A lot of card issuers have started offering free FICO scores to consumers under the FICO open access initiative. Citi was the last card issuer to tell consumers that they would be offering cardholders free access to their FICO scores starting in 2015, joining Barclays, Discover, FNBO, PenFed, Walmart, PSECU and Merrick Bank.

According to fixfox69 from FatWalletForums, American Express has also started to roll out free FICO scores to select cardholders. At the moment there isn’t a whole lot of information, but here’s what we know so far:

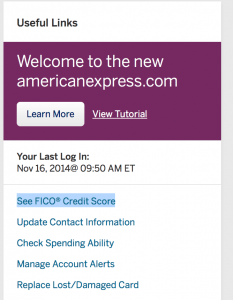

- Free FICO scores are only being offered to certain consumers when they are logged into the new version of the American Express website. Here is how to find it:

- On the right hand side underneath “Your Last Login” you will see a link that says “See FICO® Credit Score” click this.

- Read the terms and conditions and accept them if you wish to proceed

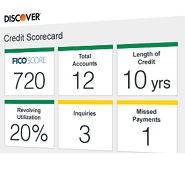

- View your FICO score, it should also list two reasons that are negatively impacting your score (e.g too many new accounts, credit utilization too high)

- Score is based on your Experian credit report (we’re unsure if this is an industry specific FICO score or a classic score. If it’s an industry specific score it should be a bankcard enhanced score)

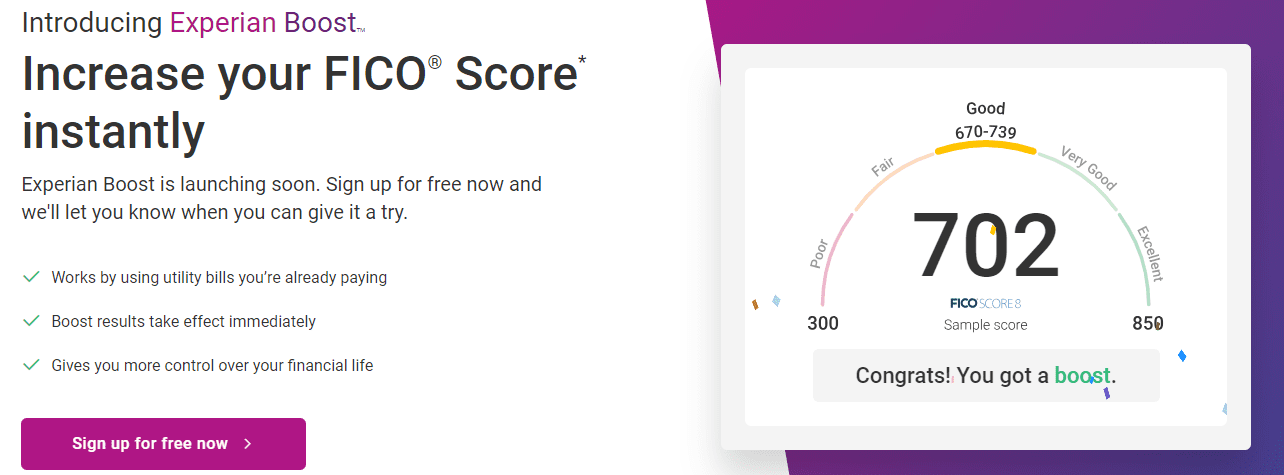

It’s great to see that this will be based on your Experian report as most card issuers currently offer a score based on your TransUnion report and Citi will be offering a score based on your Equifax report.

At the moment the scores seem to be offered on consumers who hold different cards, so that doesn’t seem to be American Express’ selection criteria. My thoughts are that they are offering this to consumers who’ve recently had their credit reports pulled. Card issuers do this on a semi regular basis to determine their risk exposure, they sometimes use this information to offer automatic credit limit increases for cardholders that have less risk than originally perceived or credit limit decreases for those whose risk levels have increased (although this is much less common). Card issuers also obviously do this whenever you apply for a new card as well. If this line of thinking is correct, then more and more AmEx cardholders will begin to have access to their scores for free in the coming months.

If American Express is planning to roll this out to all cardholders, then their timing is very interesting. President Obama’s “BuySecure Executive Order” announcement would have made more sense (this is when Citi made their free FICO score announcement). If American Express does roll these free scores out to all cardholders then the pressure will be on Chase in particular to follow suit. My sources inside Chase have indicated that they will be offering cardholders free access to their FICO scores sometime in 2015.

A month or two ago I contacted the executive department at Capital One about their lackluster credit tracker among other issues, originally they had promised to get back to me and then suddenly they had a change of heart due to “…launching changes in the offering for the new year”. I suspect these changes will be the offering of an actual FICO score rather than the score they currently provide.

It should also be interesting to see how the free credit monitoring sites that provide FAKO scores (e.g Credit Karma, Credit Sesame, Quizzle, Credit.com & WisePiggy) try to pivot now that most Americans will be able to check their FICO scores for free. We’ve already seen Credit Sesame try to differentiate their product by offering free identity theft insurance and Credit Karma offering free full credit reports.

We’ve contacted both American Express and FICO and will update this post if they give an official response. In the mean time, check your American Express accounts to see if you’re offered a free score. If you are offered a free score, could you please take some more screenshots for me and also copy and paste the terms & conditions? Feel free to e-mail this directly to [email protected] or leave it as a comment.