Offer at a glance

- Maximum bonus amount: $300

- Availability: AZ

- Direct deposit required: Yes, $500+

- Additional requirements: See below

- Hard/soft pull: Soft pull

- ChexSystems: Unknown

- Credit card funding: None

- Monthly fees: $5, avoidable

- Early account termination fee: Six months, bonus forfeit

- Household limit: None

- Expiration date: None

Contents

The Offer

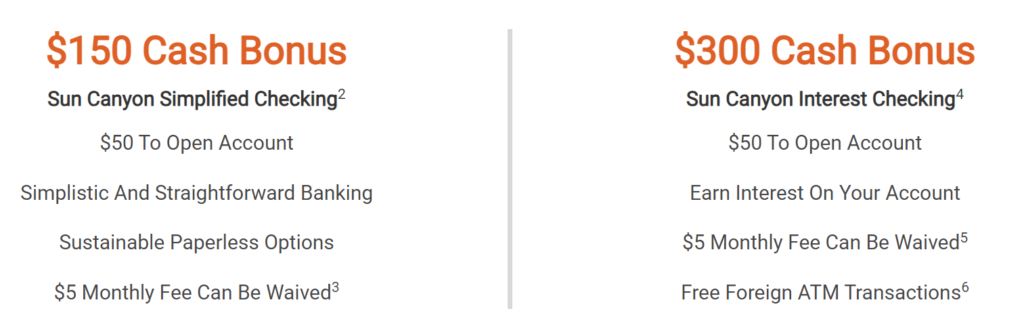

- Sun Canyon Bank is offering a $300 bonus when you open a new checking account. Bonuses are as follows:

- $300 bonus with Sun Canyon Interest Checking

- $150 bonus with Sun Canyon Simplified Checking

- Must receive a direct deposit by April 30, 2025 of $500+

The Fine Print

- $300 Cash Bonus with Sun Canyon Interest Checking or $150 Cash Bonus with Sun Canyon Simplified Checking: One direct deposit must post to your account by April 30, 2025; direct deposit needs to be an electronic deposit of your paycheck, pension, or government benefits (such as Social Security) from your employer or the government and must be $500 or higher.

- Bonus will be credited to your account within your statement cycle following your first eligible direct deposit and will be reported as income on Form 1099-INT.

- Limit one bonus per household. Accounts must be opened by March 31, 2025, to receive bonus offer.

- Bonus offers are not available to existing Sun Canyon checking customers or previous customers whose accounts have been closed within the last 90 days or closed with a negative balance.

- Must be 18 years or older and agree to maintain account in good standing for a minimum of six months.

- Account Closing: If your checking account is closed within six months after opening, the bonus amount you received for that account will be deducted at closing.

- Employees are not eligible for this offer.

- Subject to bank approval.

- Cannot be combined with other bonus offers.

- Limit one bonus per customer for either a Sun Canyon Interest Checking or a Sun Canyon Simplified Checking (not both).

- Sun Canyon Simplified Checking must be opened in-person at the branch and is not available online.

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

Avoiding Fees

Monthly Fees

Sun Canyon Simplified Checking $5 Monthly Fee

Easiest way to avoid the monthly fee is with a $500 daily balance is maintained in your checking account.

Sun Canyon Interest Checking $5 Monthly Fee

Easiest way to avoid the monthly fee is with a $5,000 daily balance is maintained in your checking account.

Early Account Termination Fee

Account must be kept open for six months

Our Verdict

Owned by Banterra and they are Chexsystems sensitive.

Useful posts regarding bank bonuses:

- A Beginners Guide To Bank Account Bonuses

- Bank Account Quick Reference Table (Spreadsheet) (very useful for sorting bonuses by different parameters)

- PSA: Don’t Call The Bank

- Introduction To ChexSystems

- Banks & Credit Unions That Are ChexSystems Inquiry Sensitive

- What Banks & Credit Unions Do/Don’t Pull ChexSystems?

- How To Use Our Direct Deposit Page For Bank Bonuses Page

- Common Bank Bonus Misconceptions + Why You Should Give Them A Go

- How Many Bank Accounts Can I Safely Open Within A Year For Bank Bonus Purposes?

- Affiliate Links & Bank Bonuses – We Won’t Be Using Them

- Complete List Of Ways To Close Bank Accounts At Each Bank

- Banks That Allow/Don’t Allow Out Of State Checking Applications

- Bank Bonus Posting Times

Denied due to Chex. They also mentioned my credit score was too low (700), which sounds like they ran a hard inquiry on me too, crap.

11/14/2024 Applied for account online

11/21/2024 Account is open

11/21/2024 Opening deposit posted

11/26/2024 DD Treasury Direct $500+

11/29/2024 Increased balance to $5,000+

11/24/2024 DD Treasury Direct $500+

1/26/2025 SM inquiring about bonus status

1/27/2025 Received a phone call confirming eligibility for bonus and that it will manually posted

1/27/2025 $300 Bonus is posted as “Checking Bonus $300”

Pathetic small credit union. Applied in person and was declined because of Chex, even though I could prove my identity in person and was local.

Applied 11/19. In state. After the screen to input DL# and answer ID verification, received the error “Transaction Declined” with a phone number to call.

Banterra Bank softed my (frozen) Chex the day after I applied. But they haven’t asked me to unfreeze it and haven’t sent a denial. Did they hard pull anyone’s Chex?

I asked if they needed more information or documents. That usually elicits a request to thaw Chex if they want it. But now I get the “outside business hours” reply to chat/text during their normal business hours.

Normal business hours are “8am-4pm CST” which a weird time zone for AZ and weird hours for CST too. As if they’re a bank headquartered in the East, pretending they are a bank headquartered in the Midwest which is pretending to be in AZ.

Strange bank.

I just checked and Banterra bank soft pulled my Chex as well. No point since Banterra is very Chex sensitive

Was your Chex report frozen? If so, it wasn’t actually a “soft” pull. It was them attempting (and failing) to do a “hard” pull on your Chex.

Yeah I forgot to mention Chex was frozen which is why it was a “soft” pull. Would have likely been hard pull if not frozen

They did a hard pull on my Chex. I applied on 11/15/24. No word from them after the confirmation email.

Update.

11/14 submitted application & inquired via Chat if I was in footprint

11/15 Rec’d response to Chat saying yes. Chex pulled

11/24 my account is officially open and pending bank approval message is no longer seen when logged in. (edited to add more details)

What were your Chex stats?

Chex:

3mo 1

6mo 6

12mo 13

18mo 21

24mo 44

Yes in-state

Before I submitted the application for Sun Canyon, I saw there was a chat feature, so I opened it and submitted a chat and said I lived in AZ and asked if I was allowed to open an account with Sun Canyon. Then, after I submitted the chat, I got the mesg that they weren’t open and someone would respond. I got a reply to my chat today and it said: William Charles

William Charles

“Sun Canyon can accept an applicant from all us states Except: NY, NJ, and CA. Once an application is submitted it will be manually reviewed. If the application is accepted you will be contacted by a member of the Sun Canyon team.”

It seems the offer is not limited to AZ. So far, I can still log in.

☹ at “Except: NY, NJ, and CA.”.

IL DP:

Applied with Chex frozen. Went all the way to bank pending approval. Tried to login today and user/pass doesn’t work. No email of denial or anything

Same issue here. Opened the account, and it allowed me to create online user/password and I was able to login in for several days. Then today I logged in to check whether my opening deposit of $50 had posted to the account or not, but got the ‘invalid user name or password’ error. No rejection email received. I’m in State.

It’s been a few days and still no communication. Still says invalid user/pass. No reason to see that account is approved. I wonder what they use to determine approval/denial

I called CS asking about the application status, they told me if there was no welcome email after the confirmation email then it meant a denial. They said they won’t necessarily send out an official denial notice.

That’s the same way that Parke handles things. NBG knows exactly what I’m talking about. 😠

NBG knows exactly what I’m talking about. 😠

A week later and a handwritten addressed letter did come in the mail for Sun Canyon on the denial with the reason being # of inquiries on Chex and Credit Report. Definitely not being able to login is a confirmation of a denial by the bank.

Per CSR, there is no promo code. You just have to apply from the offer page.

There is no hard pull on EQ, EX, or TU. I thawed them all before I applied. Chex was frozen but they didn’t try to pull it. There was no soft. At least not yet but my account is still in limbo.

I applied on 11/6 and set up online banking. Received account# and my $50 opening deposit appeared in transactions. There was a notation saying “pending bank approval”.

Next I received an Online Account Confirmation email:

“Be on the lookout for a welcome email from our Customer Care team” and a Confirmation Code.

The next morning (11/7) my login stopped working. I tried getting back to the application and/or online banking with my Confirmation Code but it returns “an unexpected error has occurred”.

I applied the day before John R but I haven’t gotten a denial email. I haven’t gotten the welcome email they said to watch for either.

This bank is a division of Banterra Bank so you might have good chance outside AZ if you’re in the Banterra footprint. I’m outside both.

I had the same experience as Sammy and

Sammy and  Peek.

Peek.

Applied OOS, was able to immediately log in to online banking where there was an account number and a heading saying “Pending bank approval.”

Few hours later, got a denial email and login no longer worked (Subj: “Application Status”, “Thank you for your interest in Sun Canyon Bank. Unfortunately, we were unable to complete your request.”)

Credit was frozen, Chex unfrozen but no pull.

No denial email for me yet.

No denial for me yet.

I got an Online Account Confirmation email instead, with a confirmation code “to use in your communications with us”.

The confirmation code doesn’t work online outside banking hours. Maybe it would work in chat but I’d rather not talk to a human because they’re unpredictable.

I still haven’t gotten the 2nd email they told me to watch for (the “welcome email”) but I only applied last Wednesday.

Any tips on what works to fake a DD?

This offer appeared 4 days ago.