Update 7/1/20: Rate reduced to 4% from 5%

Offer at a glance

- Interest Rate: 4% on balances up to $15,000

- Availability: Michigan only (“If you live, work or worship in the state of Michigan, you can join Arbor Financial Credit Union.”)

- Direct deposit required: $500

- Additional requirements: Yes, 30 debit transactions, see below

- Hard/soft pull: Hard (according to a reader)

- Credit card funding: $5,000 (according to a reader)

- Monthly fees: None

The Offer

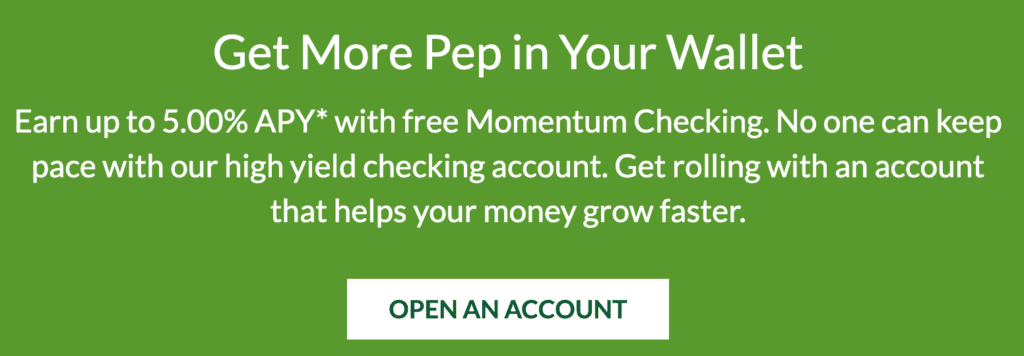

- Arbor Financial Credit Union offers an interest rate of 4% on their Momentum checking account on balances up to $15,000.

You must meet the following requirements:

- Make at least $500 in direct deposits into your free Momentum Checking account each month.

- Enroll in eStatements.

- Use your debit card:

- 30 or more monthly debit card purchases will earn 5.00% APY

- 20-29 monthly debit card purchases will earn 2.00% APY

- 10-19 monthly debit card purchases will earn 1.00% APY

The Fine Print

- Annual Percentage Yield (APY) as of 6/1/2019.

- Debit card purchases must post to your account during the calendar month. ATM transactions do not apply.

- Interest is not paid on balances over $15,000.

- One Momentum Checking account per member.

- Rate is variable and subject to change.

- If requirements are not met, you simply do not receive interest for the month.

Avoiding Fees

There are no monthly fees on the Momentum checking.

Our Verdict

Looks pretty nice for Michigan residents, we don’t see many 5% requirement accounts (usually more like 3-4%), and $15,000 limit isn’t terrible. The $5k card funding is a nice little touch too. Hopefully the debit requirement isn’t that hard to meet on small purchases. We’ll add this to the regional portion of our Best Savings Rates list.

Thanks to reader Josh for sharing one

Rate has increased back to 4%.

Website says the rate is 3%

30 debit transactions is yikes indeed ! But atleast there is no minimum per transaction like Genisys Credit Union (5$) has. I go to fill up gas in my car once a month – i pump for a few cents, end transaction, repeat 30 times. Getting harder to do that in this cold, though.

Interest down to 3% now. For reference, Genisys CU Genius Checking is still 4%, although for max.7500$.

During opening account, got hard-pulled on the credit-report. Never have I ever had that done to me for merely opening an account…and boy, i do have quite a few.

On top of that, application got denied. On pushing hard, they said: “not sufficient history of living at current address”.

It’s true, i had just moved from one building to another……within the same gated community IN MICHIGAN ! They completely ignored the 3+ years of my MICHIGAN residency until the move.

I gave them an earful. Called up Chex Systems and gave them an earful too. Wrote complaints against Chex and disputed their credit-report. But, of course, (rolling eyes) nothing happened.

So, i decided to double-down. Went physically to the nearest branch – 150 MILES drive EACH WAY – made them swallow their own words and open an account for me.

Once i have my break-even (for my gas cost, travel time, etc) thru the interest payouts, I intend to promptly close this account. At the moment, I’m keeping this going purely based on my ego to make my travel count.

Yields now down to 3%

Yikes. Lowered rate again today (10/1), now 3% on max $15k. No email announcement, just an update on the website.

Got a hard pull from Transunion, recently moved to michigan, applied online, my application was withdrawn by one of the e-commerce specialists named Claire, she mentioned it was due to inconsistencies in application (she refused to answer any other details regarding this), never got a credit card or bank account denied in last 10 years, very unpleasant experience, would rather to bank with some one else.

Rate drop to 4% (changed today, July 1). At least its not 3%-to-2%-to-1%, as elsewhere

This came as a surprise to me today. How did you find out? I looked through my emails from arbor and found no communication on it.

Just tried to fund with Citi Advantage Business platinum card it kept trying to go through as a cash advance. I will try a different credit card to fund the account.

30 debit card transactions! Yikes. No thanks I make more in 2-5% credit card cash back rewards.

denied for chex, 2 accounts in last 12 months. Sucks to get hard pulled and denied. Very risky imo

I second that!!!!

Thanks for the warning on that. Guess I’ll pass for now, not worth the risk as I’ve opened more than that in the last year

That’s very strange. They must have started running Chex because of the influx of applications. I applied in January and was approved and I’ve opened 8 accounts in the past 12 months.