This bonus has expired, view more Fremont bank bonuses here or the best checking bonuses here.

Offer at a glance

- Maximum bonus amount: $500

- Availability: Must be a Californian resident

- Direct deposit required: None

- Additional requirements: See below

- Hard/soft pull: Soft pull

- ChexSystems: Unknown, ChexSystems sensitive

- Credit card funding: $100

- Monthly fees: $18+, avoidable

- Early account termination fee: $50, six months

- Household limit: One

- Expiration date:

July 31st, 2018August 15th, 2018

Contents

The Offer

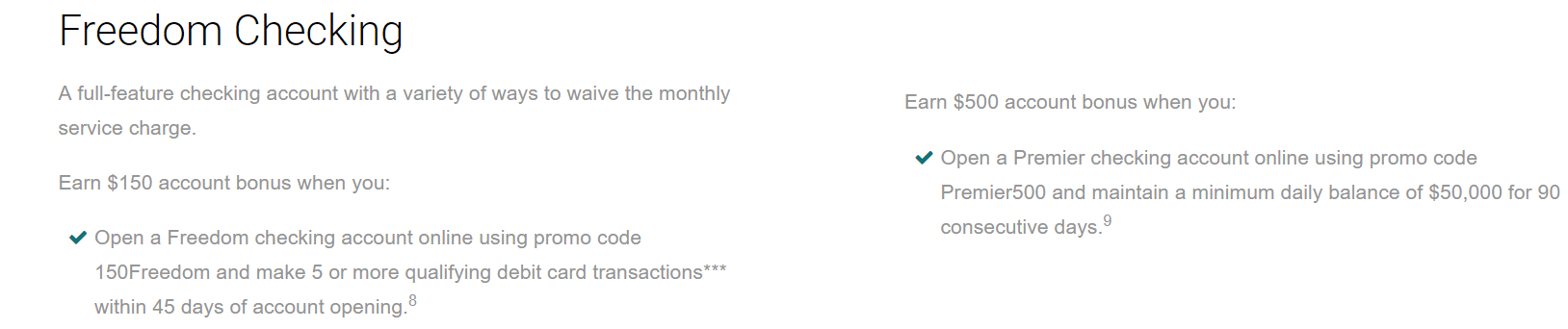

- Fremont Bank is offering a bonus of $150 or $500 for opening a new checking account.

- $150 bonus when you open a new Freedom checking account with the promo code 150Freedom and make 5 debit card purchases of at least $5 within 45 days of account opening

- $500 bonus when you open a new Premier checking account with the promo code Premier500 and maintain a minimum daily balance of $50,000 for 90 consecutive days

The Fine Print

$150 bonus:

- Offer valid for new Fremont Bank personal checking clients only. Clients who already have a personal checking account with Fremont Bank as a primary or secondary account holder are not eligible for this promotion. The client must not have closed a personal checking account within 180 days of the promotion start date (on or after May 01, 2018). The primary account holder must be 18 years or older at the time of account opening. Offer available only to legal U.S. residents with a U.S. address in California.

- Account bonus is limited to one per household.

- The offer is non-transferable and may not be combined with any other offers.

- Offer subject to change and may be discontinued at any time. Offer available to accounts opened online only and does not apply to accounts opened in a branch.

- To participate in the promotion, 1) open a new Freedom Checking account online using promo code 150Freedom between May 01, 2018 and Jul 31, 2018 and 2) Make 5 or more qualifying debit card transactions*** within 45 days of account opening.

- The account bonus will be credited to the new Freedom Checking account within 30 days from the end of the month after qualifying debit card transactions are made. “150 Freedom Bonus Offer” will appear on the checking account statement when the bonus is credit to the account.

- The new account must be open and in good standing at the time the bonus is credited to the account. The account bonus will be forfeited if the account is closed before the bonus is posted to the account.

- If the account is closed within six (6) months of opening an account closure fee may be charged, see Deposit Account Agreement Book for more information.

- Bonus is considered interest and will be reported to the IRS on Form 1099-INT, as required by applicable law. Client is responsible for any taxes.

$300 bonus:

- Offer valid for new Fremont Bank personal checking clients only. Clients who already have a personal checking account with Fremont Bank as a primary or secondary account holder are not eligible for this promotion.The client must not have closed a personal checking account within 180 days of the promotion start date (on or after May 01, 2018). The primary account holder must be 18 years or older at the time of account opening. Offer available only to legal U.S. residents with a U.S. address in California. Account bonus is limited to one per household. The offer is non-transferable and may not be combined with any other offers. Offer subject to change and may be discontinued at any time. Offer available to accounts opened online only and does not apply to accounts opened in a branch.

- To participate in the promotion, 1) open a new Premier Checking account online using promo code “Premier500” between May 01, 2018 and Jul 31, 2018 and 2) Maintain a minimum daily balance of $50,000 or $50,000 with combined balance option for 90 consecutive days6.

- The account bonus will be credited to the new Premier Checking account within 30 days from the end of the month after 90 day minimum daily balance requirement has been met. “Premier 500 Bonus Offer” will appear on the checking account statement when the bonus is credit to the account. The new account must be open and in good standing at the time the bonus is credited to the account. The account bonus will be forfeited if the account is closed before the bonus is posted to the account. If the account is closed within six (6) months of opening an account closure fee may be charged, see Deposit Account Agreement Book for more information. Bonus is considered interest and will be reported to the IRS on Form 1099-INT, as required by applicable law. Client is responsible for any taxes.

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

Avoiding Fees

Monthly Fees

Freedom Checking

This account has a $18 monthly fee (plus $2 paper statement fee). This is waived if you do any of the following:

- Recurring $500 direct deposit to your checking account or

- $2,500 minimum daily balance or $5,000 with Combined Balance Option or

- Automatic Loan Payment to an existing Fremont Bank personal mortgage loan or Home Equity Line of Credit.

Premier Checking

This account has a $29 monthly fee (plus $2 paper statement fee). This is waived if you do any of the following:

- Minimum daily balance of $50,000 or

- $50,000 with Combined Balance Option

Early Account Termination Fee

According to the fee schedule there is an early account termination of $50 if closed within six months of account opening.

Our Verdict

You’d need to keep $50,000 deposited for six months for the $500 bonus. If you put that same amount into a 2% APY account you’d earn $500 as well so it’s basically not really a bonus. The $150 bonus is worth doing though. It’s not the easiest account to keep fee free, but at least the bonus itself doesn’t require a direct deposit. If it’s a soft pull we will be adding this to our best checking bonus page. Just keep in mind they are ChexSystems sensitive so a lot of readers will be denied.

Big thanks to reader, Quango who let us know. Learn how to find bonuses and contribute to the site here.

Useful posts regarding bank bonuses:

- A Beginners Guide To Bank Account Bonuses

- Bank Account Quick Reference Table (Spreadsheet) (very useful for sorting bonuses by different parameters)

- PSA: Don’t Call The Bank

- Introduction To ChexSystems

- Banks & Credit Unions That Are ChexSystems Inquiry Sensitive

- What Banks & Credit Unions Do/Don’t Pull ChexSystems?

- How To Use Our Direct Deposit Page For Bank Bonuses Page

- Common Bank Bonus Misconceptions + Why You Should Give Them A Go

- How Many Bank Accounts Can I Safely Open Within A Year For Bank Bonus Purposes?

- Affiliate Links & Bank Bonuses – We Won’t Be Using Them

- Complete List Of Ways To Close Bank Accounts At Each Bank

- Banks That Allow/Don’t Allow Out Of State Checking Applications

- Bank Bonus Posting Times

They have a new $200 bonus on the feedom checking now. With $500 DD instead of debit card purchses this time. Same link. Expires 9/30

From the comments it looks like they are chex sensitive but could be okay after talking to them on the phone.

Thanks for the tip. Chex Sensitive is relative. I think traditional banks are far less sensitive than unions. I got approved for bank accounts even though it was listed as sensitive and opened account int the past weeks.

Oh I see, thanks! Yeah I’ve had some chex inquiries the last month or two so just been keeping an eye on it.

Thanks much, hopefully they don’t pull pull the offer early like last year:/

Opened the account in early August, and now they just closed my account without asking me. I had done the necessary amount of debits and kept having $500/month go in as DD to it… kinda of annoying.

DP:

7/29: Applied online on 7/29; received call from bank five days later with lots of questions.

8/23: Five debt card transactions and $500 transfer from Chase Bank completed

10/2: Bonus posted.

Granville

8/7 opened

8/17 amazon reloads

10/2 $150 bonus

Here are my data points for Fremont Bank Freedom Checking (promo code 150Freedom):

8/1 – opened account, funded with $100 payment from Citi Double Cash

8/7 – made 5 debit card purchases (paid Comcast bill 5 times of $5+)

10/2 – received “$150 Freedom Bonus Offer”

Account has a 6 month early terminal fee period, so I will close the account after 2/1/19.

After 2/1, I moved all the funds out of my account, so my account had a $0 balance and they automatically closed the account on 2/21.

How are you guys keeping this fee free until the account is 6 months old? Until now Ive had $2500 in it but Id like to move it if anyone knows what bank transfers count as DD (to waive monthly fee)

Last POS was 8/23. I did usual purchases in-store.

Bonus posted 10/3. statement date is more than 2 weeks out.

8/7 – opened

8/16 $5 Venmo transactions (POS)

10/2 – $150 bonus posted.

Also, if your account balance goes down to $0 (like mine did when I pulled all the money to another bank), the account will automatically close within 24hrs even if you’re still waiting for the 6mo period to end. So I only had the account opened for 2 months, got the bonus and didn’t need to pay the early termination fee.

May I ask if you could still log in online and the checking shows as closed? Or how are you verifying the account itself is closed?

Thanks

They sent a final statement in mail and I just logged in and there’s no checking account attached to my profile.

DP

8/9: Opened account online with $100 funding from Chase Sapphire Reserve (coded as purchase)

8/27: 5th debit purchase

10/2: Received $150 bonus

Thanks, logged in and see the bonus credited today for me, as well.

Did ~10x debits over the course of August.

Has anyone had their bonus post? I opened early August, did 5x $5 venmo transactions that posted as POS and I still haven’t received the bonus…

nope. i think we have til the end of the month. we’ll see.

nope

Rep says it will post with my October statement