Update 8/15/21: Readers in the comments report that the new Citi virtual account number (VAN) system is now live.

Update 8/11/21: These changes are due to go live within the next week and include being able to use it in app.

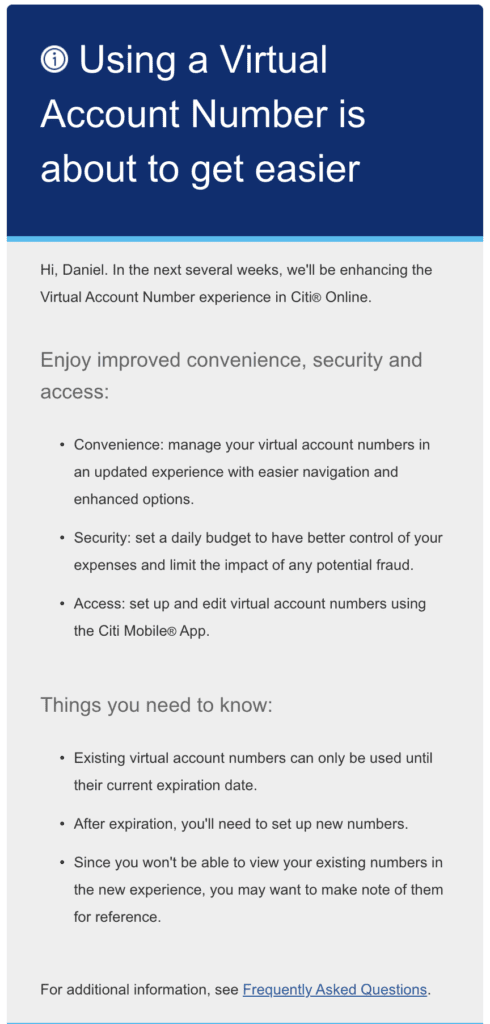

Update 7/20/21: Some additional information regarding the VAN changes. Hat tip to reader Daniel P

Update: In the FAQ they indicate that there’ll be a new, improved system rolling out in early summer 2021. Hat tip to reader diggs

Original Post:

In recent times Citi has made a number of changes to creating a Virtual Account Number (VAN), Citi update the card generation page to no longer use flash and also removed and then readded the feature for American Airline cardholders. Currently at the moment it’s only possible to generate a VAN with an end date of 7/21 or 8/21. At first it seemed like this was just part of the service as it was some period in advance, but as we continue to approach this date it’s unclear if Citi plans to discontinued the service at the end of August or make significant changes to VANs. We’ve reached out to Citi for comment but are yet to hear back.

Hat tip to reader Matt I

Merchants seem to have no problem making charges on deactivated numbers under the new system. Kinda defeats the purpose.

I was also just charged from a Merchant from a deactivated card number, AND the charge is over the authorized limit of when the virtual account was active. I called to dispute, and they said they would “investigate” and get back to me. They also have to issue and mail a whole new card as well despite it being from a virtual account number, what a pain in the …

I asked the rep how to prevent this, and she fumbled around words and even noted I was the second person she talked to that this happened to. I think she was as perplexed as I was, and said “this shouldn’t have happened”.

This is ridiculous, Shiti is Shiti.

@chuck William Charles – just checked my statement and was charged AGAIN from the same deactivated card from years prior and over the amount even allowed originally again. This is after Citi disputed it last year, sent me a whole new credit card with new card number as well. Rep just said maybe they didn’t close it correctly last time which sounds ridiculous. At this rate, I wouldn’t be shocked if it popped up again next year on yet another new card number and I go through the same process.

William Charles – just checked my statement and was charged AGAIN from the same deactivated card from years prior and over the amount even allowed originally again. This is after Citi disputed it last year, sent me a whole new credit card with new card number as well. Rep just said maybe they didn’t close it correctly last time which sounds ridiculous. At this rate, I wouldn’t be shocked if it popped up again next year on yet another new card number and I go through the same process.

I have the Simplicity Card and the feature was removed when they updated the interface. I chatted with a rep today and at first they said it wasn’t available for my card anymore and then stated it was and that a ticket was opened 10/7 for this issue with no timetable for fix. Wow.

Anyone know how to view your old VAN 1.0 numbers that are still active ? The CITI agent could not tell me .

As of today, I can set a card expiration date up to 12 months out. Still can only set $ daily limit, no aggregate spend limit.

What is the spend limit of my Virtual Account Number?

i found this at FAQ

By default, the limit of your Virtual Account Number is based on the available credit limit of the card it is connected to. We recommend setting a daily spend limit lower than your available credit limit of your real card.

AND THIS: How does a daily spend limit work?

A daily spend limit defines how much you can spend on a particular Virtual Account Number based on Central Standard Time from 12am to 11:59pm. If a transaction exceeds your set thresholds, it will be declined.

How do I change or remove my daily spend limit?

For example, if you set a daily spend limit of $100 and make a $80 purchase, a second transaction of $30 will be declined. But if your second transaction is instead $20, it will be accepted and you will not be able to make more purchases until 12:00 a.m. Central Time the following day. At that point, your daily spend limit resets back to $100. Keep in mind that recurring charges apply to any limits you set.

For those that are getting a declined number, has anyone contacted Citibank and ask for the specific reason for why a given transaction was being declined? Their virtual number support people can pull up that detail. I have used VAN2 with over fifteen vendors in the last couple weeks and had no problems at all. Weird.

Not only are the VANs declined, they are declined EXTREMELY fast which makes me wonder if the number generated doesn’t follow the proper check digit scheme and isn’t even being sent to Citi for verification. There is no delay of even a second where, behind the scenes, the website would be able to communicate to another validation system. It’s a buggy mess. Why they would even release something like that is beyond me. It would be better to just take the link down and continue to promise that “it’s coming” rather than frustrating their customers like this.

In general I’m noticing a lot of software bugs of various types with lots of online companies. I’m guessing all the work-from-home COVID stuff has hobbled proper testing and companies are installing poorly tested applications to meet internal deadlines.

I’ve kept a record of some VANs created with the old and new system.

14 old VANs all start with “5403 02” and satisfy the Luhn algorithm.

10 new VANs all start with “5120 68” and satisfy the Luhn algorithm.

The Luhn algorithm is used to validate card numbers. It may be used by some vendors to pre-validate a card number before checking with Citi or Mastercard.

Since both old and new VANs satisfy the Luhn algorithm, it’s unlikely that vendors are denying the new VANs based on that check.

My physical card starts with “54”, which matches the old VANs – possibly significant for vendor validation.

Card numbers begin with digits referred to as IINs. The IIN can be used to identify the card issuer. Many IINs are registered and this information could be used by vendors to check for valid VANs.

The first few digits of the new VANs have changed. It’s possible that vendors don’t consider “5120 68..” as valid IINs, resulting in immediate failure. This might explain why some users here are seeing some new VANs succeed (e.g., mine) and some fail, probably depending on the specific vendor and the nature of how they pre-validate the VANs numbers.

See my earlier post.

I expect that vendors declining VANs from the new system might be checking the VAN’s BIN/IIS (first 6 digits) using an outdated list of valid BIN/IIS numbers. If I were a vendor trying to cut costs and using a lazy developer, I might use a downloaded BIN/IIS list and not keep the list updated. Citi switching the BIN/IIS from 540302 for old VANs to 512068 for new VANs may have triggered failures at vendors not using an updated BIN/IIS list or service.

Dr. Thunder’s reference to extremely fast decline implies use of a BIN/IIS list, rather than a service that would take some time to return a validity check.

It’s interesting that the old VAN BIN/IIS (540302) shows in one BIN/IIS checker as a “virtual” Mastercard, while the new VAN BIN/IIS (512068) shows as a standard Mastercard. Maybe the BIN/IIS for the new VAN system was repurposed by Citi from older, obsolete physical cards. This BIN/IIS may have been removed from older BIN/IIS lists and not yet added back in some cases.

Much of this is speculation, but the evidence seems to point to a combination of Citi changing the BIN/IIS and some vendors considering the new BIN/IIS as invalid. Citi probably wanted to use a different BIN/IIS for the new VANs, but repurposed an old one to avoid failures at vendors checking BIN/IIS lists.

It would really be useful to have posters here indicate which vendors are declining the new VANs.

sorry – meant BIN/IIN

These virtual numbers used to be really useful. Now they get declined anywhere I try to use them. What an upgrade!

I’ve been using VAN2 for a couple weeks now. Here are my observations and the work arounds I am using.

Since you can no longer set an absolute dollar card limit, I create and name each card for a given merchant. I set the dollar limit to the transaction amount of the purchase and after the charge clears, I change the dollar limit to $1.00 until the next purchase from that merchant. As opposed to having to create a new VAN each purchase, I now assign a different VAN for each merchant & allow them to retain that number on their system. I’ve set the expiration date for a year from now.

For recurring monthly charges, I leave the daily dollar limit set at the monthly charge. Most are nominal dollar amounts and to me the risk of a merchant hack or double billing is worth the convenience of not having to repetitively revert the number back to $1.00.

For one off purchases, I create a VAN which expires the next month and then deactivate it once the purchase clears.

While I have seen multiple people post that you can deactive or revert the daily limit to $1.00 after the VAN has a pending status (makes sense), I haven’t actually done that with this new system. Has anyone actually done this and had the payment proceed without difficulty?

If so, many merchant purchases go pending the moment you submit the VAN for payment and you could revert it to $1.00 during the same session.

Question for anyone using Capital One VAN: Is it really true you cannot set a total or daily dollar limit on their virtual numbers?

Sir: Thank you for your post. In general my experience with the new CITI VAN system has been positive. I use some of the work arounds that you do however yours are even better and I will use some, if not all, of them myself. Knock on wood but I have not had a VAN refused on the new system. Again, thanks.

I have seen no way to set a $ limit (daily or total) for a Capital One VAN.

I have always enjoyed the Citi cards and loved the virtual credit card. I am not pleased with their new virtual credit card (VCC). I loved the fact that I could assign a VCC to a company and only that company could use that VCC. That is one strike against the new VCC.

I still will assign a different card number to each reoccurring payment by company. If transactions starts coming from that companies assigned VCC, that do not belong to that company, I will know which company got hacked.

I also wish that I could choose between setting a monthly or daily credit card limit. A lot of my reoccurring transactions are for a monthly payment.

Looks like Citi has a lot of room for improvement with this new VCC.

I also liked the VAN being linked to one vendor. I believe that was a strong tool to prevent fraud. Further, it seems to me that only being able to set a daily limit shows a complete lack of understanding on Citi’s part of how customers use the VANs. I don’t pay anything on a daily basis. The workaround to reset the limit to $1 every day for the life of a recurring payment is not going to be workable for me.

I understand Capital One has something like VANs. Anybody have any experience with their system?

We’ve been using Capital One for about 6 months because of uncertainty about Citicards VAN. Overall, it’s been a positive experience, especially when compared with Citicards. It’s dead easy to use with a web browser (we use Chrome). The Eno plug-in will generate a virtual card while you are on a vendor’s website and it’s easy to copy the account info into the vendor’s order page. VANs are tied to that vendor. We’re primarily using Capital One VANs for recurring payments.

A few downsides: Capital One VANs have no charging limit and have 5 year expiration. We don’t use for one-time payments, although I suppose you could cancel it after a charge is posted (don’t know how it would handle returns though). ENO doesn’t work on mobile devices, so you can’t generate a VAN from your phone.

We may abandon Citicards VAN if the comments on this site about multi-vendor use and daily limits hold up in the final release. Also, I’m fed-up with waiting; Citicards has been talking about their new system forever, but it seems like vaporware. And why hasn’t the design team reached out for user input. Sounds to me like Citicards doesn’t care about VAN.

I have been using VANs since they first started. However, the new Citi VANs are being rejected at multiple online vendors (restaurants for pickup, charity, etc.), which never happened with the old VAN system.

Is anyone else seeing that happen?

My latest monthly statement includes charges with both old and new VANs. The charges with the old VANs show the VAN number. The charges with the new VANs do not show the VAN number or even that the charge was made with a VAN.

Regarding Amazon, I routinely use VANs (including some new ones) at Amazon, but I’m careful to separate the orders to use different VANs. It’s a pain, but it prevents denials due to use by multiple payees.

I created a new VAN last month when the new system was briefly available. It was used at Verizon last month and the payee appeared as “VERIZON WRL MY ACCT VW FOLSOM CA”. I successfully used the same new VAN today at Verizon and the payee changed to “VERIZONWRLSS*RTCCR VW 800-922-0204 FL”. It’s possible that “RTCCR” is an indication that Verizon identified the transaction as recurring due to using the same VAN twice. Verizon seems to change between several payees, but the latest has not appeared in the past using single-use old VANs. This is some indication that new VANs might work with multiple payees.

From what I’ve heard with the new system, according to people who have talked to customer service, you should be able to use the same VAN with different vendors which may be why the charge is now shown as the actual credit card instead of the VAN number on the statement since this isn’t for single store use anymore. I wonder if this holds true then with charge-backs as well (but not returns) — even if the VAN is deactivated — since the purchase shows up as the actual credit card.

It appears that the new VAN system just masks the actual credit card for any purchase instead of creating a new card per vendor. I have yet to test this out (though the VAN didn’t work at Newegg.com — I used it with two different vendors on Newegg, but it could have been rejected with a single transaction there as well.) I will try to re-use certain VAN numbers with different vendors instead of creating multiple ones to see if this holds true.

The only downside that I see with doing this is that if the VAN is stolen, I wouldn’t know which vendor was responsible, and after deactivating it, I would have to re-issue a new VAN to all the vendors linked to it. So I may just have one VAN which is purposed for single-use (or once per year use) transactions for different vendors while keeping the other VANs that are used for monthly subscriptions and repeated transactions through websites like Amazon separate from each other.

If you use Amazon a lot, it’s worth getting an Amazon credit card. If you use the card for only Amazon purchases, there is less risk of the card # being stolen. An added benefit is that Amazon gives points for card use, points that can be used to pay for future purchases.