Deal has ended, view more bank account bonuses by clicking here.

Update 2/20/21: Deal is back and valid until March 31, 2021.

First Horizon is the new name for Capital Bank & First Tennessee.

Offer at a glance

- Maximum bonus amount: $450

- Availability: AR, AL, FL, GA,

KY, MS, NC, SC, TN, VA - Direct deposit required: No

- Additional requirements: See below

- Hard/soft pull: Soft pull

- ChexSystems: Unknown

- Credit card funding: Up to $300

- Monthly fees: $15, avoidable

- Early account termination fee: Six months, bonus forfeit

- Household limit: One per business

- Expiration date:

June 30th, 2020 September 30th, 20203/31/2021

Contents

The Offer

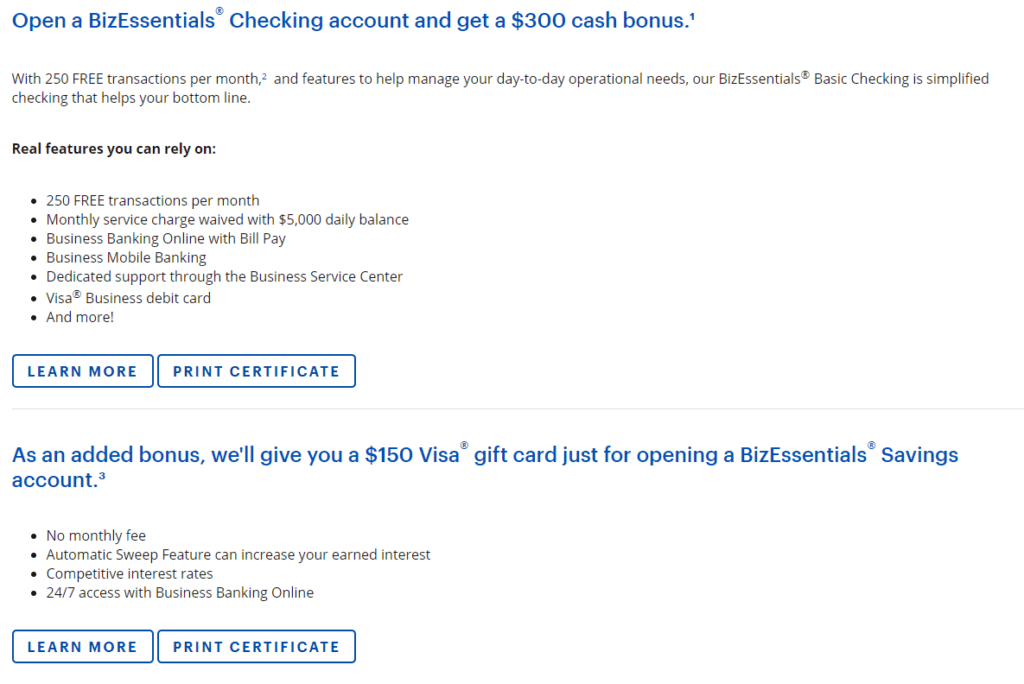

- First Horizon Bank is offering a $300 business checking bonus and a $150 business savings bonus.

- Open a BizEssentials checking account at basic level or higher and complete the following requirements to receive a bonus of $300:

- Make an opening deposit of $5,000+

- Complete 5 qualifying transactions within 30 days of account opening

- Open a BizEssentials saving account and get a $150 Visa gift card when you deposit a minimum of $2,500 at account opening

- Open a BizEssentials checking account at basic level or higher and complete the following requirements to receive a bonus of $300:

The Fine Print

Checking bonus:

- Open your BizEssentials® Checking account at the Basic level or higher by 6/30/2020 with a minimum opening deposit of $5,000 AND complete 5 qualifying payment transactions within the first 30 days of account opening to receive the $300 bonus.

- Qualifying payment transactions include checks, debit card purchases, ATM withdrawals, automatic bill payments, and online bill payments initiated through the bank’s Business Banking Online services, in any combination. Offer is non-transferable.

- Limit one business checking bonus per company.

- Opening deposit must be funds from a financial institution other than First Horizon Bank or its affiliates.

- Transfers from any type of account at Bank or its affiliates do not qualify.

- Offer and account opening subject to bank approval.

- Customer agrees to maintain account in good standing for minimum of 6 months.

- The $300 bonus will be credited to your account within 6 weeks of meeting all requirements and will be reported as income on Form 1099-INT.

Savings bonus:

- Bonus gift card will be mailed to customer 4–6 weeks after account funding, and will be reported as income on Form 1099-INT.

- Limit one gift card bonus per company.

- Customer agrees to maintain account in good standing for a minimum of six months.

- Minimum opening deposit is $2,500.

- Opening deposit must be funds from a financial institution other than First Horizon Bank or its affiliates.

- Transfers from any type of account at Bank or its affiliates do not qualify.

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

Avoiding Fees

Monthly Fees

BizEssentials checking basic has a $15 monthly fee, this can be waived with an average daily collected balance of $5,000+. Saving account has no monthly fee to worry about.

Early Account Termination Fee

Account must be kept open for six months otherwise the bonus will be forfeit

Our Verdict

This is the same bonus they used to have when they operated under the different names, it’s slightly better as the checking account only needs to be at the basic tier so it’s easier to keep fee free. Looks like you might only be able to open this account in branch currently so wouldn’t recommend it due to COVID-19. If anybody is able to open online or via the phone and get the bonus let us know in the comments. I’ll still add it to the best checking account bonus page for future reference.

Useful posts regarding bank bonuses:

- A Beginners Guide To Bank Account Bonuses

- Bank Account Quick Reference Table (Spreadsheet) (very useful for sorting bonuses by different parameters)

- PSA: Don’t Call The Bank

- Introduction To ChexSystems

- Banks & Credit Unions That Are ChexSystems Inquiry Sensitive

- What Banks & Credit Unions Do/Don’t Pull ChexSystems?

- How To Use Our Direct Deposit Page For Bank Bonuses Page

- Common Bank Bonus Misconceptions + Why You Should Give Them A Go

- How Many Bank Accounts Can I Safely Open Within A Year For Bank Bonus Purposes?

- Affiliate Links & Bank Bonuses – We Won’t Be Using Them

- Complete List Of Ways To Close Bank Accounts At Each Bank

- Banks That Allow/Don’t Allow Out Of State Checking Applications

- Bank Bonus Posting Times

Post history:

- Update 10/11/20: Deal has been extended until 12/31/20.

Back with $800 bonus for parking $25k 3 months.

It’s back with a higher offer now

https://www.firsthorizon.com/flourish?utm_campaign=smbcashoffer2024&utm_source=facebook&utm_medium=cpm&utm_content=smallbusiness-prospecting-interests&utm_term=smallbusinesscheckingoffer_na_na-paidsocial-1×1-grow-static&dclid=CLz5i9vU2oUDFfmJgwgdqSkBRA

anybody get tax docs for this one?

Is this a once per lifetime bonus? I did it back in December 2019…closed in July 2020…would like to do again.

But this seems to suggest a no go: “Limit one business checking bonus per company.”

There are also paper statement fees which are turned on by default, $2 each. First statement fee is waived. Gotta turn it off in the app. I got hit with the second month fee on my personal account after i got the $400 bonus.

Please remove Ky. No branches anymore.

Done

It doesn’t specify how long you have to leave the $5000 in checking or $2500 in savings. Anyone know if you could transfer most it out of there a few days later? You can get the value checking for $5 a month with no minimum balance requirement.

Pretty easy bonus, but you have to go in branch. Only branch now in GA is in Dahlonega.

Went in 11/30/20 to open the account.

Lady was busting my balls about the Secretary of State thing.

For a sole prop you don’t need that in GA- you need to be registered with the Department of Revenue/Department of Taxation. Sec of State is only for LLCs and such.

Luckily I brought a copy of my DBA from Hawaii when I started my business there. Lady had to call corporate and check if this was acceptable. They printed me a debit card in branch, a first for me.

I think having a federal EIN for my legit sole prop helped my case as well. It’s easy to get, do it!

But they want new customers and deposits, so they signed me up.

Deposited $5100 and then reloaded my amazon GC 6 times.

12/14/20 Bonus posted.

Also got the $150 gift card in the mail that week. You’re supposed to open a Biz Savings acct for the $150, but I had the lady in branch apply the coupon code to my biz checking acct. So I forgot to open the savings and deposit $2500 there, but still got it!

Never take no for an answer, always politely escalate the situation.

This bank now requires sole proprietors to have a dba listing with the secretary of state. Only bank that I’ve found that won’t just open as a sole proprietor with SS#. Called several branches to confirm. Screw them. Anybody have counter data points? thanks

@arch Back when they were Capital Bank, I was able to open as a sole prop with a DBA fictitious name certificate listing on the state website. They required this back in January 2019. I am in FL and from my experience, almost all of the banks require this for business accounts.

I opened when they were First Tennessee in Aug ’18 with no such nonsense. I tried again after they became Capital and failed. I thought that by this time with all the pandemic changes they might have loosened up but no. They’re the only bank in NC that has this that I have opened, and that’s quite a few. I just opened yesterday with Suntrust online, whereas in the past I had to go in branch to complete. Just curious, was your DBA just made specifically to open this account or is it legit? How much hassle to get one? Thanks

@arch Mine is legit. In FL, it costs $50 to get one and from what I recall it was an easy process.

Called local branch today to see if I needed an appointment and he asked if biz was sole prop, llc, etc… I’m sole prop w/just ssn. He said here in TN you have to have a business license to open the account.. lame