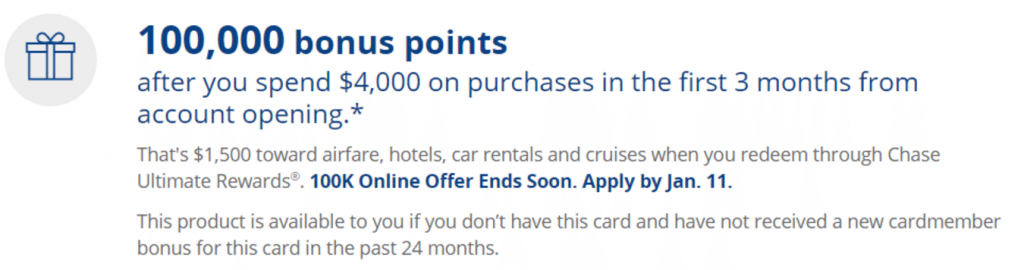

So everybody and their dog will be telling you that the Chase Sapphire Reserve bonus will be dropping to only 50,000 points after today and that it’s your last chance to get a 100,000 point bonus. Here is what you should know:

- It’s important to note that this only affects online applications and not in branch applications.

- The 5/24 rule applies to this card, meaning most readers will NOT be eligible. You should see if you’ve got a ‘selected offer for you‘ offer on this card and if you do I’d recommend applying today as chances are that bonus will drop to 50,000 points as well.

- The 100,000 in branch offer will last until at least March 12th, 2017. This is when Chase does a quarterly refresh and updates offers & APR’s. It’s entirely possible the 100,000 in branch offer will be extended in branch, but not guaranteed.

- The advantage of going in branch is you can check for pre-approved offers and these bypass the 5/24 rule as well. When you go into a branch don’t forget that the Chase Ink Preferred also has the annual fee waived first year and might be possible to get higher bonuses on the Chase Sapphire Preferred & Chase Freedom Unlimited. You can also open a Chase checking/savings account.

Honestly this change won’t make much of a difference to most people. If you can then I’d check to make sure you don’t have a selected offer for you.

My wife (who is at 6/24) got a preapproval in-branch January 7, but she didn’t have enough time to sit through the approval process. So she applied when she got home and her app is under review. She has two other Chase cards (Hyatt, $27K CL and CFU, $15K CL), so I wonder if it’d help if she offered to shift some of the available credit. Any thoughts as to whether she should A) call recon now, B) wait for a decision, or C) apply in-branch?

Hmm, I’d guess she’ll be denied but happy to hear otherwise.

I guess she might as well try recon, but most likely she’ll have to apply in branch. I’d think she can apply again right away, but maybe give a few days for the first application to clear out of the system.

online offer still shows 100k points…

Any new DPs if CPC bypasses 5/24 – ive read conflicting reports on flyertalk, slickdeals, and reddit. havent seen too many new DPs.

CPC bypassing 5/24 is dead: https://www.doctorofcredit.com/chase-private-client-statushigh-value-customers-no-longer-bypass-chase-524/

The internal memo specifically states that CPC won’t be immune to this bonus change as well.

Can i get this card with score of 700?

Thank You

Yes, it’s possible.

So….. My wife JUST applied for CSP with an online “selected for you” offer!!! WOO HOO. Approved! She is 11/24 without AUs. Thoughts on adding a CSR application on the heels of this application? Would they possibly approve it (0 in branch approvals).

Any harm? we should have no problem meeting any of the spending requirements.

No chance they approve it. Best to see if she has in branch pre-approval

Yeah… my thoughts exactly… she never gets in branch pre-approvals..but amazed that the “selected for you” offer works!

Thanks to you guys and of course the Travel Sisters blog.

to make it clear, she applied today, would there be another hard pull or anything showing up if she applied for the CSR today as well?

No, but honestly she is going to be denied so don’t see the point. Better to get another Chase card not under 5/24.

Good Morning. So, what I get from this is:

I haven’t had the card before, so 100K points could be in my future if I wait until March.

Waiting for my inquiries number to decrease. Chase is the only bank I can identify that will deny if your inquiry number is “high”. 5/24 means what exactly? Chase will deny a new card if you have gotten 5 cards in the last 24 months? WIsh I had never gone for the Chase Hyatt in July, 2015. That was a hard lesson in that despite how HIGH the score is, the inquiries can sink one’s plans.

That misstep could keep me from the Sapphire card that would benefit me.

BTW, may I ask for advice please?

I just closed my Barclay AA. I now have only Jetblue transferred from Amex. Annual fee is coming up plus I have a great CL with this card. I want so badly to have the Arrival Plus back with bonus, but I got a bonus back in 2014 and closed in 2015. Should I wait and apply for the Arrival Plus on the same day as the Sapphire Reserve?

I think Barclay will approve the Arrival after a reconsideration call due to high CL with Jetblue, which I would be forced to keep. Don’t know what Chase will do. If I have $ in the bank with Chase, does that help in the branch? I know this is not a great plan, just an attempt to get a card back to cover airfare expenses for this year. Thanks for insight.

If you are under 5/24, CSR is probably the best card for you to apply for. https://www.doctorofcredit.com/chase-524-rule-explained-detail-need-know/

Edit “The 5/24 rule applies to this card, meaning most readers will NOT be eligible.”

Updated