Terms on the Chase website state that beginning May 21, 2017, the $300 annual travel credit will be based on the cardmember year, not the calendar year.

As we know, Chase and most premium cards (CSR, Amex Platinum, Amex PRG, Citi Prestige) base their annual credits on the calendar year, not cardmember year. This is golden for signup bonus chasers since we get the credit twice within the first year, effectively creating two signup bonuses on these cards. (In the case of Chase, the year – for this purpose – ends with the date that the December billing statement is generated.)

One place on the Chase website now states that for applications submitted on May 21 and beyond, the travel credit will go based on the cardmember year, not the calendar year. This was only recently updated within the past couple of days, and other places on the Chase site have not yet been updated.

Obviously, this is terrible news, but I honestly never understood why they all don’t do this. It’s such a simple money-saver that doesn’t look any worse on paper. Unclear if Chase got the ‘idea’ from US Bank Altitude or it’s just a coincidence.

It’s still possible to get the airline credit twice by squeezing $300 in at the beginning of the second cardmember year and then cancelling the card within 30-days of when the fee hit. But it certainly makes it harder, and most ‘normal’ people won’t do that.

Related: What Counts For The $300 Chase Sapphire Reserve Travel Credit?

FAQ

Will the change affect existing cardholders?

Those who already have the card or who apply through May 20 will be able to get two travel credits in their first year.

Will the change take effect for existing cardholders?

It’s not clear at this time if Chase will change the terms over for existing cardholders as well. Not that it makes much a difference (in the first year you’ll get two airline credits and in subsequent years you’ll get one, in any case), but it is important to know the exact dates to take advantage of the credit.

I’m sure Chase will send out a mailer if/when the system of dates changes on the card. If they do change it for existing cardmembers, it could create a one-time opportunity to get another extra $300 credit out of this. More likely, this won’t happen.

Should I apply for the card now?

Hopefully, if you are eligible, you already applied when the bonus was 100k. That said, if someone is on the fence to apply now (e.g. just got out of 5/24, just started churning, whatever), I think it makes sense to apply now before May 21 with the 50k bonus, and not wait with the hopes that the bonus will increase again to 100k.

Credit goes to Travelafterwork for picking up on this change

I have a question. I got this card in April, 2019. I didn’t realize that they had changed it from calendar year to card-member anniversary year. I read somewhere though that you can wait until your anniversary year, spend the second $300 travel credit. The annual fee will hit, but then Chase will still give you time after the annual fee hits to request a refund? Is that correct? Does anyone know how long you have after the annual fee hits to request the refund/downgrade?

So is this confirmed yet? If I PC my newly acquired CSP (Fairmont card) to a CSR, will I only get the $300 travel credit once or twice? Wife already has CSR so no point to get the Reserve for me unless confirmed that I can double dip.

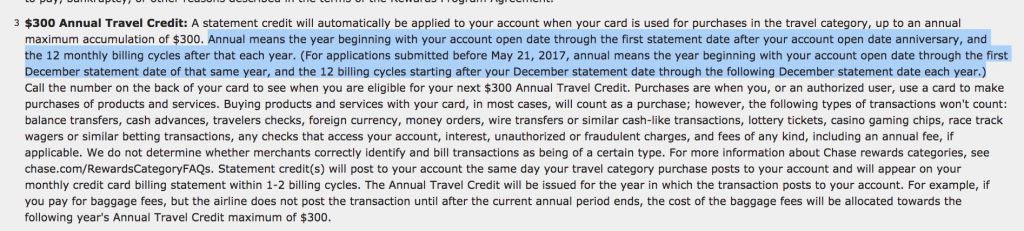

I was wondering about the triple dip and so checked the terms on my pre-rulechange CSR. The current terms online are listed as:

” (For applications submitted before May 21, 2017, annual means the year beginning with your account open date through the first December statement date of that same year, and the 12 billing cycles starting after your December statement date through the following December statement date each year.) ”

So, still calendar year.

Any news on how pre-rulechange cardholders are treated? Wondering about that triple dip potential.

I’m still seeing the old terms on most of the application pages 🤔.

Applied today (5/20) for my father but the new terms already posted. But, I found a link to the old terms that clearly lay out pre-5/21 and took screen shots. Hope I don’t have an issue.

Got the card today, the same term for 300 annual credit. so I think it is ok to upgrade before 5.21. Also it does not affect me, I will keep it for a while.

SM says upgrading is cool but reset is now not at the end of the year anymore… Careful peeps

Oh, drat, I was just trying to do this.

I took a screen shot. So it should be fine to upgrade before May 21.

They told you it’s still based on calendar year?

No, I did not ask. but it is mentioned in the term.

You mean the terms they read to you during the product-change process?

I thought they used to let you change from freedom to CSR. I’ll try and let you know.

I’d seen prior comments that this was allowed but I’ve had zero luck. Let me know if you end up being successful.

I just messaged them and was able to upgrade. I did read that you needed at least 10k credit to do it, which I had.

I product changed from Freedom to Sapphire Reserve yesterday. I had to move $1k from my Marriott credit line to get $10k total on my Freedom prior to the product change going through, but it worked.

I’ve had my Chase Freedom open more than a year.

Has your Freedom been open at least a year?

I think your freedom card also needs to be at least 1 year old.

Anyone able to product change in the last couple of days? I’ve tried via phone and secure message to change a Freedom to a Chase Sapphire Preferred with no luck. The CL is > $10k and can’t figure out why they won’t let me.

I upgraded my CSP to CSR last night. Not sure if you can do it from freedom.

I was able to PC my freedom today.