Celsius filed Chapter 11 bankruptcy in July 2022. My sincere apologies this was a bad idea.

Update 6/13/22: Celsius has paused all withdrawals and transfers, certainly not a good sign.

Contents

The Offer

Celsius Network offers a cryptocurrency interest earning account.

At times they release deposit promo codes that provide an additional return on crypto deposits (in addition to the base return).

Existing User Promo Codes

The following is a table of Celsius Network deposit promo codes:

| Released | Last Used | Promo Code | Deposit Amount | Deposit Coin | Bonus Amount | Bonus Coin | Notes |

|---|---|---|---|---|---|---|---|

| 2022-05-17 | 2022-05-17 | STABLECOIN50 | $2,500 | USDC, USDT, GUSD, USDP, BUSD | $50 | BTC | 180 Day Hold |

| 2022-03-18 | 2022-03-18 | LUNA20 | $500 | LUNA | $20 | LUNA | 90 Day Hold |

| 2022-03-18 | 2022-03-18 | LUNA150 | $5,000 | LUNA | $150 | LUNA | 180 Day Hold |

| 2022-03-18 | 2022-03-18 | LUNA600 | $20,000 | LUNA | $600 | LUNA | 180 Day Hold |

| 2022-03-01 | 2022-03-01 | AVAX20 | $500 | AVAX | $20 | AVAX | 90 Day Hold |

| 2022-03-01 | 2022-03-01 | AVAX150 | $5,000 | AVAX | $150 | AVAX | 90 Day Hold |

| 2022-03-01 | 2022-03-01 | AVAX600 | $20,000 | AVAX | $600 | AVAX | 180 Day Hold |

| 2022-01-21 | Dead | $500 | ETH | $20 | ETH | 90 Day Hold | |

| 2022-01-21 | Dead | $5,000 | ETH | $200 | ETH | 90 Day Hold | |

| 2022-01-21 | Dead | $20,000 | ETH | $600 | ETH | 90 Day Hold | |

| 2021-11-22 | Dead | $5,000 | Any Coin | $150 | BTC | 60 Day Hold | |

| 2021-08-27 | Dead | $400 | ADA | $40 | ADA | 30 Day Hold | |

| 2021-08-27 | Dead | $20,000 | ADA | $500 | ADA | 90 Day Hold | |

| 2021-08-27 | Dead | $50 | USDC/USDT | $10 | BTC | 30 Day Hold | |

| 2021-08-27 | Dead | $200 | USDC/USDT | $50 | BTC | 30 Day Hold | |

| 2021-08-27 | Dead | $25,000 | USDC/USDT | $600 | BTC | 90 Day Hold | |

| 2021-07-23 | Dead | $400 | BNB | $40 | BNB | 30 Day Hold No USA |

|

| 2021-05-28 | Dead | $400 | Any Coin | $50 | BTC | 30 Day Hold | |

| 2021-05-28 | Dead | $25,000 | Any Coin | $600 | BTC | 90 Day Hold | |

| 2021-05-28 | Dead | $250,000 | Any Coin | $2500 | BTC | 90 Day Hold | |

| 2021-05-06 | Dead | $200 | Any Coin | $20 | BTC | 90 Day Hold | |

| 2021-05-06 | Dead | $25,000 | Any Coin | $500 | BTC | 90 Day Hold | |

| 2021-05-06 | Dead | $250,000 | Any Stable Coin | $2,000 | BTC | 90 Day Hold | |

| 2021-04-02 | Dead | $25,000 | Any Coin | $500 | BTC | 90 Day Hold | |

| 2021-01-14 | Dead | $1000 | Any Coin | $20 | BTC | 30 Day Hold | |

| 2021-01-14 | Dead | $2000 | USDT | $20 | USDT | 30 Day Hold | |

| 2021-01-02 | Dead | $100 | Any Coin | $5 | BTC | Each Code $100/$5; 30 Day Hold | |

| 2020-12-23 | Dead | $500 | Any Coin | $25 | BTC | 30 Day Hold; Expires 2020-12-26 | |

| 2020-12-11 | Dead | $2000 | Any Coin | $50 | BTC | 30 Day Hold | |

| 2020-12-04 | Dead | $2000 | Stable Coin | $20 | USDC | 30 Day Hold | |

| 2020-11-13 | Dead | $200 | Any Coin | $25 | BTC | Does not show properly | |

| 2020-11-11 | Dead | $100 | ETC | $5 | ETC | 60 Day Hold | |

| 2020-07-19 | Dead | $200 | Any Coin | $20 | BTC | 30 Day Hold | |

| 2020-05-02 | Dead | $100 | Any Coin | $10 | BTC | ||

| 2020-04-23 | Dead | $200 | Any Coin | $10 | BTC | 3 or 30 Day Hold | |

| 2020-04-22 | Dead | $100 | Any Coin | $10 | BTC | Expires 20200518 | |

| 2020-04-20 | Dead | $100 | Any Coin | $10 | BTC | US Only | |

| 2020-04-10 | Dead | $100 | Any Coin | $10 | BTC | Failed 20200418 | |

| 2020-04-10 | Dead | $100 | Any Coin | $10 | BTC | US Only | |

| 2020-04-10 | N/A | $100 | Any Coin | $10 | SGA | Outside US Only | |

| ???? | Dead | $100 | Any Coin | $10 | BTC | Failed 20200420 | |

| ???? | Dead | $100 | Any Coin | $10 | BTC | Failed 20200420 | |

| ???? | Dead | $100 | Any Coin | $10 | BTC | Tested 20200418 | |

| ???? | Dead | $100 | Any Coin | $10 | BTC | Tested 20200418 | |

| ???? | Dead | $500 | Any Coin | $50 | BTC | Tested 20200418 | |

| ???? | Dead | $100 | Any Coin | $10 | BTC | Tested 20200418 | |

| ???? | Dead | $500 | Any Coin | $50 | BTC | Tested 20200418 | |

| ???? | Dead | $500 | Any Coin | $10 | CEL | Tested 20200418 | |

| ???? | Dead | $100 | Any Coin | $10 | BTC | Tested 20200418 | |

| ???? | Dead | $500 | Any Coin | $50 | BTC | Tested 20200418 | |

| ???? | Dead | $100 | Any Coin? | Tested 20200418 | |||

| ???? | Dead | $500 | Any Coin? | Tested 20200418 | |||

| ???? | Dead | $500 | Stable Coin (USDC, GUSD, TUSD, and PAX) | $10 | BTC | Ended 20190818 | |

| ???? | Dead | $500 | Stable Coin (USDC, GUSD, TUSD, and PAX) | $10 | BTC | Tested 20200418 | |

| 2020-02-29 | Dead | $1000 | Any Coin | $100 | BTC | Ended 20200229 | |

| ???? | Dead | Tested 20200418 |

New User Promo Codes

First time depositors can use promo code HODL50 which rewards $50 in BTC for a $400 deposit that is held for a minimum of 30 days. [Note these codes are updated frequently]

This should also work when combined with a referral code [discussion], which also rewards $40 in BTC on a $400 deposit held for 30 days. So to trigger both new user promotions a deposit of $800 would be required for an $80 bonus. [It looks like only a referral code or a first time transfer code will now work].

The Fine Print

- Promotional bonuses are generally locked for 30 days

- Full Celsius Promo Code FAQ

Geographic Restrictions

- Celsius Network Earn product is not available in the following states:

NY(Update May 2020 now available in NY), TX (not stable coins), and WA

My Simple Process

I worked through the active promo codes above, following a two step process:

- I entered the promo code

- Within the Celsius App -> Profile menu -> “Enter a promo code”

- Then sent a USDC (a US dollar stable coin) deposit to my Celsius USDC wallet address

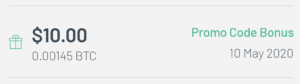

As soon as the deposit posted, the locked bonus became visible within my “Total wallet balance”

I worked through the promo codes one per day, but I think it might be OK to do multiple in series (add the promo code, make the deposit, repeat) on the same day.

There is a LeoFinance data point that the promo codes may stack. I’m not sure if that still works, at the least it’s strongly discouraged in the FAQ and I assume could generate some sort of adverse action. [Dave S notes that this may trigger the bonus but that it will later be cancelled]. I think the promotion is strong enough that I’ll do any active codes in sequence.

Our Verdict

Lending your cryptocurrency holdings to Celsius is much further out on the risk spectrum then lending your dollars to a bank for a signup bonus.

So please take caution and only consider this path if you can deal with even a complete loss of any crypto transferred [and as always please don’t consider this post as any form of advice].

For me personally, it’s a good deal:

- As I figure, the base interest rate (7.25% on stable coins deposits as of 2020-04-15) compensates for the risk of loaning the crypto, so the bonus codes provide almost pure bonuses, or

- If I look at the bonuses in terms of a percentage return. A 10% return for the month is something like a 200% return for the year (if I could compound at that rate, and if I did the math correctly, [and of course this is on a limited amount of money over only a short period of time])

Celsius Network is also currently offering a signup bonus.

We look at some of the basics, options, and risks (No Insurance, Price, Technology, Counterparty, …) of crypto interest earning accounts in our Crypto Lending Options post.

Please share any new promotional codes in the comments below (your location inside or outside the US would also be helpful) and subscribe to the comments for the latest code updates.

All the best!

(HT: The Financier, CNW)

History

- Update 07/19/2020: New promo code SUMMER discovered (HT: Kasey Cook)

- Update 05/02/2020: New promo code SPRING added (HT: Tyler)

- Update 04/23/2020: New promo code POV added (HT: Dave S)

- Heads Up: This locked promotion will appear earlier in your transaction history because of the shorter 3 day lock period.

- Please subscribe to comments if interested in receiving updates on new deposit codes, I will stop republishing this post on each new deposit code.

- Update 04/22/2020: New promo code PAKMAN added (HT: Benji)

- Update 04/20/2020: New promo code APRIL0410 added (HT: Papas)

Files for bankruptcy

“Crypto lender Celsius Network LLC has filed for bankruptcy protection a month after halting withdrawals, in the wake of a collapse in digital currency prices that stretched the crypto lending platform’s business model past the breaking point.”

https://www.wsj.com/articles/crypto-crash-drags-lender-celsius-network-into-bankruptcy-11657758483?mod=breakingnews

“Celsius Network was a ‘Ponzi scheme,’ company’s former investment manager alleges in lawsuit”

https://www.marketwatch.com/story/celsius-network-was-a-ponzi-scheme-companys-former-investment-manager-alleges-in-lawsuit-11657241889

(If paywall open in incognito.)

and…….there goes Vauld

Voyager done now?

Yup.

https://www.investvoyager.com/blog/voyager-update-july-1-2022/

BlockFi next https://twitter.com/otteroooo/status/1537497403246268416 !!!

I guess they dropped to…

…zero degrees Celsius.

Now you know why I use this username. More reward usually brings more risk! And if you don’t fully understand how higher returns are being generated, then stay away!

Now you know why I use this username.

*Only has 1 comment in history*

Hope you didn’t lose much on Celsius 😂

If nothing else, it’ll be nice not having to read comments on 4% FDIC-insured account threads about how stupid I am for not dumping all my money into “stablecoins” and making 10+% “risk free”.

I think most people were smart enough to spread it around various places and Celsius had one of the lower rates. All told, it’s likely people will have recoveries as Nexo has already reached out about purchasing the company. People that weren’t holding loans or leverage of any kind will almost for sure recover all their stablecoins. Those will leverage will likely end up with nothing (or worse). Obviously no one knows for sure.

My opinion is that this is wishful thinking, but I hope you’re right. I think the Nexo thing is just a way to attract customers, even if they did buy Celsius they won’t be able to afford to make anyone whole. The Celsius ToS makes it clear that if they suffer a serious downturn they aren’t required to give us anything.

Nobody credible said this stuff was “risk free” and the obviously well-designed stablecoins are still stable, so your comment is uninformed and unnecessary, but I do understand that people like to feel superior especially when something they don’t understand has some negative news. Personally I’m still up 31% on the crypto side of my portfolio over the past 2 years, even after counting all of my funds in Celsius as lost. Like any smart investor, I started small and spread out my money, and in the crypto space that means using multiple services/brokers as well as multiple specific coins. I wasn’t greedy and sold as prices went up. And of course I was lucky, things could have certainly gone the other way. But everything financial is risky whether it’s speculation like crypto or stocks or choosing to be super-duper-FDIC-safe and choosing to LOSE money to inflation with your 4% “gains” while the banks get richer and richer.

Reread my post. I literally put stablecoins and risk-free in quotations to highlight the absurdity of the things that those people argued. Oh, there are well-designed stablecoins, I own some USDC for the reasons you mentioned. But many supposed stablecoins aren’t what their name says, many have argued much less risk than is true (including you), and your condescension highlights WHY people like me laugh when this stuff happens. If you’re still making money in the space, good for you. I’m not sure what purpose your hyping could serve except to convince YOU that you’re right.

LOL, you show glee at the misfortune of others, then accuse me of condescension. The funniest part is (I think?) we agree that nobody credible said this was “risk free”, so if your post was meant to get back at the minority of non-credible crypto people, why not find a better place than here, where lots of sincere and realistic people come to discuss this stuff? No, you’re being disingenuous, it’s obvious that you feel good knowing that your 4% is better than these fools who lost money on “stablecoins”.

I posted this here because this is the website where I was told an FDIC-insured 4% was stupid compared to the 10+% people were getting on Celsius. Here. On this website. The website that those posters commented on.

Are you new to DoC? Plenty of people were comparing stablecoin to I-Bonds and how they were a much better idea for a risk-free investment. Good for you that you’re still up 31% up? Are you letting us know or are you just telling yourself that to convince yourself you were right? The issue was the fact that people on here, Reddit, Slickdeals were praising crypto up until these major dips over the past couple months. Anyone who actually listened weren’t so lucky and would now be in the hole. Of course, everyone should do their own due diligence, but it’s concerning that people continue to spout how stablecoin is just as risk-free as a freaking US bond.

Wow so you mean if you invest in Stablecoin

1. They give you an outsize interest rate

2. They give you zero protection of capital

and none of these stablecoin company and their executive becomes richer and richer?

So what exactly is their business model are they some kind all charity compare to the all evil banks??

Someone is drinking a lot of Kool-aid 🤣🤣🤣

Are stablecoin withdrawals not limited as well right now?

But I thought one of the benefits that people love to spout is the fact that crypto has so much liquidity?

But patoot, they have stable and coin in the name. In the same way that a roll of quarters holds its value if I throw it into the ocean or give it to a conman.

RIP Celsius and my 4-figure balance

RIP my nearly 6 figure balance across all crypto platforms.

Looks similar to that short ladder by Citadel when the Robinhood kids

couldn’t find the sell button for their Gamestop shares.