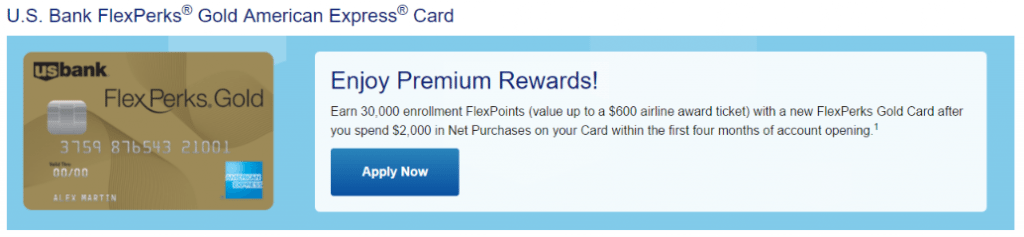

U.S. Bank have launched a new credit card called the U.S. Bank FlexPerks Gold American Express Card (they also launched the U.S. Bank Cash 365 American Express card at the same time). Let’s take a look:

- Sign up bonus of 30,000 FlexPerks when you spend $2,000 or more within the first four months of account opening

- Card earns at the following rates:

- 3x points at restaurants

- 2x points at gas stations

- 2x points at airlines

- 1x points on all other purchases

- $25 airline allowance with every award travel ticket booked (good towards baggage fees, in flight treats & more)

- No foreign transaction fees

- TSA PreCheck or Global Entry automatic statement credit reimbursement for whichever program you apply for first

- Annual fee of $85 is not waived the first year

How Much Are FlexPerks Worth?

Sign up bonuses and category spending bonuses are only as good as the points they earned. We’ve gone in depth on how much FlexPerks are worth in this linked post (give it a read). For those who need a refresher:

- Airfare (maximum value of 1.5¢ per point)

- Hotels, car rentals & cruises (maximum value of 1.5¢ per point)

- Merchandise (value of 1¢ per point, waste of time)

- Gift cards (value of 1¢ per point, also a waste of time)

- Statement credit (value of 1¢ per point)

- Annual fee (value of 1.7¢ per point for this card, see below)

As you can see the base value is 1¢ for statement credit and up to 2¢ when you redeem for airfare (although it’s difficult to get this maximum value).

Pay Annual Fee With Points

You can use points to offset the annual fee, but only in year two onwards. The annual fee is usually $85, but you can pay 5,000 points instead. This gives you a value of 1.7¢.

Our Verdict

I think this card is definitely worth considering for the first year, 30,000 sign up points is a pretty good deal for a minimum cash value of $300 (best cash credit card sign up bonuses) and a maximum value of $600 if you redeem for flights. Just keep in mind the $85 annual fee that can’t be paid with points in the first year. You also get the PreCheck/Global Entry credit, but I imagine at this stage most people already have that from another credit card. What’s most interesting to me are the bonus categories (really just the restaurant category).

- Restaurants 3x points (up to 4.5% back), the next best is 3% cash back or 3x points.

- Gas/air travel 2x points (up to 3% back), better options for gas purchases

- All other purchases (up to 1.5% back), much better options out there.

What are your thoughts on this new card? Will you be picking one up? I spend a lot of money on restaurants, so I’m very happy (especially with no foreign transaction fees). I just wish there was a 5% cash back option for restaurants. Before applying for this card, make sure you freeze these two credit bureaus first as that will improve your chances of being approved. I’d also recommend reading these 20 things everybody should know about U.S. Bank credit cards.

AF hit a few days ago, so I called and asked for retention offer, or to PC to something without AF. I suspected I was going to be told to go away. Instead, CSR offered Cash + Plat Visa, or Cash 365 Amex. Decided on Cash+ Visa, which will be my 2nd Cash+ card. Said it will take like two weeks, and I can select my categories once card arrives. I was cool with that.

So, at very end of the call, I ask… the $85 AF will be waived, right? I won’t need to worry about paying it, correct? Not even kidding, CSR says “federal regulations prohibit them waiving the AF”. I said I have never heard of this, and re-explained I was only seeking to not pay the current $85 fee that was posted a few days ago, and had already paid the AF the year prior and was not seeking reimbursement. She offered to have a manager call me, or speak to me at that time. I chose call-back, because if that is what her team is being taught, I wanted nothing to do with her manager.

I will say overall this card was very cool to top off FP points on top of SO’s Olympics special promo FP Visa last year.

1. As I recall, she was able to refer me to this card, even though she had the FP Visa. I however wasn’t able to refer her to the FP Visa, as they said she couldn’t do two special promos. So, YMMV, but worth a shot.

2. I was able to transfer all my FP to her, and then cash-out for travel. Why do this? The Amex Gold does not do real-time redemption, but instant cash-out is possible via the Visa.

Thanks, updated

Calculations in title still off.

Never got the call back from the “manager” about the possibility of the AF being waived after product change. I can see in online banking that the product has been changed to the Visa Cash +. Called, and spoke to a rep that said it can take up to 10 cal days for fee reversal, that the AF waive policy is 30 days from posting, & he would anticipate the fee will be reversed. And, he apologized for the confusion on the part of the prior CSR. Calling back May 3rd if not done.

Today, day 11, the $85 reversal of the annual fee finally posted, dated yesterday.

Apparently nobody talks about this card, probably because of that upfront AF… so I am guessing nobody will actually read this. Here it goes anyway:

DP: EQ pull (VA) 790 FICO 10K limit, my 3rd US Bank CC. (4th if you count Elan Fidelity)

I applied mid-April because I was looking for a way to top off my FlexPerks points before I close my FP Visa. 2K spend is reasonable, even with it being the evil AmEx. Between paying ahead on car insurance, property taxes, and a few bills and restaurants, it was not hard for me anyway. Just waiting on my sign-up bonus, and I suspect it will post after statement close of meeting spend.

I used my SO’s FlexPerks number as a referral, even though I already had a FP Rewards Visa, and she had only the FP Visa. She was awarded 5K FP.

Since I already had a FP account and points balance, I was able to pay the annual fee w/ 5K points. AF posted at the end of the first month – as soon as it did, I paid via points via the FP portal and about a week or less later, the $85 AF was credited back to the CC account.

I was planning on signing up for the PreCheck/Global Entry to get it reimbursed, even though I am not a frequent traveler. However, I was not aware it isn’t just an online process. You actually have to make an appointment to be seen to process the app, and for me, the Global Entry office is two hours away, and not somewhere I frequent. My precheck office is 20 mins away, so I might get around to doing Precheck, but it’s not very convenient. So – those folks that don’t live near a giant international airport, you might want to do some research.

One other annoyance – I haven’t been able to link it to Drop. My other 2 US Bank cards are linked just fine, but this one doesn’t show up. Not sure if is a Drop limit w/ US Bank, or the US Bank site at fault. Reported to Drop a couple weeks ago and it’s not resolved.

How to get $25 travel credit for gift card?

do you know when you pay the annual fee for year one? Year end or beginning of year?

Does anyone know if the FlexPerks Gold Amex gives a bonus if you spend $25,000 in a year like the US Bank FlexPerks Visa card does? I believe the Visa gives a 3,500 bonus for meeting the annual spend requirement.

I just looked through the Terms & Conditions and don’t see anything to that effect on the Gold AmEx.

This is a general question. I opened and closed many accounts two years ago and made $2500. Did the same recently. Is a third cycle likely or will the banks decline?

Thanks, Jenny

Does any one know if funding a bank account will trigger the bonus?

You can redeem the 5000 points for the annual fee credit within the first year. I saw the option available for around 70 days before I clicked it, and from what I read it should work up to 90 days after the fee posts.

I figured I would give it a try because I saw the option under “redeem”, and it cleared just fine.

Just figured you all would want to know an interesting DP.

DP: Just received an email from US Bank saying my sign up bonus needs a 5K spend, not the listed 2K spend. I sent them a screen shot of the offer and will see if they change it, but heads up to people waiting on the bonus after hitting that 2K spend to maybe check what they have listed as your bonus spending requirement.

i have the us bank visa card if i go for the am ex flavor with my points combine ?