Deal has ended, view more bank account bonuses by clicking here.

Update 10/17/24: Extended to October 31, 2024.

Update 10/5/24: Deal is back until October 15, 2024. Seems to be in branch only Hat tip to DesertActor

Update 7/23/22: Deal is back until December 31, 2022. Hat tip to payyoutuesday.

Offer at a glance

- Maximum bonus amount: $300

- Availability: Must live, work or worship in Pima, Pinal, Cochise, or Maricopa Counties, Gila River Indian Community Reservation, Arizona’s “Copper Basin” Area

- Direct deposit required: No

- Additional requirements: See below

- Hard/soft pull: Soft pull

- ChexSystems: Unknown

- Credit card funding: $2,000

- Monthly fees: $12, avoidable

- Early account termination fee: Six months, bonus forfeit

- Household limit: None

- Expiration date: December 31, 2021

Contents

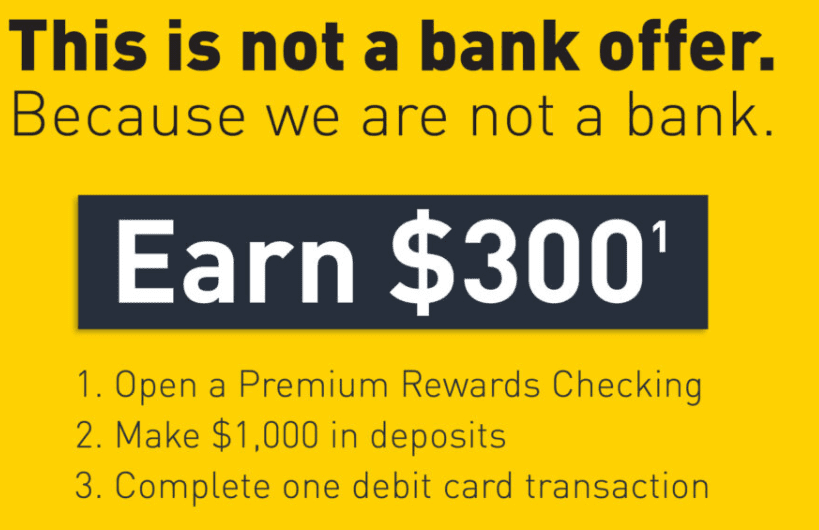

The Offer

- VantageWest is offering a bonus of $300 when you open a new Premium Rewards Checking account. Bonus requirements are as follows:

- Make $1,000 in deposits

- Complete one debit card transaction

- Or you can get a $150 bonus when you open an essential checking account. Bonus requirements are as follows:

- Make $500 in deposits

- Complete one debit card transaction

The Fine Print

- New Vantage West Members are eligible for one of two rewards options:

- 1) To qualify for the 30,000 Rewards Points bonus ($300 cash value), you must open a new Vantage West Membership and a Premium Rewards Checking account and complete each of the following within 60 days of account opening: Deposit an aggregate total of $1,000 and complete 1 debit card transaction (transaction must be completed with the debit card). Or

- 2) To qualify for the 10,000 Rewards Points bonus ($100 cash value), you must open a new Vantage West Membership and an Essential Checking account and complete each of the following within 60 days of account opening: Deposit an aggregate total of $500 and complete 1 debit card transaction (transaction must be completed with the debit card).

- Promotion runs June 1, 2021- December 31, 2021.

- Your checking account must remain open for at least 6 months.

- If it is closed within 6 months of the open date you may be responsible for reimbursement of any bonus awarded.

- Minimum opening deposit for Premium Rewards Checking and Essential Checking is $20.00.

- Essential Checking does not earn rewards points.

- A qualifying product (Premium Rewards Checking or Credit Card) must be opened to continue earning rewards points.

- Your account must be in good standing at time the bonus is awarded.

- The Rewards Points will be credited to your rewards account within 30 days of the date the last requirement is met.

- Limit one new Premium Rewards or Essential Checking account, per membership and per member, will be eligible for the bonus.

- Offer available to non-Members who have not had a relationship with Vantage West in the past 6 months.

- Offer valid for new Premium Rewards and Essential Checking accounts only.

- Members with any existing Vantage West relationship are not eligible for the bonus. Conversions between Premium Rewards and Essential Checking are not eligible for the bonus.

- Offer cannot be combined with any other offers associated with opening a checking account.

- See Vantage West Rewards terms and conditions for details and restrictions of the program.

- All accounts are subject to approval. Additional restrictions may apply. Subject to change without notice.

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

Avoiding Fees

Premium Rewards Checking ($300 Bonus)

This account has a $12 monthly fee. This is waived if you do any of the following:

- minimum daily balance of $3,000, or

- combined average daily balance in all deposit accounts of $10,000 or

- monthly net direct deposit of $750

Essential Checking ($100 Bonus)

This account has no monthly fees to worry about.

Early Account Termination Fee

Account must be kept open for six months, otherwise bonus will be deducted.

Our Verdict

This offer is significantly better than the old $200 bonus as no direct deposit is required. VantageWest also offer a 5% card. This bonus is definitely worth doing and even better due to the higher than normal bonus and the credit card funding available. Will be added to the best checking bonuses.

Useful posts regarding bank bonuses:

- A Beginners Guide To Bank Account Bonuses

- Bank Account Quick Reference Table (Spreadsheet) (very useful for sorting bonuses by different parameters)

- PSA: Don’t Call The Bank

- Introduction To ChexSystems

- Banks & Credit Unions That Are ChexSystems Inquiry Sensitive

- What Banks & Credit Unions Do/Don’t Pull ChexSystems?

- How To Use Our Direct Deposit Page For Bank Bonuses Page

- Common Bank Bonus Misconceptions + Why You Should Give Them A Go

- How Many Bank Accounts Can I Safely Open Within A Year For Bank Bonus Purposes?

- Affiliate Links & Bank Bonuses – We Won’t Be Using Them

- Complete List Of Ways To Close Bank Accounts At Each Bank

- Banks That Allow/Don’t Allow Out Of State Checking Applications

- Bank Bonus Posting Times

Opened in person on 10/21

Completed DD on 10/24

Completed 1 purchase on 11/2

Bonus redeemed on 12/4

Looks like its no longer valid

I have auto loan with them. Does that allow me to have this bonus OOS?

“Offer only available to non-Members who have not had a relationship with Vantage West in the past 6 months.”

You’re already a member so that disqualifies you.

Someone who could open a new account OOS would qualify.

any reason to still have their checking account or credit cards? I opened a checking and savings long back mainly for their visa 5% card and now its gone, so thinking to close all the accs probably just leave the visa card open (?)

I no longer live in AZ as well.

Since you’re OOS I would keep the CC and membership but close checking. That preserves your OOS back door for future offers open to members.

So not all CU are once a member always a member huh? I thought you can close and reopen as long as you were member sometime back

Bummer, both P1 and P2 declined online. Churned Vantage West 4 times in the past. Not sure if I feel like going into a branch to try to open there. I generally prefer to just do things online. I might try to reapply in a week or so and see if it goes through then.

Applied today and was declined. I called in and they said that “some accounts” cannot be opened online and I would need to visit a branch office. It wasn’t clear to me if that was a general comment, or for my application specifically. The branch nearest me is temporarily closed until after the current promo expires, so I won’t get to test an in-branch app this time around. They did ping Chex, and that could be a factor. I’m 5/6, 6/12 on inquires.

Per the website, must be opened in branch through 10/31.

They extended it to 10/31 now.

The fine print at the foot of the landing page says “Promotion only valid at our Golder Ranch location at 15250 N. Oracle, Suite 150, Catalina, AZ 85739.”

Oh, nevermind – I was looking at the public landing page, this link doesn’t have that verbiage.

Just saw this is available again until October 15. It looks like it reopened September 1, but I didn’t see it until now. https://vantagewest.org/celebrate-with-vantage-west-fall/