Update 5/18/20: Today is the last day for the 100,000 mile bonus.

Update 3/16/20: Card has now officially launched.

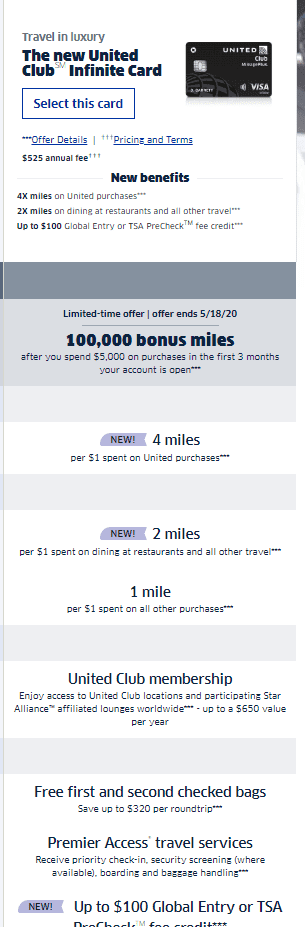

As rumored Chase has launched a New United Club Infinite Card with $525 annual fee. Let’s take a look at the card in more detail:

- 100,000 mile sign up bonus after you spend $5,000 on purchases within the first 3 months your account is open. Valid until 5/18/20

- This product is not available to either (i) current Cardmembers of any United ClubSM credit card, or (ii) previous Cardmembers of any United Club credit card who received a new Cardmember bonus for this credit card within the last 24 months. If you are an existing United Club Visa Signature Cardmember and would like this product, please call the number on the back of your card to see if you are eligible for a product change.

- Annual fee of $525 (not waived first year)

- United Club membership

- Card earns at the following rates:

- 4x miles per $1 spent on United

- 2x miles per $1 spent on dining at restaurants and all other travel

- 1x miles per $1 spent on all other purchases

- Free first and second checked bags

- Premier Access travel services

- Up to $100 Global Entry or TSA PreCheck

- 25% back on United in flight purchase

- No black out dates

- No foreign transaction fees

Don’t think this card or this landing page was supposed to go live until 3/16. It also looks like United might be seeking government assistance, so not sure now is the wisest time to be stocking up on United miles.

You guys shouldn’t fear losing your miles. There are several types of bankruptcies a business can file. United could file for bankruptcy but still operate. The U.S. government will continue to either bailout or assist United and other airlines because despite how much everyone loves and hates airlines, they’re still very much needed. Without airlines, we can’t fly for business meetings, take leisurely getaways, or contribute to tourism, which is a vital for the economic survival of some cities/states (think Hawaii), which rely on tourism revenue.

Doesn’t look to be available anymore

Horrible time to launch this card. Made more so with consumer spending way less on CC’s as think I read Chase was down approx. 40% of CC usage and the US consumer in general is using way less credit. Some people seemed to of learned from the 2008 crisis? Chase might have to waive the 5/24 rule to get interest in this card along with their other cards. Whenever a economic downturn happens for whatever reason lenders will eventually loosen restrictions to get customers that can use/afford cc’s and aren’t scared. I for-see the 5/24 rule going bye-bye or loosening up in the near future as more customers are needed to meet targets.

better SUB/SBs incoming, unless the bank crash (not all of them will)

Meanwhile, what IDIOT though this was a good time to roll out an airline card? Oh yea, the same folks that can not figure out the cancelled flight policy. LOL!

As to club access – if it only allows access when flying on UA – not worth much, other than the first year. Renewal rates will be terrible.

I assume these are planned months in advance, advertising paid for in advance, etc. Not like they decided to do it last week.

Under normal circumstances I’d be interested. These aren’t normal circumstances.

If UA file bankruptcy, will they empty everyone’s miles?

Nobody knows for sure, but I think in some past BK, miles were still there. They NEED to do that or they can not get enough people to keep flying them.

What happens to airline gift cards if airlines go bankrupt?

like all other gift cards I guess..there might be a period in which to use them up and then they go to zero… except, unlike say Toys R US, the airline are barely flying to use them up and soon even the few routes they flying will probably end,

Any dp on whether 5/24 applies to this leaked link?

From discussions with several managers, the 5/24 rule applies to all Chase cards, unless specifically NOT noted for a particular card, in which case that offer for that card is part of a limited promotion for only that card.

Would be a great time for Chase to waive the 5/24 rule!

DoC, what does this mean?:

‘ . It also looks like United might be seeking government assistance, so not sure now is the wisest time to be stocking up on United miles. ‘

What happens if you are holding United miles? Do they become worthless?

Nothing really happens if they get/seek government assistance, but you’d think it means they are struggling financially and if that’s the case then the future of the airline would be in doubt. I doubt that it comes to anything like that.

Got it…Thank you for the quick response!

Of all the domestic carriers, UA has one of the largest cash balances. I do believe they will get help because the current administration will offer it…but if UA fails, so will DL and AA, and they will all wash away their debts (read as retirement payments)

The concern is going concern.

A sinking ship takes everything with it.

It also means that United is likely to emerge a smaller airline with less routes. Miles are worth less with less options to use them. It’s also going to be very hard to use miles at any good rate for a while until international routes open all up again.

Let them fail. We have enough domestic carriers to support the U.S. and they’ve made it clear they don’t HELP consumers.

I say that as someone with stock exposure to the company

What?

More competition is always better.

If they fail, by definition they are not competitive.