This is a guest post by Parker Bonnell of Honest Policy. As we mention in the outro insurance credit scores is something we’ve been meaning to tackle for some time so it’s always great when we can get somebody who is an expert to help with content specific to that niche.

Contents

Introduction

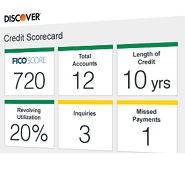

One thing that many people don’t know is the affect your credit can have on your insurance. In most states, your credit score can play a larger role in the price of insurance than many other factors do. If you didn’t know that, you’re not alone. About two-thirds of Americans are similarly unaware, according to a study conducted in 2005 by the Government Accountability Office. On the flip side, having or paying for insurance does not have much effect on your credit score, with the exception of not paying your bill on time (total payment history accounts for 35% of your FICO score).

Will an insurance quote affect your credit report?

No. The credit check that occurs when you apply for insurance is not like when you apply for a new credit card either. While they will show up on your personal credit report, they are not provided to lenders, so will not be considered when calculating credit scores. This is confirmed by Experian here.

In most States your credit report/score can be used by insurers to determine the premiums you should pay (the exception being health insurance where this is prohibited at a Federal level). If your credit information is having a negative effect on your insurance price then under the Fair Credit Reporting Act insurers are required to you a notice of adverse action. Generally a notice of adverse action is required if any of the following happen as a result of your credit:

- Insurance is denied

- Rates are increased

- Policy is terminated

If you’ve ever been denied for a credit card then you should be familiar with these notices of adverse action. Unfortunately unlike card issuers these notifications can be hard to spot. One can see rough estimates of credit’s effects on prices for multiple insurers in each state by using the credit tool over at Honest Policy.

What States are exempt?

Some States do not allow insurers to use credit information to determine your insurance premiums. These restrictions vary based on the type of insurance and are outlined below.

Auto

Credit affects your insurance premium unless you live in California, Massachusetts (according to this comment it can still be somewhat used), or Hawaii. If you are in one of the other 47 states, the cost of insurance for someone with poor credit can be more than twice that of someone with great credit.

Home

Here the only exceptions are Maryland and Hawaii. In other states, the insurance price difference between low and high credits can be even more significant than for auto.

Life

With life insurance, your credit score typically has little effect on the price of your premium, unless you’re going through bankruptcy (or have gone through it recently). The reason bankruptcy proceedings may be lead to a denied application or higher prices is because of the insurers worry that you won’t be able to pay your premiums.

Health

Credit has zero effect on your health insurance prices. Due to the ACA, the only things that affect the price of this is your location, age, and whether you smoke.

Renters

According to the comments it should just follow the same exceptions as home insurance.

Credit score exception

In some states including Delaware, Iowa, Rhode Island, Connecticut and Nevada, you can apply to your insurer for a credit score exception if your score has suffered as the result of an “extraordinary” life event. If approved, your insurer will provide a policy quote that doesn’t take into account your poor credit (which should be far more affordable). Such events generally include the following:

- Catastrophic events, as declared by the Federal or State Government

- Serious illness or injury of yourself or an immediate family member

- The death of a spouse, child or parent

- Divorce or involuntary interruption of legally-owed alimony or support payments

- Identity theft

- Temporary loss of employment for 3 months or more if resulting from involuntary termination

- Military deployment overseas

- Other events, as determined by the insurer

Other states where exemption requests are reportedly available are Colorado, Florida, Louisiana, Montana, New Mexico, Texas, and Virginia. It is plausible that other states have since enacted similar provisions however. The easiest way to check would be to contact your insurer and ask about the possibility. If you find out your state has them, let us know in the comments, and we can update accordingly.

Why do insurers use credit for insurance prices?

It might seem odd that an insurer would use your credit score for determining the price of the policy premium. With auto insurance for example, why assume that someone who has a low credit score is therefore a riskier driver who warrants higher prices? Well, according to a few studies there is greater likelihood that someone will make an insurance claim if they have poor credit. At least one of these studies found that the use of credit scores for pricing had a disproportionate impact on certain minorities (primarily Latinos) and low-income individuals.

Insurance Credit Scores

A popular misconception is that insurers simply use a standard credit score (such as FICO or VantageScore). But they actually use industry specific scores called insurance credit scores. Reports indicate that they focus on certain key factors that are similar to how traditional credit scores are calculated but with different weightings. Credit Karma offers a tool that provides at least one estimate of your insurance score (via Transunion called auto insurance score) if you’re looking for an idea of where you stand. Keep in mind though that there is a difference between “educational” scores such as these, and your “true” scores.

For auto insurance there are three major insurance credit score systems (unless the insurer is using their own in-house formula):

- FICO Auto Score 9 XT

- LexisNexis Attract™ Auto Insurance Score

- CreditVision Auto Score

The FICO 9 XT Score for example looks particularly carefully at the past 30 months of an applicant’s history. It also ignores accounts from collection agencies that have been paid off (as does the CreditVision Score), and differentiates between unpaid medical and non-medical bills that have gone into collections. This means that if you’ve been working on improving your score lately, and have paid off your debts, it will have a more significant impact than it would for a traditional credit score.

Insurance Score Ranges

As mentioned, the insurer may have their own scoring system where the range isn’t available to consumers. If they’re using one of the three systems mentioned above though, the ranges are as follows:

- FICO | 250-900

- LexisNexis | 500-997

- CreditVision | 300-850

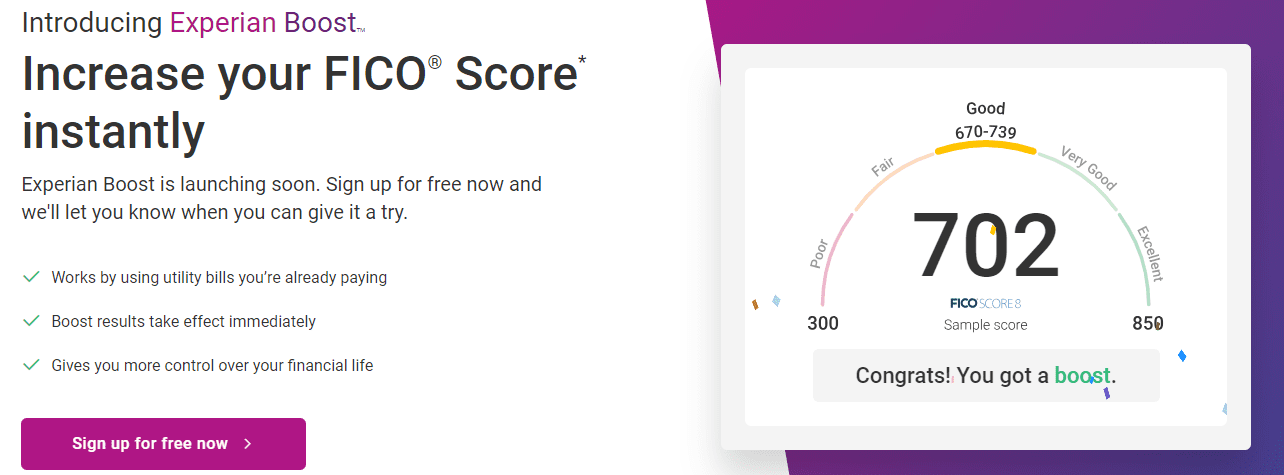

What is a good insurance score?

Experian reports that the categories for FICO are:

- Excellent is 800+

- Very Good is 740-799

- Good is 670-739

- Fair is 580-699

- Poor is 579 or less.

According to LexisNexis their scores are as follows:

- Good is 776-997

- Average is 626-775

- Below Avg. is 501-625

- Poor is less than 500.

TransUnion doesn’t provide a guide, but their CreditVision score uses the same numbering system as a traditional credit score, where presumably the same categories apply:

- Excellent is 750+

- Good is 700-749

- Fair is 650-699

- Poor is 550-649

- Bad is less than 550.

Final Thoughts

Thanks to Parker for putting together this post, it’s been something I’ve been meaning to write about for a long time but I’ve never found the time or known enough about it to do it justice. I think this is a great jumping off point and I’m confident as readers share their own knowledge and data points we can make this post a useful resource page.

If you found this post helpful then check out Honest Policy, they provide tools and data to help pair consumers with the right insurance carrier for them. The best carrier for a single guy with poor credit but a nice car is not the same as someone with a family of 4 who is a homeowner but has a DUI. Our goal is to inform the consumer how to get the most value from the 2-3 carriers that are the best potential match for them. They also have a blog you can check out here.