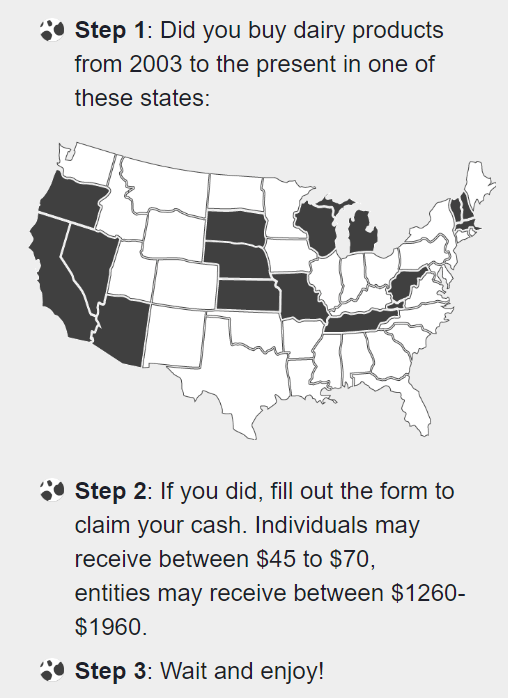

The Offer

JPMorgan Chase has agreed to settle a lawsuit, they allegedly were accessing consumer credit reports when they had no right to do so under FCRA.

You were a borrower or guarantor on a JPMorgan Chase Bank, N.A. or Chase Bank USA, N.A. (collectively “Chase”) account or Chase-serviced account whose credit bureau information was accessed by Chase through an Account Review Inquiry during the period October 16, 2009 through October 16, 2014 at a time when the subject account met any one of the following criteria (“Eligibility Events”):

- The account was closed with a zero balance

- The account had been sold or transferred to a third party

- The debt on the account had been discharged in bankruptcy

- Chase had foreclosed the property securing the account loan

- Chase had sold in a short sale or had transferred through a deed in lieu of foreclosure the property securing the account loan.

The Fine Print

- Settlement pool is $8.5 million

- Claim must be received by March 23, 2016

Our Verdict

I imagine a lot of people would’ve had accounts opened & closed during that time period with Chase, especially if you’re into Chase checking & savings bonuses. How much you’ll receive will depend on how many other claimants there are.

Other class action lawsuit posts:

Hat tip to Class Action Lawsuits