Deal has ended, view more bank account bonuses by clicking here.

Update: Seems to be available in Massachusetts, Connecticut, Rhode Island, New Hampshire, Vermont, and Maine

Offer at a glance

- Maximum bonus amount: $200

- Availability: MA, CT, RI, NH, VA, ME

- Direct deposit required: Yes, $1,000+

- Additional requirements: None

- Hard/soft pull: Soft pull

- ChexSystems: Unknown

- Credit card funding: Up to $250

- Monthly fees: None

- Early account termination fee: $10, 90 days

- Household limit: One

- Expiration date: December 31, 2020

Contents

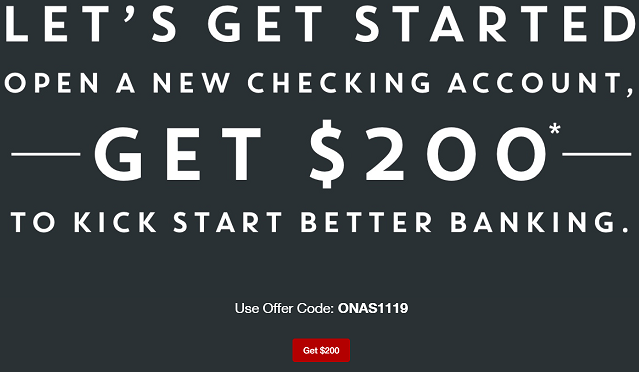

The Offer

- South Shore Bank is offering a $200 checking bonus when you open a new checking account and complete the requirements:

- Receive a direct deposit of $1,000+ within the first 90 days of account opening

The Fine Print

- South Shore Bank employees not eligible for the promotion. One new account per household, must be 18 years old or older.

- Promotion valid through December 31, 2020. Offer is subject to change without notice. These offers are available online for applications completed using the “Apply Now” button on this webpage, or if media campaign and promotion code are mentioned in branch. Applications submitted through other pages on the website will not qualify. Qualifying criteria must also be met to receive the $200 bonus. If a prospect decides to open a different checking account online and mentions the campaign, they will still receive the bonus. Excludes Student Checking and all Business Checking accounts.

- To receive the $200 cash bonus applicants must open and use a new Free Checking account with direct deposit totaling $1,000 or more within the first 90 days of account opening. A qualifying Direct Deposit is defined as a recurring Direct Deposit of a paycheck, pension, Social Security, or other regular monthly income electronically deposited by an employer or an outside agency into the new Free Checking account.

- Upon requirement completion, South Shore Bank will deposit the $200 bonus into your new account within 30 days after the initial 90 days.

- Bonuses are considered interest and may be reported on IRS Form 1099-INT (or Form 1042-S, if applicable).

- New account will not be eligible for offer if any signer has signing authority on an existing South Shore Bank consumer checking account or has closed a checking account within the past 6 months. Fees and charges may apply, please consult with a South Shore Bank representative for details.

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

Avoiding Fees

Monthly Fees

They offer a free checking account with no monthly fees to worry about.

Early Account Termination Fee

There is an early account termination fee of $10 if closed within 90 days.

Our Verdict

Given it’s a soft pull and there is a small amount of credit card funding this one is worth doing. Will be added to our list of the best bank account bonuses.

Hat tip to reader nurglefish

Useful posts regarding bank bonuses:

- A Beginners Guide To Bank Account Bonuses

- Bank Account Quick Reference Table (Spreadsheet) (very useful for sorting bonuses by different parameters)

- PSA: Don’t Call The Bank

- Introduction To ChexSystems

- Banks & Credit Unions That Are ChexSystems Inquiry Sensitive

- What Banks & Credit Unions Do/Don’t Pull ChexSystems?

- How To Use Our Direct Deposit Page For Bank Bonuses Page

- Common Bank Bonus Misconceptions + Why You Should Give Them A Go

- How Many Bank Accounts Can I Safely Open Within A Year For Bank Bonus Purposes?

- Affiliate Links & Bank Bonuses – We Won’t Be Using Them

- Complete List Of Ways To Close Bank Accounts At Each Bank

- Banks That Allow/Don’t Allow Out Of State Checking Applications

- Bank Bonus Posting Times

Bonus posted today

Employer DD Dec 31 2020

Me too. Cheers everyone.

Mine too. Used only Discover Bank ach.

Bonus posted today 3/3/2021. My work DD hit around 1/15/2021

How in footprint were you? I’m not in a surrounding county, but in MA. No bonus 🙁

I am located in Norfolk County, but I did not receive the bonus yet. I am going to wait until the 30 day payout period passes then message a representative.

Account Opened: December 7, 2020

Bonus (Should) Post: April 7, 2020

I opened early December as well. Opening was a bit of an ordeal so not sure of the exact date they will use. Fingers crossed for the both of us.

Bonus posted today. Woo Guy

Woo Guy

Denied by CHEX

How many in the last 12/24 months

Anyone able to sign in to the account? Tried logging in yesterday and today to check my test real DD but keep getting an error message

For MA, this is only available in the following 3 counties: Norfolk, Plymouth, Suffolk

The offer page on the bank’s web site appears to have been removed.

@Yawgoog William Charles Yep, this one looks like it’s dead.

William Charles Yep, this one looks like it’s dead.

Anyone know if the direct deposit really needs to be “recurring”?

If you want to be safe I would do at least two that total $1000. I plan to do several small ones since I can easily change my DD.

I did a one-time $1000 real employer DD, and got the bonus. So datapoint – does *not* need to be recurring if real DD.

Declined due to out of state address. I’m in CT. They said if I went to the branch they could probably open an account for me, but they wouldn’t online or over the phone.

Declined due to chex. Also said my credit score was about 100 points lower than stated elsewhere.