Contents

The Offer

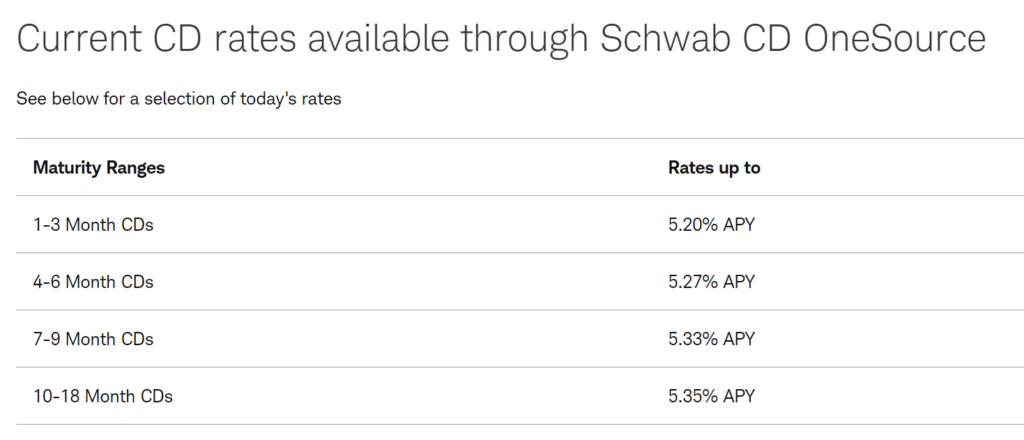

- Charles Schwab is offering up to 5.35% APY on a range of CDs. Deals are as follows:

- 1-3 Month CDs 5.20% APY

- 4-6 Month CDs 5.32% APY

- 7-9 Month CDs 5.28% APY

- 10-18 Month CDs 5.35% APY

Our Verdict

This is better than the high yield savings account rates currently on offer.

Can this be combined with the CS referral offer – http://www.schwab.com/client-referral?

Schwab is absolute dogshit.

I would stay away. Many banks and CU’s are directly offering CD’s at or above 5.5%, and for longer periods of time.

I’m new to Schwab CDs.. I’m only seeing 5.05% as the highest.. anyone else? I’m also not seeing 1 month.. just 3 month. Maybe I’m looking at the wrong place or don’t understand

Looks like the rates have dropped a little. APY vs APR might be in play as well.

1-3 Month CDs 5.25% APY

4-6 Month CDs 5.31% APY

7-9 Month CDs 5.39% APY

10-18 Month CDs 5.25% APY

Don’t use APY rate if CD maturity is less than one year and coupon frequency is “at maturity”. Then, use coupon rate because that is the rate you are going to realize. There will be no compounding.

Rates up since this posted. Hold

so a 1k investment would yield 1,012.71 for 3 months?

There are plenty of CD calculators online.

Principle x rate x time (for 1 month time is 1÷12=.083)

Great rates. Will go for the 1 or 3 month option

.

..

…

Schwab has been frequently mentioned as a possible default risk (CNBC, Bloomberg, WSJ, etc…). While I don’t think they will go bust, make sure to not have more than $250K cash on deposit (i.e. cash & Schwab CD’s) with Schwab as that would exceed the FDIC insurance limit. While Schwab will likely not default and the Government would likely insure Schwab deposits over $250K I would keep my Schwab cash below $250K. The high rates are probably due to the Schwab going BUST rumors….

is Fidelity a risk?

Any cash/cd deposit under $250k is insured so not at risk. If you have lots of cash it is best to spread the money around many banks, buy Treasuries or other high rated debt.

Haha, this guy gets his financial advice from CNBC.

Lou, where do you get your financial advice? CNN Lou

Lou

That’s even worse than CNBC

How does FDIC insurance work for CDs in Schwab CD OneSource?

All CDs in CD OneSource are offered by FDIC-insured banks. The Federal Deposit Insurance Corporation insures deposits at FDIC-insured banks. The basic insurance amount is $250,0001 per depositor per insured bank. Each CD you purchase from a different institution is FDIC-insured in aggregate based on ownership type at that bank. For example, if you own two CDs, $250,000 from one bank and $250,000 from a second bank, and you have no other deposits at those banks, you’re covered for $500,000.

https://www.schwab.com/fixed-income/certificates-deposit