Update: No longer accepting new applications.

Amalgamated Bank of Chicago offers the Platinum Rewards credit card, is it of interest to us due to the 5x rotating categories and $150 sign up bonus. Let’s take a look in this quick review

Card Basics

- Card earns 5x rewards points on up to $1,500 in combined purchases each quarter in rotating categories (similar to the Discover it & Chase Freedom cards). 1x points on all other purchases.

- $0 annual fee

- Sign up bonus of $150 statement credit after making $1,200 in purchases within the first 90 days

- 0% introductory APR on purchases and balance transfers for the first 12 months (balance transfer fee of 3% or $5, whatever is higher)

How Much Are Points Worth?

Points are worth 0.75¢ to 1¢ per point, this varies based on what you redeem them for.

- Travel portal: 1¢ per point

- Gift cards: 0.77 – 0.93¢ per point

- Statement credit: 0.75¢ per point

Rotating Categories

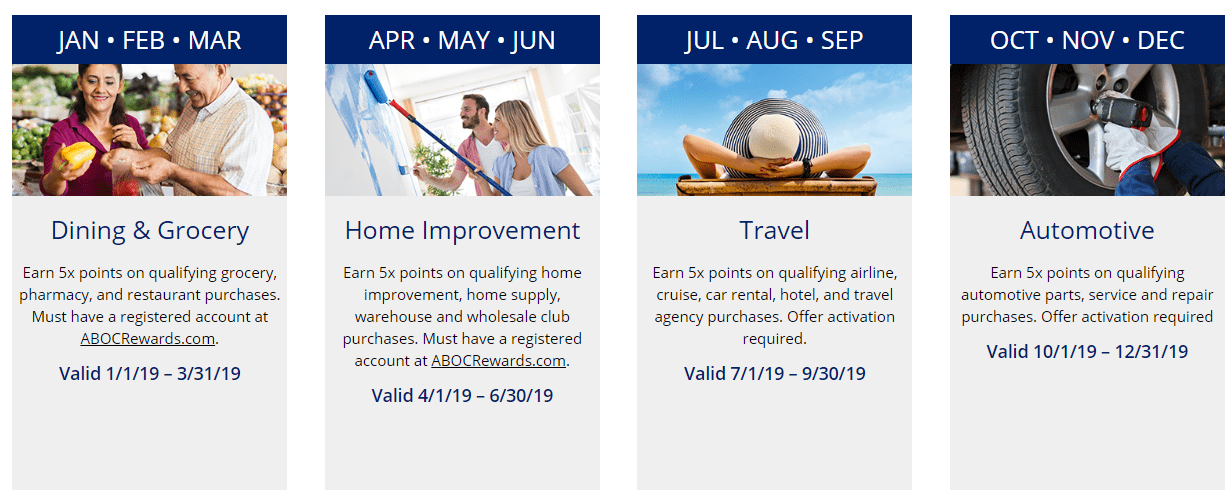

The 5x rotating categories for 2019 are as follows:

- Q1 (January – March): Dining, Grocery, and Pharmacy

- Q2 (April – June): Home Improvement & Wholesale/Warehouse Clubs

- Q3 (July – September): Travel (airline, cruise, car rental, hotel, and travel agency purchases)

- Q4 (October – December): Automotive parts, service, and repair purchases

The card was launched in 2017, but they added the 5x categories in 2019 so this is the first year they have been offered.

Our Verdict

Basically a 3.75-5% back card depending on what you use the points for. The sign up bonus of $150 is in line with what is usually offered on the Chase Freedom, obviously the points aren’t as valuable and the minimum spend requirement requires more spend. I have no experience with this bank and can’t really seem to find much information so if anybody goes for this card please share your experiences in the comments below.

Hat tip to MtM

https://www.aboc.com/Personal-Lending#Personal-Credit-Cards has a “ABOC Visa Signature Travel” card with a bonus of 30,000 points when you spend $2500 in 3 months, and 0% APR on purchases & balance transfers for 12 months. It earns 1.5 points per dollar. But I don’t know how much points are worth when redeeming.

Applications were previously suspended; now the mention of it being ‘temporary’ has been removed: “We are no longer accepting applications for new accounts.” https://www.aboc.com/personal-credit-cards.aspx

Applications for the Platinum Rewards card are currently suspended.

Per the ABOC website:

“ABOC Platinum Rewards Mastercard®

Coming soon!

Thank you for your interest in an ABOC Platinum Rewards Card! We have temporarily stopped taking applications while we work on an exciting new set of benefits and features. Stay tuned!

If you already have an ABOC Platinum Rewards account, you can continue to make purchases and enjoy the features of your card.”

Does anyone know what “Select Online Retailers” include for Q2 2021?

Does having a banking relationship helps in getting the card?

Well, they don’t do banking outside of Chicago. I guess I can only wait for my credit report clearing for one year.

Beware: Q2 (April – June): Home Improvement & Wholesale/Warehouse Clubs DO NOT apply to Costco.com. My fault for not checking but I bought Costco Cash Card and I didn’t get the extra 4 points per dollar spend. I did get the points for in-store purchase from Lowes and Home Depot so gift cards purchase won’t work.

Hi Bill,

Saw the below notification for ABOC MC.

As of July 1, 2019, your Amalgamated Bank of Chicago Mastercard has no foreign transaction fees!

Is anyone else not getting the additional 4x points posting for home improvement store purchases in April? First quarter was no problem…. I don’t see anywhere I should have activated the new category.

Interestingly enough, ABOC credited my account the point amount for the $150 statement credit to my account before the qualifying transactions posted, and deducted it automatically for the sign-up bonus the next day as “New Account Bonus for 150 Credit”. I did not realize this as I had manually redeemed the points for $150 statement credit from the early point credit and now am sitting with a negative rewards balance, but technically scored an extra $150 for now which will eventually be repaid. I would not recommend this unless you want to go several quarters with a negative rewards balance to be slowly paid but score another $150 which can be used elsewhere.

Applied today, LOL/24:

Thank you for applying for the ABOC Platinum Rewards Mastercard. Your application has been received and is currently being processed. We will notify you of our credit decision by email and postal mail within 14 business days.

They pulled EX, will update on decision

I received same response. Actually forgot about app and icard showed up in the mail in 2 weeks. Seems fine for what we do..so far. Hit the $1200 spend with “grocery purchases” and points posted. 150. bonus will probably take some time.

Denied, too many credit inquiries (22 EX pulls in the past 12 months, though 5 of those were for a car loan & a couple for a mortgage) EX FICO 8 score=746, so whatev