Update 10/25/24: There is now a $150 referral bonus as well. Don’t think it can be stacked as it requires a checking account.

Offer at a glance

- Interest Rate: 5% APY

- Minimum Balance: $50

- Maximum Balance: $2,500

- Availability: Must live, work, worship or attend school in select counties in AL, GA

- Direct deposit required: None

- Additional requirements: None

- Hard/soft pull: Unknown

- ChexSystems: Unknown

- Credit card funding: Mentions card funding as an option

- Monthly fees: None

- Insured: NCUA

The Offer

- MAX Credit Union is offering 5% APY on balances up to $2,500 on the Elevate Money Market account. There are no requirements to earn this rate

Avoiding Fees

This account has no monthly fees to worry about

Our Verdict

5% APY is a nice right, especially with no requirements. If you have the full $2,500 in there you’d earn $125 a year, $75 more than you would in a 2% APY account. How good this account is will really depend on how long they keep the 5% APY. Might make sense to focus on savings account bonuses with higher returns instead.

Hat tip to reader AL_PF

I have a referral for MAX, am I allowed to post it? I won’t until I know for sure.

Long story short: The $5 MAX4Kids Foundation donation eligibility option for membership was supposed to have been deleted from their website. It’s no longer an option. I had sent an email asking about using their website to donate via their PayPal/GoFundMe options online instead of doing an in branch donation, and after 30 minutes over 2 phone calls they made a “one time exception” to honor it for me/gave me special instructions to apply online (it’s not even a selectable option for eligibility in the online application), they have my name on file and will be matching it to my application, which will be automatically rejected for being out of area.

So, luckily enough I was able to open an account from IL, but it looks like that’ll be closed going forward.

Ha… after all that, I ended up getting a Chex denial anyway. So, Chex sensitive. Not sure what my current Chex counts are, but I’ve opened 33 acounts in the last 6 months and been denied for 9, 5 explicitly for Chex scores.

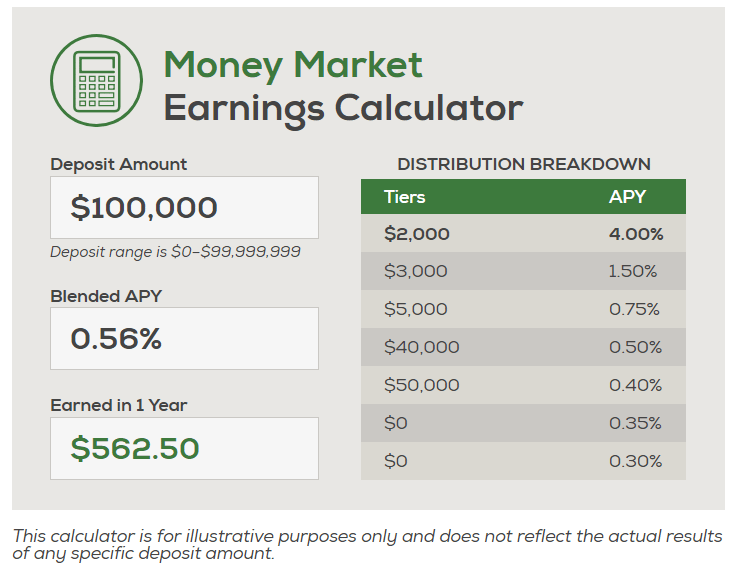

It’s also 3% on amounts from $2.5K-$5K, making it essentially 4% on up to $5K. You can also apply for membership in-branch by making a donation to their charity, even if you live outside of their geographic footprint.

Also, you can only use a Visa or Mastercard to fund if you want to use a card. I tried using an American Express (to help with my Propel SUB) and then a Discover (just to test it), and while the screen will load up the information, you’ll get an error message telling you to use a Visa or MC.

Stupid they don’t allow you to donate online. No one is going to go to another state to apply in the branch.

That’s just the blended rate and takes into account the 5% on balances up to $2,500 I think

Membership limited to handful of counties around Montgomery AL and Columbus GA. https://www.mymax.com/get-started-with-max/who-we-serve

I successfully signed up online. You could do CC funding up to $3k. It mentioned being subject to a credit check and ChexSystems, but didn’t get a credit check notification.

I have never done credit card funding on a new account. Does it count as cash advance on your credit card or as a purchase?

It depends on the bank and on the credit card issuer. DoC has a page full of (outdated) info on that. You could always lower your cash advance limit so that it will be blocked in the event it will be counted as a cash advance.

Did it count as a cash advance?

It did not. Used Chase WoH.

GA here, I’ll pull the trigger on this one and report back

Brandon, any luck?