Deal has ended, view more spending offers by clicking here.

The Offer

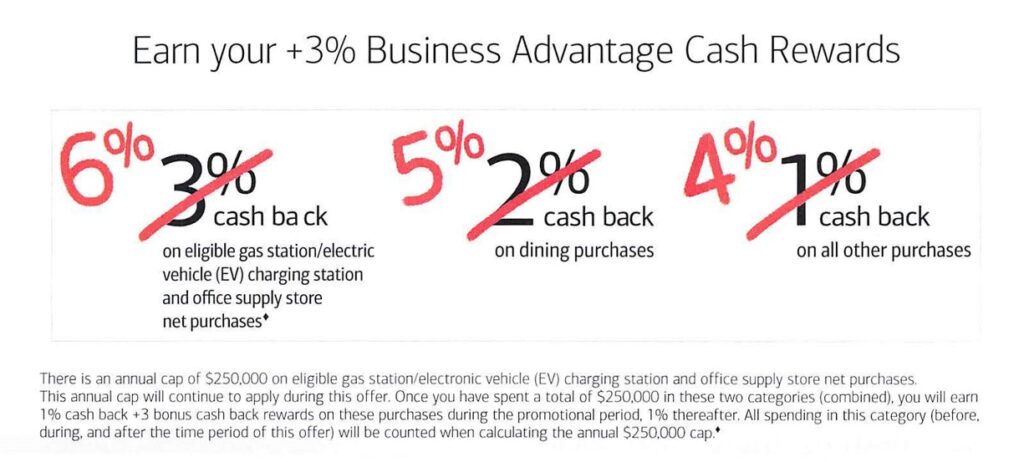

- Bank of America has sent out a letter offering an additional 3% back on all purchases on the Business Rewards card (not sure if sent out on other cards as well).

The Fine Print

- Must register by June 20, 2024

- Valid on purchases July 1 – September 30, 2024

Our Verdict

Doesn’t seem to be any cap, insane offer as you can earn 4% everywhere. Hope many readers were targeted.

Hat tip to curmudgeon

Anyone have any data points on plastic coding as business services still? if so what was the reciepant?

I did a charge to a hoa and it ended up coding as

REAL ESTATE AGENTS AND MANAGER–RENTALS

FYI buying GCs with the Customized Cash Rewards card through the Pepper App codes as “Computer Software Stores.” The MCC is 5734. This falls under the Computer Services category which, if selected, earns 3% back normally or 6% with the boost for those who received the offer. Since you get 10% back with Pepper on all purchases for the first 15 days after sign up it’s effectively 13% or 16% back.

Not sure if you want to make a note of this William Charles

William Charles

Added a note https://www.doctorofcredit.com/pepper-rewards-app-buy-top-gift-card-brands-get-5-back-plus-20-20-referral-bonus/

Contrary to what another poster said below, preferred rewards status does provide a bump to the earn rate under this promo. My first charge posted at 4.25% – 1% base (everywhere), 3% promo, 0.25% biz gold status. This means the earn rate for me should be 4.25, 5.5 or 6.75% depending on the charge. Nice!

ditto. this is incredible. any ideas what BofA limitations on cycling limits are?

Not a clue, sorry.

Further follow up – can confirm that office supply purchase posted at 6.75% earn rate.

what category is considered rent?

Any way to tell if the offer codes are unique or not?

I would say yes. My P2 and I received 2 separate unique codes.

Thanks!

Anyone maybe have a code they’re not going to use?

I gave the heads up on on the “contact us” thread about this the other day – looks like it can be really lucrative – crazy thing is I got this 2 days after I canceled the credit card. I’m going to call BofA and see if they re-activate this card so I can use this…

I’ve had 2 business BOA cards targeted. I haven’t used either in almost a year. Perfect timing. Interesting that I received the offers about 6 days before activation deadline.

Received postal mail letter for the 6%/5%/4% with $50K cap. Used card for 2 months EOY 2023 and sock-drawered ever since (no use for 6+ months).

The offer I got is on my Biz Advantage card— NOTE: You don’t get any BOA status bonus on these -so it nets out to:

6% CB in category of choice on biz card (for which the categories aren’t very good– I’d rather earn 5x UR on a freedom card than 6% CB as gas stations for example- even 3x UR on travel or office supply stores is as good or better than 6% CB for folks who travel)…So this’d never get used.

5% back on dining (again I’d rather have 3x UR than 5% CB so I’d never use it– but for non-travelers this one is a small improvement over folks with Plat Honors status who got 4.5% without the offer)…

4% on non-category… which is the only bit really worth considering, and it’s (to me anyway) still not clearly superior to 1.5x UR or 2x MR with a Freedom Unlimited or Amex BBP since I rarely get less than 2.5c/pt for my UR/MR, and usually more…. this one is very solid for non-travelers though.

You’ve really drank the Kool aid. Maybe tpg is a better site for you

The kool aid of basic math?

I’ve flown many times, including multiple times in the past year, to Europe, Asia, and South America– all getting well north of 2.5c/pt for UR and MR…(just under -7- cents a point on ANA The Room from JFK as one example)– . and you can trivially get 2-2.5c/pt at Hyatt hotels almost anywhere the same way with UR.

Again if you never leave your house, this deal is fantastic- especially 4% CB for non-category…. but for the 6% category one it’s going to be inferior to 3-5x UR or MR for folks who travel much at all.

Likewise the 5% CB for food will be inferior to 3-5x UR/MR you can otherwise earn in that category for those who travel. Heck for that one, for this month, you don’t even need to do point transfers— Freedom is earning 5x UR on dining, and with a CSR those points get you -7.5 cents per dollar spend- in travel cash in the Chase portal.

7.5 is considerably more than 5 in case you haven’t had enough kool aid to recognize that 🙂

As I said- non-category spend is the only place it’s even close… with Chase you’re talking 1.5 UR on Unlimited, so at 2.5c/pt you’re at 3.75c per dollar spent, a bit worse than this BoA deal… if you’re someone who rather than Hyatt hotels and coach flights tends to use your UR for business or first class travel then Chase wins… Amex has no good hotel option, so 2x MR on BBP will again be inferior to the BoA 4% cash if you only fly coach in most cases- but handily beat the 4% CB if you fly biz or first usually.

Many people know that it is possible to get outsized value on points by booking premium cabins, I’ve done it many times myself. There are people who travel often who still have a large stash of points and miles due to the many sign up bonus offers available in the market, and would prefer cash back as that is fungible and investable with 5% savings rates. Unused points carry an opportunity cost as it does not earn interest.

If you are able to consistently get 2.5 cents/point on UR/MR, even after the parade of devaluations, reduced supply of premium awards, and the time spent finding/tracking awards, then more power to you. If you are constantly on the road and are low on points, then choosing points can make sense. But for those who want an easy and immediate return on spend, this cash back offer from BofA is very attractive. The cash back can be invested, or spent on anything they wish, beyond just travel.

Time to pay for quarterly tax.

Can you confirmed paying your taxes earned the bonus rate? And if so which website did you use?