Update 08/04/18: This pop up is now showing up on business cards. Previously it was only showing up on personal cards.

We reported last week that American Express has added wording to the credit card application process whereby vague, unknown factors affect whether you are eligible for the signup bonus. Interesting news came in now from Thepointsguy that Amex has added a qualification-check into the credit card application process.

After you submit your application, Amex will give you a pop-up telling you clearly that you are not eligible for the bonus, and asking you whether you want to proceed with the application anyway.

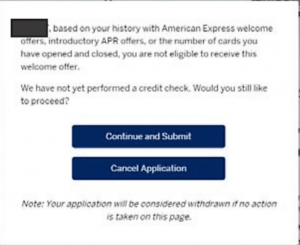

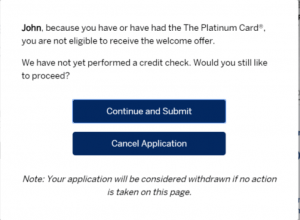

There are even two separate pop-ups: one for someone who has already gotten the bonus (Amex’s ‘lifetime limit’ rule), and a separate pop-up language for someone who has never gotten the bonus but is ineligible for the bonus due to having applied for too many cards or whatever other factors Amex considers.

In other words, they’ve added clarity to the application process so that you’ll know for certain whether or not you are eligible for the bonus: if you don’t get a pop-up, that seems to be a confirmation that you are eligible, and that should mean Amex will not deny you at a later stage. Also nice that they give this pop-up before doing any credit check.

The downside, of course, is that Amex is actually enforcing their arbitrary rules about who is eligible for a new bonus. Maybe we’ll even be able to eventually crack the code on what the Amex criteria are, similar to how it became known Chase’s 5/24 rule.

Below are images of the two pop-ups, as shown on TPG:

Let us know if you try it out and get the same results – it’s possible the system is in trial mode.

Tangentially, if this really ends up working, it’ll add clarity to the Amex lifetime rule which is said to reset after around 7 years. It’ll also save us from having to pore over spreadsheets to check our card history with Amex since they’ll do the work and tell us if we are eligible. Let’s see how this develops.

I was able to bypass this message by putting spend on my other Amex card. I received my new AMEX marriott business card and used it enough to have the 80,000 points posted to my amex account. However the points were never transferred to Marriot. When I called Amex to ask why, they said,

” I see your card account is under review right now that’s the reason points are on hold :-

Perry – 8:41 AM

Account Reviews are completed for accounts that: Are identified as high risk for misuse. Have earned points/miles on their Co-Brand accounts in a manner that indicates misuse, and are therefore, not eligible for the promotional bonus points / miles.

Examples of misuse:Spending and returning. Purchasing gift cards to meet the spend requirement. Downgrading and / or cancelling shortly after receiving promotional bonus / points.

Perry – 8:41 AM

how long does this review take?

You – 8:42 AM

Well review usually takes 60 days and if you are in urgent need of points, for this you can have a word with our dedicated team directly who are conducting the review and they will let you know the current status as well as exact date of completion of review as well

Perry – 8:44 AM

If you are comfortable, can I share direct number of the team with you ?

Perry – 8:44 AM

ok

You – 8:44 AM

You can reach our servicing specialist team ( toll free ) at 800-528-4800 available 24 hours a day / 7 days a week. They will assist you on this right away”

I dont do gift cards; i dont spend and return. However I do have a history of cancelling cards after i receive the bonus.

You should never cancel Amex card earlier than 12 months + 1 day from the day of opening… this is specifically stated in the T&C and considered to be “gaming the system”. You should always wait for 12 months + 1 day at least (although personally I recommend waiting till the next annual fee posts)… especially that there is NO BENEFIT of cancelling the card sooner. It is acually opposite. Keeping the card for longer (as long as it does not cost you anything) has benefits (ability to earn referral bonuses, occasional spend bonuses, status in programs, good for your credit history).

So, wishing you all the best, but you could have easily avoided that review by playing safer.

Good luck.

Thanks for your response. Yes I was coming around to being more careful with Amex, but last year I did cancel one before the year was up. I did pay a $450 fee for card last year. Maybe that will help. I plan to put a little spend on the card and then call them up to see what I can do. Before I started using it I confirmed via text I was eligible for the program. I also applied from an invitation. We’ll see…

PS I also have been paying my annual fee on my amex blue cash card for probably 10 years.

Talked to them. They said they are checking my spending to make sure I didnt do any fake spending. Which I did not. So hopefully this review will finish and points will post.

Just to end the story, my points vanished for a couple weeks and then came back. All is good. Lesson learned though.

I am wondering if there are any DP of anyone who received this message in the past and is now in the clear? I have been trying for AMEX cards since December but keep getting the window for P1 & P2. Wonder how long I’ll be shut out…?

I got that message until I realized I had a USAA AMEX card I hadnt used in several years. I put some spend on it and it cleared up. Not only did it clear, but I actually got an invitation to apply for the card I wanted (marriott bonvoy business).

Just got a pop up while applying for the Hilton aspire. Never had that card before. Only 3 amex. One blue cash preferred open 29 months ago, one personal gold opened exactly one year ago, and one business gold opened 6 months. Never closed any credit cards and spend pretty heavily on both gold cards but not so much any more on the blue.

I was using a referral from my girlfriend who I referred to an amex 4 months ago so maybe that was it?

i got same ineligible popup as last month. “based on my history…”

I applied for two Amex biz cards today (one charge card and one credit card), and was approved for both, however, neither showed the bonus eligibility popped up beforehand…

interesting DP….just applied for Amex Gold Biz card (had one 4 yrs ago). Applied today and got no bonus eligibility pop up. Think I’m good for the welcome bonus again?

I’m very confused by the criteria used by the tool to check eligibility. Today I got the popup for the revamped AMEX Gold (previously PRG) but somehow I am eligible for the new SPG Luxury. OTOH, my wife is ineligible for both of them. Here are our DPs:

Me:

Current:

– Blue Cash (10+ years)

– Everyday (9/2016)

– Delta Platinum (11/2017)

– Ameriprise Gold (11/2017)

Closed:

– Delta Gold (4/2015 -> 4/2016)

– Platinum (8/2015 -> 10/2016)

– SPG (2/2017 -> 7/2018)

Wife:

Current:

– Everyday Preferred (9/2015)

– Delta Blue (11/2017; changed from Delta Platinum opened in 10/2016)

Closed:

– Delta Gold (4/2015 -> 4/2016)

– SPG (2/2017 -> 7/2018)

– Ameriprise Gold (6/2017 -> 8/2018)

Overall we have very similar cards. My wife and I have closed the same number of cards in total, but recently she closed two and I only closed one. She also had a product change about a year ago. OTOH, currently I have 3 credit cards and 1 charge card with AMEX whereas she only has 2 credit cards.

Anyway, at the very least, it seems like the eligibility criteria are different for different cards.

Which of the 2 pop-ups (based on Amex history, or had this product before)?

AMEX history

DP – I just wanted to try to get the pop up on a card I knew I had before. So I applied for the PRG which I got 2/17 and cancelled 2/18. I pulled the 50k offer incognito and was approved after never getting the message. Then tried to apply for the Green card which I opened and closed the same days as PRG and got the pop up message.

Currently have 3 (now 4)personal and 2 business cards. Just got the BRG last month.

Interesting, please let us know if/when the bonus actually comes through.

Bonus came through on 12/20 after meeting spend on 12/18.

On PRG or Green?

PRG – This was right before they updated the card. Maybe that had something to do with it? I’m now getting the pop up on every card. Even if I haven’t had it before.

What did the pop up message say? That you had the card before, or based on your history with Amex?

So, did the bonus actually comes through by using the incognito mode?

Well, I have good news for a change…

Retried applying for the card a couple of weeks later, and this time it worked (showed me the pop-up 2 weeks ago). What changed since then? Last bonus I have received on another Amex card became “older” (still it is pretty recent – July), and I closed one Amex card (Charge card)… which I thought should be considered as a negative. I intentionally applied 2 weeks ago BEFORE I closed any more cards, but the message appeared, this time around – right after I closed the card – it worked fine. Instantly approved as well.

The closed card was a “charge” card, so I can not contribute the earlier message to the maxed out number of cards open.

I also thought may be Amex thought showing me a pop-up once is enough (other words they marked me in the system somewhere that they showed me that message, and this time they did not although the bonus is not allowed), but I waited a few days, and chated with a rep confining the bonus is attached to my offer.

To sum up – worth waiting and retrying. I will report in a couple of months when (if) bonus actually posts.

Thats awesome! How many Amex cards did you have open when you were approved?

When saw a pop-up 2 weeks ago I had 2 personal + 2 biz (one of them was a charge card, not a credit card). When approved few days ago 2 personal + 1 biz (charge card was closed by that time). Also, 1 personal was closed around 6 months ago.

Good luck.

What are people’s thoughts on how to get off of the Amex blacklist? I’m thinking things like paying an AF at year 1, or at least converting the card instead of closing. Putting some spend on the cards living in the sock drawer. What else?