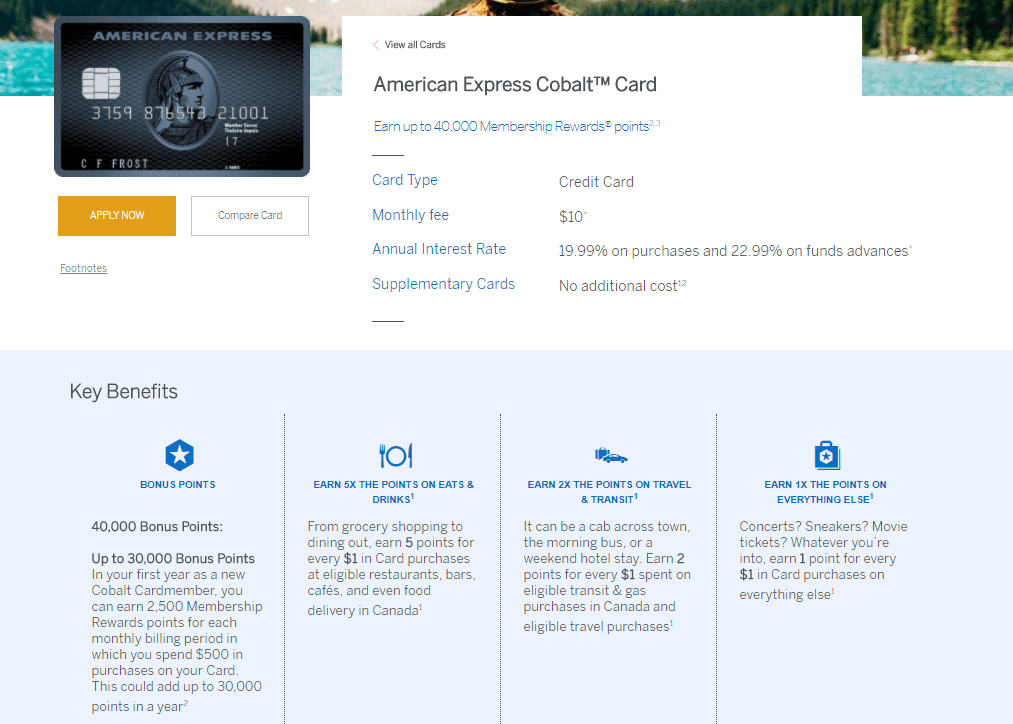

American Express has launched a new Cobalt card in Canada. The card is very different to standard credit cards with a focus on monthly fees & rewards rather than yearly ones. Let’s take a quick look at the card followed by what it might mean for us.

Card Basics

- Card comes with a $10 monthly fee

- Earn 2,500 Membership Rewards points for each monthly billing period in which you spend $500 or more (first year only)

- Receive a sign up bonus of 10,000 bonus points when you spend $3,000 or more in the first 3 months

- Card earns at the following rates:

- 5x points on eats & drinks

- 2x points on travel & transit

- 1x points on all other purchases

Points don’t transfer to airline partners, but they do transfer to SPG at a ratio of 2:1. This means the card earns 2.5x points on eats/drinks category.

What Does It Mean For Us?

This card actually has the same card art as another card, the American Express Explorer that is available in Australia. That card has a $395 annual fee, 100,000 point sign up bonus and $400 travel credit annually. Also earns 2x points on all purchases. I heard from a source at American Express that they were happy with the launch of that card in Australia and wanted to trial it in Canada before possibly releasing it in the United States. Given this new Cobalt card has been released that doesn’t look to be the case anymore.

This could mean that American Express want to trial this Cobalt card before a possibly launch in the United States, or that this is just a pure stand alone product for the Canadian market.

Our Verdict

I think we will see more cards with sign up bonuses that are broken down over a long period than the standard three months/90 days. We already see a bit of this with cards like the Chase British Airways card but card issuers are all about long term card member value at the moment so I suspect we will see even more of it. I’m not sure what card I’d prefer, the Cobalt with it’s 5x on dining out or the Explorer with the 100,000 sign up bonus and 2x everywhere. Obviously both programs have points that aren’t as valuable as normal Membership Rewards. What card would you prefer to see and why?

Where does it say that it transfer to hotels? I looked all over the link, and I see is:

Redeeming Rewards

Redeem your points towards whatever card purchases you want6 – your options are anything but limited

Redeem for flights through the Fixed Points Travel Program4

Redeem for concerts and events on Ticketmaster.ca7

Redeem for gift cards and merchandise through Membershiprewards.ca

Redeem for purchases on Amazon.ca5

Nothing on there is seems like hotel transfers.

Just for the 2.5X SPG for dining I’d take the Canadian Cobalt version

I think some combination of the Cobalt and Explorer card would be good for Amex. Many people are wary of charge cards, so a premium credit card which platinum-like benefits would probably be successful.

I also wouldn’t be surprised if they use something like the Cobalt to phase out or overhaul the Everyday cards, which don’t seem to have much marketing push anymore.

Would love to connect. Not sure why you believe the MR points on this are less valuable than normal MR – they are the same. And the proposition is not a first year only.

They don’t transfer to all travel partners like regular MR, only to hotels.

Hey mmgfarb, just for reference it looks like David works for American Express according to the e-mail address. I just sent an e-mail so hopefully he can verify a few things for me…

Wow. That’s……Certainly interesting that an AMEX VP is lurking around on DoC

aw crap. just more verification that the RATS are indeed in the house. not that its a surprise or anything…

You would be surprised how many high level execs browse through this site, Reddit, etc. Many of them are churners too.

Not surprising consider this post is ranking highly for cobalt related terms.

Anybody can enter any email address here, so it could just be somebody posing as an AMEX employee. Kinda strange though.

He replied to my e-mail so doesn’t seem to be the case.

Hey David,

Thanks for getting in touch, just sent you an e-mail.

Looks like there was some confusion here and what I originally posted is accurate.

They have forex fees on this one though. Hopefully Amex would not in the US market.

I find it hard to believe Amex would release another 2x card after BBP, although, maybe they want a personal version.

It is for first year only.

This offer is only available to new American Express Cobalt Cardmembers. For current or former American Express Cobalt Cardmembers, we may approve your application, but you will not be eligible for the Membership Rewards points offers available in the first 12 months of Cardmembership. Offer subject to change. To qualify, you must have at least $500 in net purchases posted to your account by the last day of each billing period.

time to look for a job in Canada

or a hottie.

I had to re-read the Cobalt because the 2,500 monthly bonus seemed too good to be true. Yeah, I think we should call out that this is only for your first year.

The Cobalt would have been a no-brainer except for the airline transfer exclusion. Airline points are the best redemption options to get bang for buck. (although takes some effort) You could transfer to SPG and then transfer from SPG to airline. SPG pts will transfer to most airlines on a 1:1 basis. Unfortunately, since you get a reduced rate to start out of, it’s essentially 2.5 SPG/airline point for every dollar with the card. If you maximize SPG’s transfer bonus of 5,000 pts for every 20,000 SPG pts transferred, then that becomes 3.125 airline points per dollar.

That’s intriguing, but the effective $120 annual fee ($10 per mo) on the card makes the value questionable. Unless there is some other card benefit (maybe a travel credit) to offset the annual fee, this card would tough to keep after the bonus offer. I’m kind of impressed by Amex that they seemed to have found a balance with this card.

5 MR points even without airline transfers is still pretty good if you can redeem for 1 cent per MR point through other redemption options. But, it’s a hard decision if you already have a CSR or Amex Blue Cash since those categories are covered. It’s an interesting card if you don’t have those cards already and you’re spending a lot in either restaurants or groceries.

Will make it clearer that the monthly points are first year only.

looks like im gonna get canadian citizenship for this. hope its made of metal.

Canada needs to keep you people out. Build a wall.

haha. hilarious. ur here too buddy…