Update 12/27/20: These offers are showing up again. You can also get the 75k + $100 statement credit directly via here.

The Offer

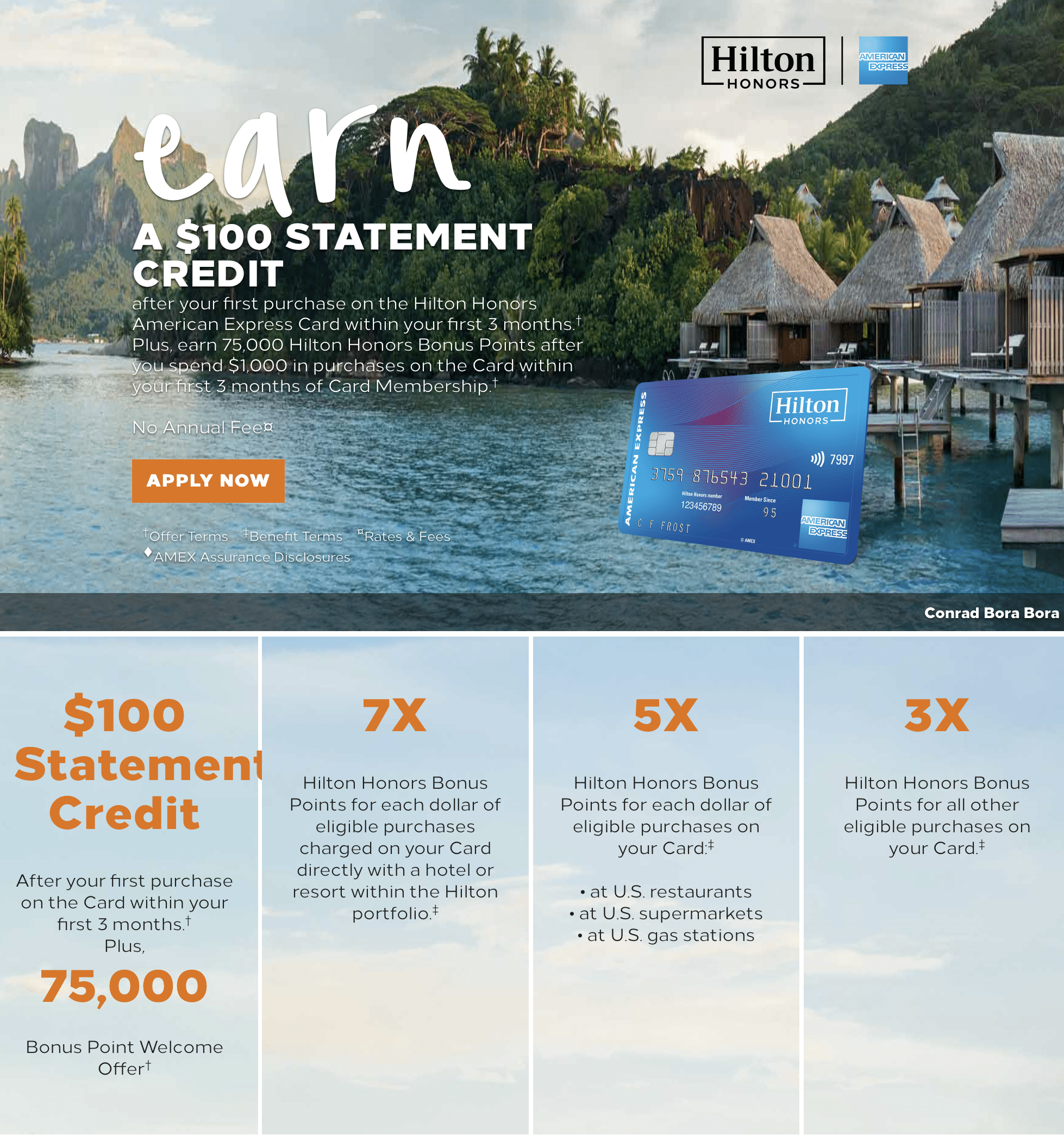

- American Express has two different increased bonuses on the Hilton no annual fee card:

- $100 statement credit after first purchase and 75,000 Hilton points after $1,000 in spend. This offer shows up when doing a booking on the Hilton website. You don’t need to complete the booking, it will show at the payment page and you can click over without booking/paying.

- 100,000 Hilton points after $1,000 in spend within the first three months. This offer is available via incognito mode, read up on how to get this offer to show here. ‘

Card Details

- No annual fee

- Card earns at the following rates:

- 7x on Hilton hotels or resorts

- 5x at U.S. restaurants, U.S. supermarkets and U.S. gas stations

- 3x on all other purchases

- Welcome bonus offer not available to applicants who have or have had this product.

Our Verdict

Previously the best bonus on this card was 75,000 + $50. This new bonuses are the new high. The statement credit offer is better if you value Hilton points at 0.4¢ or less. Keep in mind you’re not eligible for this bonus if you’ve had or have this product. There are also increased bonuses on all the other Hilton cards at the moment:

- American Express Hilton Aspire Bonus Increased To 150,000 Points – Best Ever

- Hilton Honors American Express Business Card 125,000 Point Offer + $100 Statement Credit(not new)

- American Express Hilton Ascend Bonus Increased To 150,000 Points (Best Ever)

As always if you have any questions, read this post first as they are probably answered there. American Express doesn’t match sign up bonuses if you’ve recently applied, but they sometimes offer courtesy points. They didn’t seem to be doing that when the Aspire bonus recently increased so I don’t think they will this time either but always worth a try.

Hat tip to Chong786 & lobonomnom

received a mailer today for 100k points + $100 stmt credit after $1000 spend

it’s marketed as “power pair promotion”

hilton.com/powerpair

https://www.doctorofcredit.com/increased-signup-bonus-offers-on-american-express-hilton-honors-surpass-and-business-cards-via-referral-link/

I signed up for the 75k points and $100 statement credit offer.

I used my temporary card number to spend $2 on Amazon on Dec. 28, no other purchases.

A $100 credit appears on my Recent Transactions list dated Dec. 30. When I click on the credit it says from Amazon.com.

No idea why Amazon pushed a $100 credit my way, but under “Additional Information” it states:

“on First Purchase

within 92 days of acquisition”

OK, I did some searching and it looks like the $100 credit was just an early payout for my $100 signup bonus. Was hoping it was some additional promotion I got 😉

This happened to me with my AMEX BlueCashPreferred.

I had a charge for something like $150 to my local grocery store and then a credit immediately after it which said ‘credit adjustment’ or something and the location info listed my grocery store. I thought… “what the heck happened? did my Grocery Store send me a credit back??”

I was super confused until I remembered that the SUB was $300 and realized the grocery store purchase was the transaction that hit the MSR, so AMEX immediately applied the SUB. Still strange to me that Amex codes the location to match the previous purchase, but looks like this may be a consistent thing across all Amex cards.

“Welcome bonus offer not available to applicants who have or have had this product”

Isn’t it usually that the SUB isn’t available if you’ve previously received a SUB for this product? I just downgraded from Surpass to the no AF card last week. So I have this card but haven’t received a SUB for it.

Not with Amex. You usually can’t get the bonus if you product change to it either.

This is true of almost every CC issuer and not just Amex.

You should call and ask nicely for one.

Always better to cancel cards than downgrade, you lose the chance to obtain sign-up bonuses.

My offer is 80K after 1000 spend.

Got this card with same offer a few years ago. Have since added my daughter on my card. Will that interfere with her getting this card for herself? .

Shouldn’t.

Should I apply just for the $100 statement credit even if I don’t care about Hilton points?

$100 is more appealing than 25k extra Hilton points right now IMO, especially during a pandemic. Cash is king. 25k isn’t really worth all that much (0.4-0.5 cpp)

At launch, the Aspire card offered 100,000 point SUB. Now the no annual fee card gets an applicant that much.

A big reason is because the points are worth less than at launch. Hotel cards always look great with big bonuses but the points are worth substantially less than other currencies.

Just canceled an Amex Hilton Surpass a week or so ago with $95 AF after declining to downgrade card to this version. Didn’t have any retention offers.

Will it look bad if I apply for this card after such a short time span?

If they let you apply without the popup, it should be fine

In life like in comedy, timing is everything. You done good. Go for it.

100k points is worth about $300 realistically in most cases.

lol, then it is a pretty good offer for a no fee card *shrug emoji*

Stayed at Homewood suites for 5 days using 66k points. It was about $450 in cash. Your 5th night is free with the award booking which makes it really worth it for longer stays.

Do you think the Aspire is worth keeping long term if you want to stay in Southeast Asia/Japan? I’d have to see which resorts are good to use the $250 & if there are many Hiltons that have lounges.