There’s a somewhat substantiated rumor on Flyertalk that US Bank will release a new premium card in May called the Altitude Reserve Card. And, yes, the card will be metal. 😉

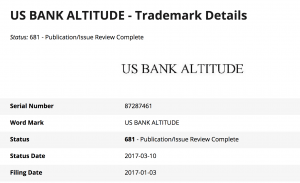

Before we dive into the details, let’s give a little proof to this from a trademark filing from US Bank from January 2017 for the card name US BANK ALTITUDE which was approved in March. (HT: d3vi0uz on Flyertalk).

Other than that, we just have Flyertalk member lebowski2222’s word who saw the memo from a US Bank employee. The memo seems to have been sent out on April 4th, and employee training will begin on the 18th for a May release of the card.

Signup Bonus

The signup bonus will be 50,000 Points when you spend $4,500 in the first 90 days.

Unclear how the points will work, but Flyertalk reports that the 50k will be worth $750, perhaps toward travel (?). Time will tell.

We don’t know what the annual fee will be which is obviously an important question. Given the $325 travel credit (see below), it’ll likely come with a hefty fee in the $400-$600 range.

Points Earnings

- Triple Points on travel purchases

Sounds like everything will earn 1x, which will apparently be worth 1.5% somehow, and travel will be 3x which should be worth 4.5% somehow.

Card Benefits

- $325 Annual Travel Credit

We’ll have to see what works for the travel credit, and whether it goes with the cardmember year or the calendar year.

- 12 free gogo wifi passes

- Airport Lounge Access

- TSA Pre-check

- Black car and car rental service (?)

- Visa Infinite Concierge service and more

- Custom Engraved Metal Card

Our Verdict

No verdict, we’ll have to wait and see on this one. Let us know if you have any more information.

Hey general comment on your US Bank/ U.S. Bank posts. It seems like roughly half the time you title them “U.S. Bank” and the other half you do “US Bank”. This makes it hard to search because searching one form excludes the other form. So if you could, it would help if you stick to one convention when doing your US Bank posts.

Yeah I know, will try to fix this.

If there’s a business version of this card, I’m in.

Stopped by a US Bank branch today and while making a deposit, casually inquired about a “new credit card I heard about.” Rep confirmed that it’ll be out in May and described it as similar to the CSR, but the interesting part was that he said it was only for existing customers. He could have been misinformed, and he didn’t clarify if that meant existing credit card or banking customers. I have a cc and checking account and asked him if I’d eligible and he said yes.

He was also very curious where I learned of the card 🙂 (Oh you know…some website out there…)

That would be an interesting twist if they limit it to customers who have a checking with them

Wanna make a guide on what the best checking account is for US Bank?

Hmm, maybe we should wait to see if the card comes out and if it needs a checking account? In that case, sounds like a good idea for one of us to write about.

Gold Package Checking at US Bank has no monthly fee and no minimum balance, with any credit card or loan product at the bank. Also get some other perks with Gold, such as free second Easy Checking account, free Money Market savings, 2 free non-US bank atm fees waived per statement, and discount on mortgage origination fees.

Been banking with them for 10+ years and have never had troubles getting cc’s, doing tons of ACH’s for paying all my cc’s, or making MO deposits. Not a bad time to start!

how much and how many MO you do at US Bank? im surprised.

I believe I read a few months back that US Bank was no longer approving applications from people who had their SageStream and ARS reports frozen… or maybe it was only during recon, I don’t remember. But anyway, do we have any idea how easy/difficult it might be to product change from the Flexperks Visa Signature to this new Visa Infinite card if/when it is released? I’m not familiar with how easy it is to do product changes with US bank..

sigh. why does everything have to be Reserved? cmon AMEX, just do it. go balls to da wall. Amex Platinum Stratosphere Reserved….

gawd damn has anyone looked at the entire lineup of Amex overseas products? ITS INSANITY… cmon USA markets!

I somehow doubt Korean as they are a UR transfer partner, but who knows, US Bank does issue the card in USA. Those airlines represent all 3 alliances and have great charts.

There’s plenty of precedent for multiple programs having the same transfer partners — British Airways, Singapore, and Air France/KLM are transfer partners of both UR and MR, and Virgin Atlantic is a transfer partner of UR, MR, and TYP. There are probably more that I don’t recall of the top of my head.

That said, it could easily go the other way — it depends on the details of Korean Air’s deal with Chase.

It’s hard to predict, so we’ll just have to wait for more details 🙂

Good point!

If anyone, we need BoA to come into premium cc arena. They already have Alaska, Asiana, Virgin Atlantic, spirit and amtrak among others.

On a side note, I just got an email from us bank skypass cc on a new promo for spend $25 on amazon three times and get 2500 skypass miles.

Decisions, decisions. My only planned applications this month are a CitiBusiness AA Plat, once my inquiries start dying in late April (lame, I know). And I’m already holding off on personal cards or EQ pulls until mid-May so that I have a good shot at the Propel World. End-of-May, I’ll only have 4 cards in 6 months – I wonder what my shot at approval with US Bank is in that case?

Kind of excited to see the details on this new card, hopefully it’s not another SunTrust bust for me 🙁

(https://www.reddit.com/r/churning/comments/5d382q/dp_no_suntrust_platinum_elite/)

What do you already have in terms of U.S. Bank cards? Might be worth closing them now if you don’t want to keep long term (throw a bit of spend on them before closing).

To quote Edwin Starr, absolutely nothing. I’ve barely branched out in terms of issuers, close to 40% of my cards are just from American Express, lol

Should be pretty easy to get approved then, I’m starting to think I need to hold an intervention for DoC writers, first Chuck not doing the $250 Wells Fargo/Merrilll+ bonuses and now this… Fingers crossed this Reserve card does come out and it can be your first!

I don’t really have any USB cards either, haha. Just one old one (my first card), some sort of old version of the Cash+ which doesn’t get any 5% or anything. Never use it, just for age I keep it. They wouldn’t let me upgrade it to Cash+ cuz it was signed up as part of some affiliate side program and can’t transfer.

Oh boy!

I don’t agree with previous comments about why they got their rep. US Bank almost certainly pull 3 bureaus and was very annoying up until last summer when they won’t give you VS and downgrade you to Visa Platinum with a much worse sign-up/everyday bonus. That’s probably why everyone hates them.

Experian, Equifax and TransUnion are all big credit evaluation organizations. But it’s interesting that they only pulled your TU. Maybe only Capital One was famous for 3 pulls? Anyway I feel the same like you. Most banks pull 2 bureaus, 3 isn’t something unacceptable. I don’t understand why people are so exaggerated about this…

youre confused with cap 1 dude. but anyway, US Bank gets a bad rap because they will bitch slap you hard when they feel like it. just go look on flyertalk and reddit.

I’m more anxious to see if they offer the VI airfare discount on this card. If not, it won’t be able to compete with CSR IMO.