The Offer

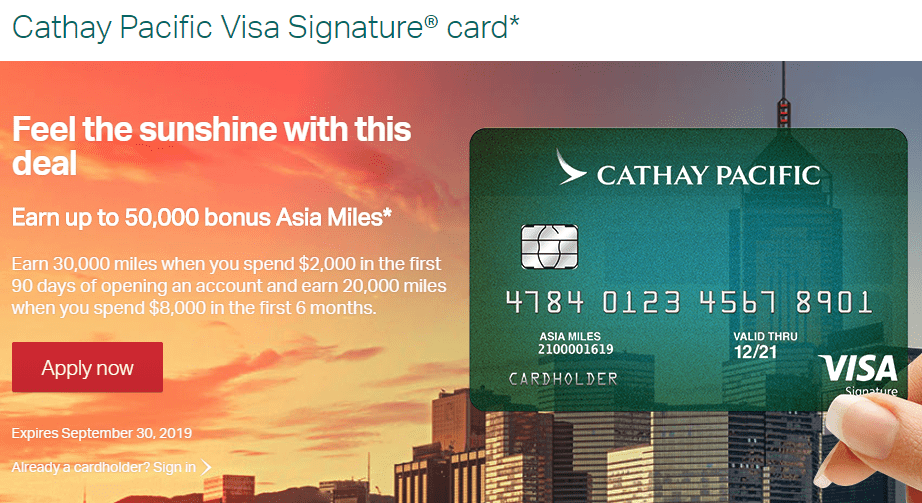

- Cathay Pacific is offering a bonus of up to 50,000 miles on the co-branded Synchrony credit card. Bonus broken down as follows:

- 30,000 miles after $2,000 in spend within the first 90 days

- Additional 20,000 miles after $6,000 extra spend within the first six months

Card Details

- Annual fee of $95 is not waived the first year

- Card earns at the following rates:

- 2x Asia miles per $1 spent on eligible Cathay Pacific travel and in-flight purchases

- 1.5x Asia miles per $1 spent on dining in the US or aboard

- 1.5x Asia miles per $1 spent on purchases outside of the US

- 1x Asia miles on all other purchases

- No foreign transaction fees

- Complimentary first year green tier membership in the Marco Polo Club (Cathay Pacific’s loyalty program. Green tier is their base level and as I understand it first year is always free. Second year onwards you need to pay $100 USD or earn 100 Club points).

Our Verdict

We’ve seen deals of 65,000 miles before and targeted offers of up to 90,000 miles. So this isn’t as competitive as those. Few other things to note:

- Read this post if you’re not familiar with Synchrony credit cards

- Our full review of this card can be found here

- Marriott, American Express Membership Rewards & Citi ThankYou points all transfer to Cathay Pacific

- Cathay Pacific award charts can be found here.

Because we’ve seen better offers on this card, we won’t be adding it to our list of the best credit card bonuses.

Hat tip to reader Thomas & TW

Offer has changed:

Earn 40,000 miles when you spend $2,000 in the first 90 days of opening an account.*

Expires March 31, 2020

First year of Marco Polo hasn’t been free in years, if it ever was. Currently it’s $100 to start and you can renew with 20 club points (I think they got no uptake at 100)–20 club points is basically two JFK-YVRs in economy. Green means (lowest) priority checkin and boarding with premium economy, which is not so bad if you usually fly international economy with them. So the annual fee and the Green fee waiver would cancel each other out if the card is otherwise worth it to you. Note that Asia Miles expire three years after you earn them and their lifespan is not extended by later earnings as with U.S. airlines.

The offer for this card fluctuates every few months but 2 years ago, it was 50k for 3k spend. I’m still going to apply and churn this though. Asia miles are useful for me since I fly sfo-hkg periodically.

DoC, the 65k offer was also targeted right? 50k was the highest ever for a public offer? I don’t think 50k is bad but what really kills it for me is the $8k spend requirement.

I thought 65k was public

I just googled “cathay pacific 65k” and all the blogs (including yours) tagged it as targeted. Perhaps there was another one that was public?

Had it in Aug 2017, closed in Oct 2017 after getting the bonus points. Got it again Mar 2019, got the bonus points. YMMV

What is the best use of their points for you?

Thanks.

Taking flights.

Is this card Churnable? I had it 2 years ago and cxled over a year ago. I tried to search on this site for the answer, but on the Synchrony Card info page it only says that you can not have a “second” card, (already having one open. What about having already closed it for a year? Can same product again?

Yes you can churn it.