Deal has ended, view more bank account bonuses by clicking here.

Offer at a glance

- Maximum bonus amount: $700

- Availability: FL, NJ, NY

- Direct deposit required: Yes, no minimum

- Additional requirements:

- Hard/soft pull: Soft

- ChexSystems: Unknown, sensitive

- Credit card funding: None

- Monthly fees: $3-$12

- Early account termination fee:$25, six months

- Household limit: None

- Expiration date: January 31, 2025

Contents

The Offer

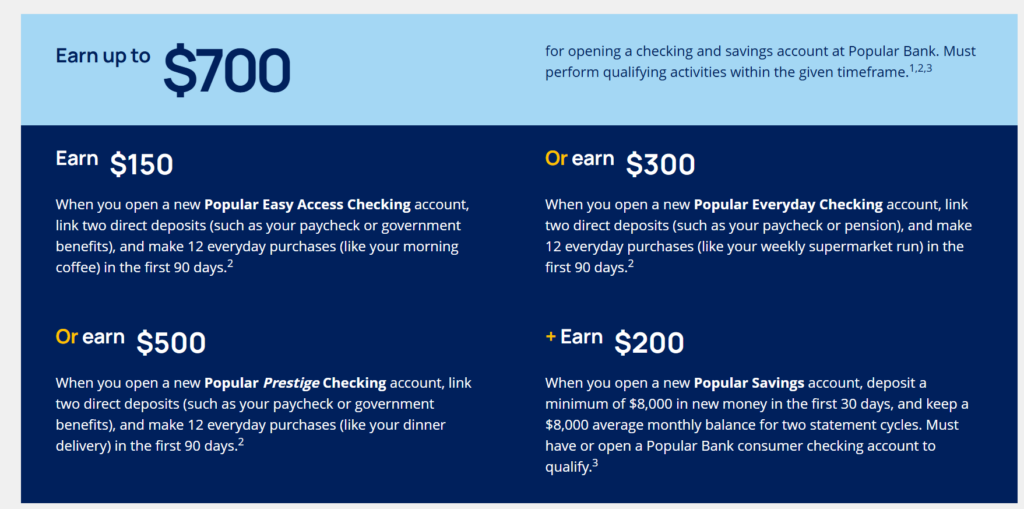

- Popular Community Bank is offering a bonus of up to $700 when you open a new checking account. Bonus is as follows:

- Checking bonus:

- Earn $150 When you open a new Popular Easy Access Checking account, link two direct deposits (such as your paycheck or government benefits), and make 12 everyday purchases (like your morning coffee) in the first 90 days

- Earn $300 When you open a new Popular Everyday Checking account, link two direct deposits (such as your paycheck or pension), and make 12 everyday purchases (like your weekly supermarket run) in the first 90 days.

- Earn $500 When you open a new Popular Prestige Checking account, link two direct deposits (such as your paycheck or government benefits), and make 12 everyday purchases (like your dinner delivery) in the first 90 days

- Earn a $200 bonus when you open a new Popular Savings account, deposit a minimum of $8,000 in new money in the first 30 days, and keep a $8,000 average monthly balance for two statement cycles. Must have or open a Popular Bank consumer checking account to qualify

- Checking bonus:

The Fine Print

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

Avoiding Fees

Monthly Fees

- Easy Access Checking. $3 OR $0 if you set up a recurring monthly direct deposit of $250

- Everyday Checking. $10 OR $0 if you maintain $1,000 in average monthly balances5 or set up a recurring monthly direct deposit of $750.

- Prestige Checking. $12 OR $0 if you maintain $2,000 in average monthly balances.

Early Account Termination Fee

There is an early account termination fee of $25 if closed within 6 months.

Our Verdict

$500 checking bonus is very good as it’s not difficult to meet the requirements to keep the account fee free. $200 savings bonus is worth doing as well as you only need to tie up funds for ~two months. Will add these to our best bank bonuses. I’d be surprised if these offers don’t get pulled early so sign up ASAP if interested.

Useful posts regarding bank bonuses:

- A Beginners Guide To Bank Account Bonuses

- Bank Account Quick Reference Table (Spreadsheet) (very useful for sorting bonuses by different parameters)

- PSA: Don’t Call The Bank

- Introduction To ChexSystems

- Banks & Credit Unions That Are ChexSystems Inquiry Sensitive

- What Banks & Credit Unions Do/Don’t Pull ChexSystems?

- How To Use Our Direct Deposit Page For Bank Bonuses Page

- Common Bank Bonus Misconceptions + Why You Should Give Them A Go

- How Many Bank Accounts Can I Safely Open Within A Year For Bank Bonus Purposes?

- Affiliate Links & Bank Bonuses – We Won’t Be Using Them

- Complete List Of Ways To Close Bank Accounts At Each Bank

- Banks That Allow/Don’t Allow Out Of State Checking Applications

- Bank Bonus Posting Times