon request on certain cards with low annual fees. If you don’t want to risk it, the only option is to downgrade 60 days before the anniversary date.

We’ve added a note to our post on Best Downgrade Options & Rules For Each Card Issuer.