The Offer

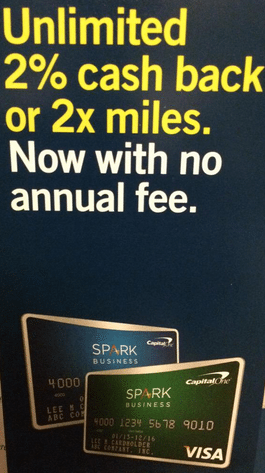

Awhile ago a reader told me that it was possible to get the Capital One Business Spark card with no annual fee if you applied in branch. The flyer they showed me (shown below) mentions the no annual fee and I was able to confirm that this wasn’t only for the first year, it was for the life of the card.

It didn’t mention any sign up bonus, so I didn’t bother mentioning this bonus. That’s because if you apply online you can get a cash bonus of $300 when you spend a total of $5,000 within three months and add a second user (authorized user) within 60 days of account opening.

Yesterday reader Bay11 let me know that they were able to get the following bonus when they applied in branch (with the no annual fee):

- $50 for adding second user within 60 days of account opening

- $250 for spending a total of $5,000 or more within three months of account opening

The Fine Print

- No annual fee ever

- 2% cash back on all purchases

- Must apply in branch (if you apply online you’ll be charged $59 from year two onwards)

Our Verdict

A $300 cash bonus is very competitive (best cash bonuses can be viewed here), couple that with the fact it earns 2% cash back and it’s a Visa and it has no fee and this is a very compelling offer. The problem? Capital One pulls all three credit bureaus when they run your credit, if your able to spread your inquiries over all three credit bureaus then that’s the equivalent of applying for three cards. To understand this better I’d recommend reading through my credit card application strategy.

One way to account for this is to apply for multiple Capital One cards in the same day, doing this should result in these inquiries being combined (although there aren’t a lot of data points either way). If this is the case, then it could make sense to also apply for the Capital One Venture card which also comes with a $400 sign up bonus. $700 in bonuses is much more attractive for 3 credit pulls than only $300.

Sometimes Capital One offers a bonus of $500 on this card, so it’s well worth checking for targeted bonuses from Capital One first. There is also a $250 checking bonus for Capital One business checking customers (and a $100 bonus from Capital One 360).

What are your thoughts on this offer? Share it in the comments. Do you know of any other similar in branch offers, please let me know below.

Spark Cash Spark Cash for Business

They have a $500 bonus after 4500 in spending with an annual fee of $45 waived the first year.

https://www.capitalone.com/small-business/credit-cards/spark-cash/?irgwc=1&external_id=IRAFF_ZZd65bcc544f7c401598a3ca51760d948a_SBCIR_K357390_A344893L_C47ce9ab4Nc8c9d13eebf088ac9297c93_S-227801491

With regards to signing up for multiple cards at the same time, I would not get my hopes up too high. I tried the triple browser trick for all Cap One cards, and all three failed. They did not get rejected, they just flat out failed. I tried again with the same result. It was as though their system saw all three come in at the same time and it canceled all three without even processing one card application. I have since avoided all Cap One cards. I will probably go for them down the road, but at the moment they are low priority.

Very attracting… But I don’t have a business sadly. Seems no chance of getting approved?

You can apply for a business card without a business. just use SSN for the EIN.

Probably more difficult to do in branch.

I just messaged CapitalOne to see if they’ll waive the fee on my existing account forever. Will report with results.

Please keep us posted, very interested in your outcome! Thanks!

Got nothing from the online messaging, but I called and they basically indicated they would be happy to waive the AF year after year. Their system doesn’t let them outright delete the fee, but the CSR proactively scheduled a January 3rd 2016 appointment where they’d call me to have the fee removed and pretty much indicated this could be done indefinitely! Not bad. I do probably put around $100k/year on the card in real spend, so that could be a factor.

I received a targeted CO business spark offer a couple of months back for 500.00 sign up bonus and 1.5% cash back no annual fee ever. Signed up and meet min spend with Redbird. R.I.P.

Strange that it has the lower earning rate.

I’ve read that Cap1 business cards show up on your personal credit report not only at account opening but also on your monthly spend. Is this accurate?

Yes.