The Offer

Direct link to offer (why not use a readers referral link instead?)

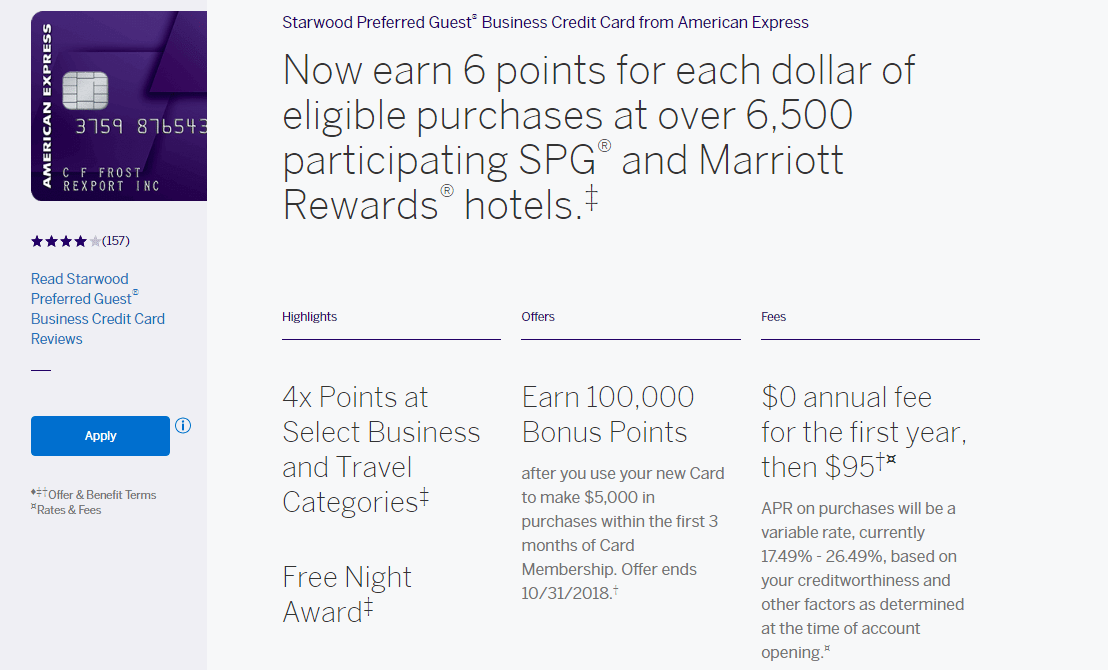

- American Express is offering a sign up bonus of 100,000 points on the SPG business card after $5,000 in spend within 3 months

Card Details

- Offer valid until 10/31/2018

- Anniversary free night award up to 35,000 points (this is a free night certificated that can be used on properties costing up to 35,000 points)

- $95 annual fee (waived first year)

- Card earns at the following rates:

- Six Marriott rewards points per dollar spent at participating hotels

- Four Marriott rewards points per dollar spent at U.S. restaurants, U.S. gas stations, wireless telephone services purchased directly from U.S. service providers and on U.S. purchases for shipping

- Two points per dollar spent on all other purchases

- Silver status and earn gold status by making $30,000 in purchases within a calendar year (increases to $35,000 in 2019)

- Free unlimited Boingo Wifi

- Coming in 2019: Receive 15 nights towards elite status

- Premium in room internet access at participating properties

- Can only get the bonus once per lifetime

Our Verdict

These are Marriott points, so it’s 33,333 points under the old SPG program. We’ve seen two bonuses of up to 35,000 points before ($5,000 spend vs $8,000 spend). Keep in mind these programs become unified on August 18th, 2018. It’s also worth remembering that getting this card will limit what Chase Marriott cards you can get. If you get this card/bonus you won’t be eligible to get the sign up bonus on any Chase Marriott card for the next 24 months. I previously suggested that signing up for this card before those new rules go into place, especially if you pick up the bonus on the Marriott business card now as well (getting the bonus on the Marriott personal card would be difficult for most people due to the 5/24 rule). This is even more true with this increased bonus.

Bonus on the personal card has also been changed from the $200 statement credit over to 75,000 points. Will do a post on this shortly.

DP: Been getting the ‘You will not be eligible for this bonus, do you still want to proceed with the application message multiple times over the past week

Tried again today and I was automatically approved for the card with no message

The same thing happened to me a few days ago. I got the card yesterday, and contacted CS through chat today. They told me I was eligible for the bonus.

Just signed up and got approved for the SPG Business.

History: I got this card in April 2017, got the bonus, and later closed the account in January 2018.

Today: I got a mail offer to sign up for this card. I didn’t think it would work, but I gave it a try and got approved. I didn’t get a message saying that I wouldn’t be eligible for the bonus, etc, which I do get when I try and sign up for the AmEx Delta Platinum cards. I wonder why?

Do you still think I’ll still get the bonus points?

I want to sign up for this card here shortly, but noticed that none of the referral links from the referral page are working. Is it something I’m doing wrong, or did the referral program stop?

Wife instantly approved. 9 other amex cards and 5 chase cards in past 2yrs, no popup

Got approved at first, 25k limit which I think is extremely high. Should i decrease the CL to prevent a possible financial review? Cumulative AMEX CL is 36K with this new card. Suggestions please?

Datapoint – just tried to apply for the SPG Biz for the 100k points. Before the application was submitted, got the “Not eligible for this offer” warning from Amex, so I stopped.

I currently have 3 credit cards (2 personal/1 biz) + 1 biz charge card from Amex. Have had the SPG Amex personal before but that has been cancelled. Also have the Chase Marriott Biz currently (got it a few months ago).

It sounds like none of those should preclude me from the bonus.. is that an erroneous warning from Amex? Or have the new rules already gone into play? Or do they count personal and business card bonuses as one now?

How long have you had your current AMEX cards? I’m wondering if this is also a data point on how strict the algorithm AMEX uses to classify ‘churners’, which they now warn beforehand about no bonus. Was your warning one of these:

https://www.doctorofcredit.com/american-express-adds-signup-bonus-eligibility-check-during-the-credit-card-application-process/

Im just trying to plan a strategy where I can keep my Amex spg base personal card and get more bonus points – currently chase is a no go due to 5/24, and if I do get under that number there are at least 2 cards I’d want before the Marriott one.

It’s the first warning – based on history and number of cards etc. All except one of my cards have been at least a year old, and the one should be close to a year old

Also, here is the language on the application page:

“Welcome offer not available to applicants who have or have had this Card. We may also consider the number of American Express® Cards you have opened and closed as well as other factors in making a decision on your welcome offer eligibility.”

It sounds like Amex may have identified myself as a churner, which seems pretty aggressive.

Hmm… maybe they only consider cards closed regardless of the number of cards opened. My wife and I have been getting only amex cards in the past year, as many as possible, with zero issues and only auto-approvals. However, we haven’t closed that many (yet) because the AFs are just now starting to come up.

If that is the case, it seems that best approach is to take a year to collect every amex card you can before AFs start coming up

https://www.americanexpress.com/us/credit-cards/card-application/apply/starwood-preferred-guest-business-credit-card/54663-9-0-4D988FA664EDFB8B29D6C79D949A814F-200002-g69fV2*vt7*LfGHP+p2s9kFAnrQ=?intlink=us:acq:rewards:mgmee:applynow:starwood-preferred-guest-business-credit-card:GBAB:0001:US-mgm-seo-copypaste-474-200002-GBAB:0001#/

So if I read the rules right I could get this card now, and the 90 days after I would still be able to get the Marriot Preferred Plus person card 90 days later.

If you got approved now and get the card number exp date, then quickly meet the min spending, will the points posted as 100,000 SPG then translated to 300,000 Marriott lol?

Haha that would be insane. We can dream right?