Credit Karma was launched in 2007 and provides consumers with two free credit scores and full credit reports that update weekly. They also provide credit tools which are used to educate their customers on how credit scoring works, including how certain credit decisions will affect credit scores.

Credit Karma was launched in 2007 and provides consumers with two free credit scores and full credit reports that update weekly. They also provide credit tools which are used to educate their customers on how credit scoring works, including how certain credit decisions will affect credit scores.

Free Credit Score

Is The Score Really Free?

Yes, the two scores Credit Karma provide are provided for free. They never ask for credit card information at any stage and don’t charge any of your accounts in anyway shape or form.

Are The Scores They Provide Accurate?

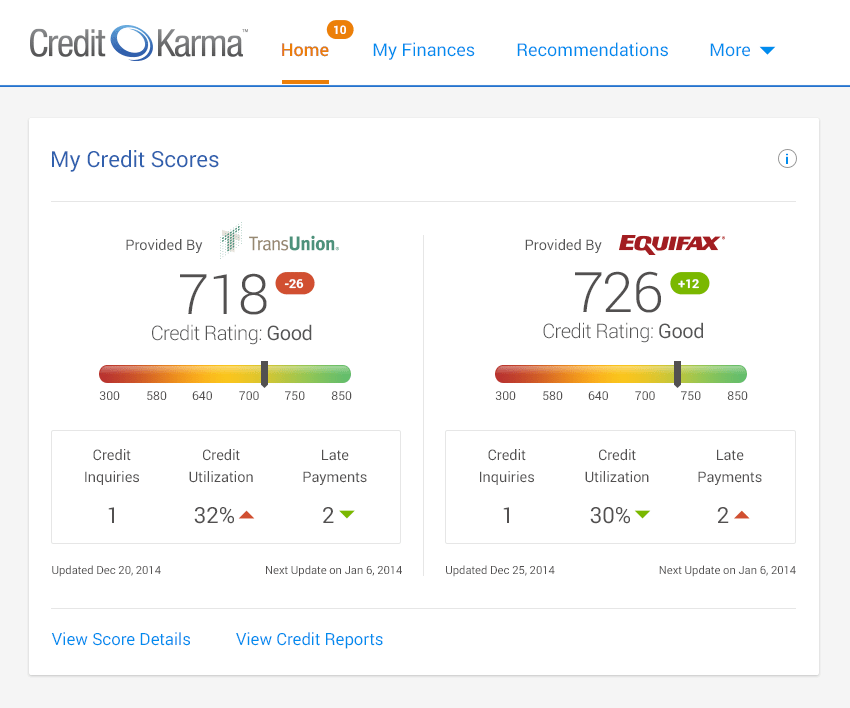

Credit Karma now provides consumers with two versions of their VantageScore (version three), one score is based on your TransUnion credit report and the other is based on your Equifax credit report. In the past they also offered the TransRisk credit score and several industry specific scores, but they no longer offer this (these scores were not used by lenders at all).

VantageScore V3

VantageScore is one of the few credit scores that lenders actually look at when approving or denying new loans or cards. Unfortunately it only has a market share of 6% (compared with 90%+ for FICO score). The VantageScore Credit Karma provides consumers with is Version 3 which has a range of 300-850 rather than 501-990 that Version 1 + 2 had.

When I checked my TransUnion VantageScore was 746 compared to my TransUnion FICO of 809. As you can see there is a big 63 point difference between the two, with the Vantage being much lower. This’d probably put me into two different scoring categories and is why you should always check your FICO score before applying for important loans or credit cards.

[Read: How To Get Your Free FICO Score]

When I checked my Equifax VantageScore it was 746 compared to my Equifax FICO score of 821, which is an even bigger difference of 75 points.

As you can see there is a pretty big difference between my Credit Karma scores, which is why I’d only recommend free credit monitoring websites as a guide to see if your scores are increasing or decreasing over time and for the tools themselves.

[Read: FICO Score Vs VantageScore]

Free Credit Report

In late 2014, Credit Karma announced that it’s users would now be able to access their full credit reports with TransUnion (you can now access your full Equifax report as well). These reports are updated weekly and there is no charge for this service either.

Consumers can get access to their full reports once per twelve months for free by using the website http://annualcreditreport.com/. Although it’s nice to see Credit Karma also offering this service as part of their product offering as well.

Credit Tools

Credit Karma has a number of credit tools that are available to their members. We’ve outlined what these tools are and what they are used for below.

Credit Score Simulator

This score simulator let’s you see how credit decisions (opening or closing an account for example) will affect your credit score. They state that this is for educational purposes only, but we’ve found that it’s fairly accurate and a good way of seeing how making a credit decision will affect your Credit Karma credit scores.

Credit Monitoring

Credit monitoring notifies you whenever a major change has been made to your credit report (in this case your TransUnion credit report). This can be useful for monitoring for credit fraud or identity theft.

Account Monitoring

This is a new feature Credit Karma has added and allows you to add your online financial accounts (e.g banks, credit cards, etc). They’ll then notify you whenever a bill is due or their is suspicious activity.

Credit Report Card

This report card summarizes the key components in calculating your credit score (e.g payment history, utilization ratio, etc) and then gives you a grade from A-F – along with an overall grade.

Credit Advice Forums

They also have a credit advice section where members can ask and answer questions to each other. Often the information isn’t 100% accurate, but quite often good discussions take place there.

Calculators

Home Affordability Calculator

Enter monthly income before taxes, down payment, monthly debt payments and mortgage interest rate and it’ll return the maximum home you can afford. Unfortunately it doesn’t take into account your credit score or history so it’s a pretty vanilla calculator.

Debt Repayment Calculator

Enter balanced owed, interest rate and one of desired payoff timeframe or expected monthly payment and the calculator will tell you either the expected monthly payment (if you chose desired payoff timeframe) or expected payoff time (if you chose expected monthly payment). Again this is a vanilla calculator and doesn’t take into account your credit score/history or offer any alternatives (e.g a credit card you’d be eligible for that has a introductory APR of 0%).

Simple Loan Calculator

Enter loan amount, interest rate and number of years and this calculator tells you the monthly payment. Another simple vanilla calculator.

Amortization Calculator

Enter loan amount, interest rate and number of years and this calculator shows you the number of payments that need to be made, how much those payments are and your total payments. Also gives a chart of principal, interest and balance.

Our Final Thoughts

Credit Karma is a get way for consumers to get access to their VantageScores and credit reports for free from Equifax & TransUnion. They continue to improve their website and product offering by adding more and more features. I find their credit monitoring features the most helpful, I can keep an eye on two of my credit reports at once and see which credit card bureaus are doing a hard pull from.

If you’re unsure about whether to sign up, my suggestion would be to give it a try to see how you like it. It’s completely free and you can always cancel your account if you’re no happy with the service.

https://www.creditkarma.com/creditcard/Upgrade01

The $400 bonus is noted here.

Looks like creditkarma is only transunion now.. Equifax doesn’t show up on my logon anymore

Shows on mine.

Why don’t you have an unsubscribe button? I want to cancel my subscription to Credit Karma. Immediately!!

Contact Credit Karma to unsubscribe.

The new auto hub says the DMV has four cars registered to my name. I don’t know these cars, what the?

Why doesn’t CK report from experian, as this seem to be the one that keeps the lowest scores and then screws you when you go for a loan??

I tried to setup an account, but based on my information they responded that I already have an account.

I also am unimpressed by ck and the scores I see I went to apply for a car loan was denied due to my scores being off almost 100 points then what credit karma is saying how can they give ppl such inaccurate info and it b ok FREE or NOT it’s frustrating and embarrassing to say the least I would NOT recommend them….

Once again, people are blaming CK for their not getting a loan. People they only report…they do not make you apply for a loan or lower your credit score. It is YOUR fault your score is so low you are denied loans. Take a little responsibility for your self for one. CK is a tool nothing more. Do you blame your hammer for hitting your finger?

They lie to all of us they will not help or work with me. I will give them a big fat F-, don’t use them.

My biggest problem with CK is there one size fits all offers. They claim I should apply for the exact same credit cards that I already have. Also, some of their recommendations (i.e. Chase) are often wrong. I know even with a relatively high credit score (at almost 800) Chase will not approve me because of too many hard hits (6) and that I burned them over ten years ago.BTW: I did recently contact Chase and offered to pay the balance in full (it is/was a disputed item), but Chase never sent me any statement of what they claimed I owed.

I agree. The Offers section, I avoid. The positive takeaway from Credit Karma for me is seeing any major changes weekly like a credit pull. They do offer a one size fits all prequal for credit cards which could be a plus, but honestly, one must educate themselves on if they should apply for a card or not on their own research not from Credit Karma’s Good, Fair, Poor system.

The internet has answers if you can find them…

They aren’t looking at all the details of your personal report to generate those offers. It’s likely just done off your score, as well as who’s paying them the most money to advertise their credit cards. Remember, it’s an ad. CreditKarma’s software presumably knows nothing about the fine print and banks’ internal policies like Chase’s 5/24. They don’t even know what specific credit card products you have; all they see on a credit report is “credit card from XYZ bank”.

I use 5 free credit score sites to get an idea of what my Non-FICO credit scores are. Credit Karma monitors both Trans Union and Equifax and updates weekly. Credit.com monitors Experian and updates twice a month. WalletHub.com monitors TransUnion and updates daily. CreditSesame and Bankrate.com monitor TransUnion and update once or more a month. None of these are supplying the FICO score. Since they are all free, I appreciate all the collective input that they supply.

Finally a sane person comment here!!!

Thnk you.

For many other comments:

Please use the tool for what it is designed for an you save yourself a lot of trouble.