We’re reposting this because American Airlines send out an e-mail to a lot of people about this offer and we’ve had a lot of questions.

Contents

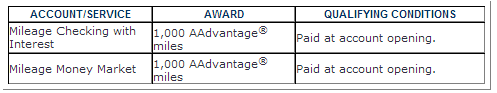

The Offer

- Receive 1,000 AAdvantage miles when you open a Mileage Checking with Interest account. Earn additional miles for completing the following:

- 10,000 miles: Receive direct deposits totaling $2,000 or more per month for six consecutive statement cycles

- 5,000 miles: Use BankDirects Bill Pay program and pay three different payees at least $500 a month for six consecutive statement cycles

- 5,000 miles: Use your BankDirect® Visa® CheckCard for a minimum of twelve transactions that total at least $500 per month for six consecutive months

- 1,000 miles: Refer a friend and if they open a Mileage Checking with Interest account you’ll both earn 1,000 miles each (the person you refer will earn 1,000 miles in addition to the 1,000 miles they receive as a sign up bonus). You can refer up to a maximum of 10 people (feel free to share your links in the comments section, you can also ask for a referral in this flyertalk thread)

- You’ll also earn miles based on your balance (these accounts also earn a cash APR of 0.01%):

- 100 miles per $1,000 (although miles do not come in chunks so you’d earn 1 mile on $100 in balances) in collected balance on the first $50,000 (5,000 miles) per month. This is an interest rate of 1% if you value your points at 1¢ each.

- 25 miles per $1,000 in collected balances after the first $50,000 per month. This is an interest rate of 0.25% if you value your points at 1¢ each.

The Fine Print

- Allow six to eight weeks for your AAdvantage miles to post to your AAdvantage account

- Limited to one Mileage Checking account with Interest per household

- $500 minimum to open

- Online only bank

- No expiration date

- Because these are miles and not cash, you don’t need to pay taxes on them (although Citi recently out 1099 forms for a similar bonus they did, so this may change)

- Miles don’t count towards million mile status

- FDIC insured

Avoiding Fees

Mileage Checking with Interest Monthly Fee $12

There is no way to avoid the monthly fee of $12.

Early Account Termination Fee $15

BankDirect charges an early account termination fee of $15 if you cancel your account within 90 days of opening. This shouldn’t be an issue as you need to keep the account open for a minimum of six months to get most of the bonuses.

Our Verdict

- Opening this account will be a soft credit pull

- BankDirect manually verifies all direct deposits and it must match the income you listed on application, as such you’ll need to divert your income for this offer.

- They don’t allow credit card funding

We’re going to break down our verdict into two sections; sign up bonus & on going bonuses.

On going bonuses

It’s only worth doing this on amounts less than $50,000 (as after that you only earn at 0.25% compared to 1%). It’s really going to depend on what your combined state & federal taxes are, how much you deposit is and how much you value points to determine if it’s worth it or not.

Sign up bonuses

You cannot waive the monthly fees and you’d need to keep the account open for an absolute minimum of six months to complete most of the requirements. This means you’ll need to pay $72 out of pocket and at most you’ll get 22,000 points.

The requirements are also very strict and require you to maintain direct deposits for six months. They also verify that you are depositing your full income (even asking for pay stubs to prove this). If you get 1¢ in value then you’ll end up making $141 after fees (probably $129 as you’ll need to pay an additional months fees).

If you regularly use American Airlines and can get decent value out of these points then this offer might be worth it. I personally won’t be taking advantage of this offer because I’d rather have my money invested in the market (with a healthy emergency fund in a high interest checking account).

We’ve added this promotion to our current list of bank account sign up bonuses, it unfortunately didn’t make it to our best bank account bonus list.

Direct link to offer | Screenshot of offer

Hat tip to this flyertalk thread

I would never do this just for the sign-up bonus. As a customer, I can tell you that doing business with BankDirect is clunky, so it’s not worth the trouble for a short term relationship.

As far as long term investments go, it probably works best at exactly $50K. Above that, you can buy mileage earning CDs from them that are OK, but not as lucrative as the 50K checking account.

Obviously, this deal is better for folks in higher tax brackets. If you are, and you’ll use the miles, I think it’s probably worth it. There’s a decent discussion on Flyertalk about the value. With interest rates so low, it’s not like you can make a lot more money parking your cash in a “regular” checking account. And earning some miles for award tickets is definitely more fun than earning tiny amounts of interest.

“…at most you’ll get 22,000 points.” “You’ll also earn miles based on your balance…100 miles per $1,000…in collected balance on the first $50,000 (5,000 miles) per month.” -DoC

It’s 22,000 miles for meeting the direct deposit, debit card, bill pay, and referral. But that doesn’t include the 5,000 miles per month for maintaining $50,000. So, that’s an additional 30,000 miles for a total of 52,000 miles for six months. Am I missing something?

Never mind. I just noticed that you segregated the sign-up bonus and the ongoing bonus. Although in the ongoing bonus section, you didn’t reiterate the miles earned, like in the sign-up bonus section.

DoC, i though it might be pertinent to point out that my Insurance agency used my number of bank accounts opened to determine my quote. The notice i received:

Federal Fair Credit Reporting Act Disclosure Notice

Thank you for contacting GEICO for a rate quote.

The price we are quoting you is based in part on information provided to us by the consumer reporting agency listed below.

We are sending you this notice, as required by the Fair Credit Reporting Act, because you received a higher price based on your credit information. However, you may contact us for additional consideration if the credit information used is a result of an extraordinary life circumstance.

The consumer reporting agency provided the following description of the credit factors that had the most influence on the price we quoted you:

-Insufficient number of installment loans (-)

-Insufficient time since oldest bankcard account opened (-)

-Insufficient time since oldest account opened (-)

-Excessive number of bank revolving accounts (-)

Please note that the consumer reporting agency did not participate in our adverse decision. They are unable to provide you with specific reasons for our decision.

I find this obscure. Do Credit Reporting Agencies report the number of bank accounts i have and why should that matter?

Bank revolving accounts are credit cards, not bank accounts. Hence why they are showing up on the credit report.

Like Alex mentioned, this isn’t bank accounts but simply credit cards.

Per the flyertalk thread they are strict about direct deposit since the bonus is given manually. http://www.flyertalk.com/forum/american-airlines-aadvantage/1047553-questions-bankdirect-consolidated-50.html

As far as the auditing thing, even if you were penalized it would be interest and MAYBE a 20% penalty on top of regular taxes. Not that big a deal, especially since there is a reasonable position that miles and points are not taxable. http://www.taxdebthelp.com/tax-problems/tax-audit/irs-audit-penalties

Are you sure about the Direct Deposit being your full income? The offer I see states” A direct deposit must be received payable to a listed account holder for six (6) consecutive statement cycles, totaling a minimum of $2,000.00 per month.”

The fine print says $2,000 or more but when they check they sometimes ask for paystub verification.

Are you sure you don’t have to pay taxes on this?

Maybe the bank does not send you a 1099, but you might still need to report and pay taxes on this.

Is there anyone with this account that was already audited by the IRS and found this OK?

I did this several years ago. I did not have to pay taxes on it.

What do you mean under “this”? Opening the account or get audited?

By “this” I mean I opened the account with BankDirect and earned all the miles. There was nothing to report for tax purposes.

What would you use as the ARV?

No idea. If the IRS would say miles worth its sale prices, 22000 would be $649 (per http://www.aa.com/buymiles), making this a pretty mediocre signup bonus: $330 value minus $227.15 in taxes (in 25% federal + 10% state bracket and with 1.5c per mile value) = ~$100

If the 1.5c is fine by the IRS, this account would make sense: the “interest” is 1.8% (minus tax), that’s super high for a non-rewards checking.

What high interest checking accounts do you keep your emergency fund in DOC?

Don’t really keep that much in cash anymore to be honest because my expenses are currently much lower than what they were. I used to have it in 5% accounts, but not worth it with only $1,000 limits now. Basically just sitting in 1% accounts while I wait for something better to come along.

You can find more objective information on this: https://www.doctorofcredit.com/high-interest-savings-to-get/

I would gladly keep $50,000 in an account in order to collect 5k miles per month, but not with the fee. The problem with the fee is that they can always increase, it just seems dumb to pay someone to hold your money.

Back in the day http://www.dansdeals.com/archives/10317 it was a good offer. Unfortunately… times have changed.

Yup, plenty of much better offers out there. Also please use a regular name and not your site name in future.

What has changed?