This bonus has expired and is no longer valid. Click here to view the best business checking bonuses.

Offer at a glance

- Maximum bonus amount: $2,500

- Availability: Nationwide, must open at a Bank of America branch and get a small business specialist to give you this offer. Branch locator found here.

- Direct deposit required: No, see below

- Additional requirements: See below

- Hard/soft pull: Soft pull

- Credit card funding: No

- Monthly fees: Waivable

- Early account termination fee: None mentioned

- Expiration date: February 28 2018

The Offer

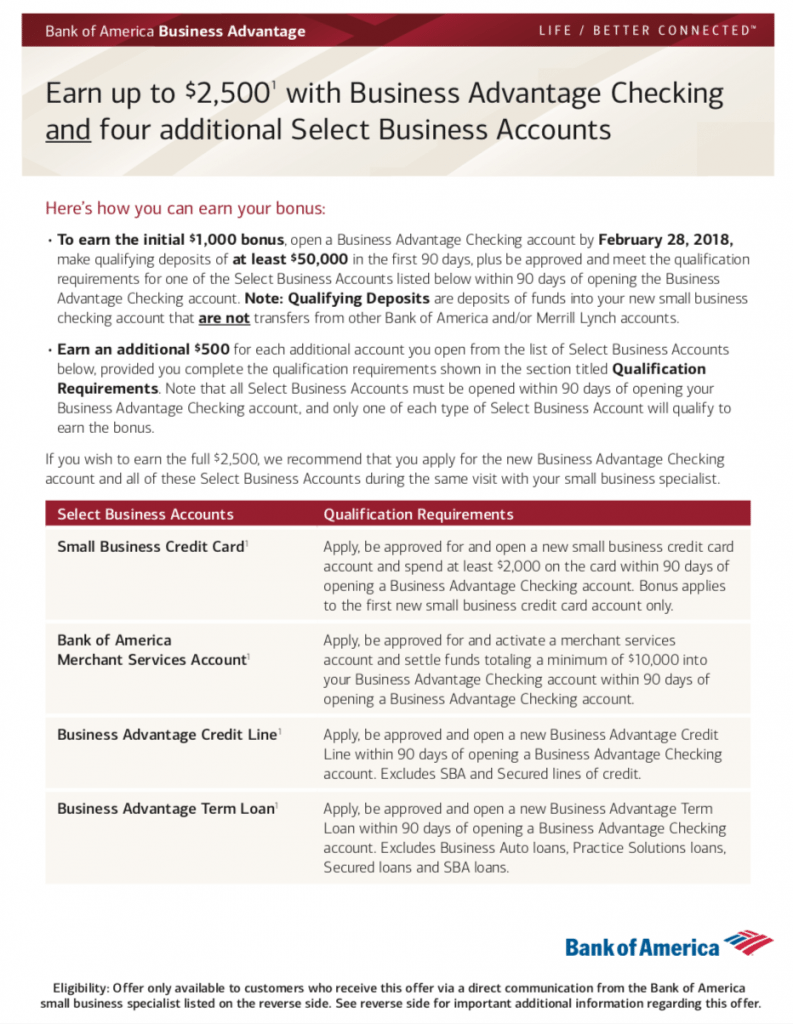

- Receive a $1,000 bonus when opening a Business Advantage checking account + one of the other accounts listed below (e.g. a BofA business credit card); must deposit $50,000 of outside funds into the checking account within 90 days

- Receive and additional $500 for opening each of the other three accounts listed below; open three for an additional $1,500 bonus ($2,500 total bonus)

Here are the four options which count for this bonus offer:

- Small Business Credit Card: Apply, be approved and spend at least $2,000 on your small business credit card within 90 days of opening your Business Advantage checking account.

- Business Term Loan: Apply, be approved for and and open a new term loan within 90 days of opening your business advantage checking account.

- Business Line of Credit: Apply, be approved for and and open a new line of credit within 90 days of opening your business advantage checking account.

- Bank of America Merchant Services Account: Open and activate a merchant services account and settle $10,000 of funds into your Business Advantage account within 90 days of opening it.

There’s no direct link for this offer we’ve aware of; reader Matt was given this by his Bank of America small business banker. Ask in your local branch to see if it’s available for you, you’ll have to talk to the small business banker to check. The offer code for this offer is: BBR7OFF, that might help the banker find it since there are many different offers codes showing in their system at all times.

The Fine Print

- Offer only available to customers who receive this offer via a direct communication from a Bank of America small business specialist

- New Business Advantage checking account must be opened by 2/28/2017 and the qualifiers of all Select Business Accounts selected must be met within 90 days of opening your new checking account

- Bank of America may change or terminate this offer before this date without notice

- Bank of America employees are not eligible for this offer.

- To redeem this offer with your Bank of America small business specialist, use offer code (redacted)

- To Earn the Initial $1,000: There are two steps to earning the Initial $1,000 bonus. First, you must open a Bank of America Business Advantage Checking account by February 28, 2018. Additionally, you must make at least $50,000 in Qualifying Deposits (less cash received) into that new business checking account within ninety (90) days of account opening. “Qualifying Deposits” are deposits of funds into your new Small Business Checking account new to Bank of America and/or Merrill Lynch. A transfer done via ATM, online, or teller, or a transfer from a Bank of America consumer account or brokerage accounts such as Merrill Edge or Merrill Lynch account is not a Qualifying Deposit. You must not be an owner or signer on a Bank of America business checking account that is open or that was closed within the last six (6) months.

- Second, you must open and meet the qualifiers of one Select Business Account requirements within 90 days of opening your new Bank of America Business Advantage Checking account as set forth in the sections marked a), b), c) or d) below.

- a) Apply and be approved for a new small business credit card account and make at least $2,000 in new Net Purchases with your new credit card that post to your account within 90 days from the opening of your new Business Advantage Checking account. “Net Purchases” exclude any cash advances, transaction fees, returns and adjustments.

OR - b) Apply, be approved, open and activate a new Bank of America Merchant Services account and settle at least $10,000 of merchant processing funds into your Business Advantage Checking account within 90 days from the opening of your new Business Advantage Checking account. Activation is defined as the submission of a batch greater than $20 of any card type. You must not be an owner or signer on a Bank of America Merchant Services account that is open or that was closed within the last six (6) months. The processing volume calculation will include only Visa, Mastercard, Discover and American Express transactions, less fees, refunds and chargebacks. If you have multiple merchant services processing accounts that settle into a single eligible Bank of America DDA, the processing volume calculation will be combined for those accounts and you will only receive a single bonus payment.

OR - c) Apply and be approved and open a new Business Advantage Credit Line within 90 days of opening your new Bank of America Business Advantage checking account.

OR - d) Apply and be approved and open a new Business Advantage Term Loan within 90 days of opening your new Bank of America Business Advantage checking account.

- a) Apply and be approved for a new small business credit card account and make at least $2,000 in new Net Purchases with your new credit card that post to your account within 90 days from the opening of your new Business Advantage Checking account. “Net Purchases” exclude any cash advances, transaction fees, returns and adjustments.

- To Earn an Additional $500: Earn an additional $500 for each new select business account that you open from the sections above (a/b/c/d), provided you complete the related qualifying activity for each product (only one incentive per product type eligible). Maximum earnings of $2,500.

- Additional Terms: All new accounts and services opened must be in good standing at the end of any 90 day qualifying behavior period.

- We will make every attempt to deposit the earned cash bonus directly into your Business Advantage Checking account within 90 days from the end of your qualifying period.

- All account applications are subject to our normal approval process. Your account does not qualify for the bonus until you provide all of the information we require in connection with opening the account by the promotion end date. This includes information we require to identify each account owner and to report the bonus to the Internal Revenue Service (IRS), including a validly completed IRS Form W-9 or Form W-8 (as applicable).

- The value of this bonus may constitute taxable income to you. To the extent required by law, Bank of America may withhold tax or other amounts from the payment. Please consult your tax advisor, as neither Bank of America, its affiliates, nor their employees provide tax advice. Please consult a financial center, visit bankofamerica.com or see the Business Schedule of Fees found at bankofamerica.com/businessfeesataglance for other account fees, rates and information.

- Reproduction, purchase, sale, transfer or trade of this offer is prohibited.

- Offer limited to one per business customer and one business entity, regardless of the number of businesses owned or operated by the customer.

- Excludes Business Auto Loans, Loans through Practice Solutions, SBA lines, SBA loans, Secured lines and Secured loans.

- Some small business credit card applications may require further consideration and additional information may be requested. All credit cards are subject to credit approval and credit card account limits are subject to creditworthiness. Normal credit standards apply. Bank of America may prohibit use of an account to pay off or pay down another Bank of America account. Some restrictions may apply.

Avoiding Fees

The Business Advantage checking account comes with a monthly fee of $29.95 per month, but this fee is waived for the first three months. After this introductory period you need to do any one of the following to keep it fee free:

- $15,000 average monthly balance

- $35,000 combined average monthly balance of linked business accounts

- Spend $2,500 per month in new purchases using a linked Bank of America business credit card (be sure the credit card is linked to the bank to get the fee waiver; people have had problems with this in the past)

- Actively use Bank of America Merchant Services or Payroll Services by Intuit® or Remote Deposit Online service

You should be able to downgrade to the Fundamentals checking at some point down the road which has easier requirements: just $250 in credit card spend or $5,000 balances. It’s probably worth waiting until the bonus posts before downgrading – judging from prior comments, that could be take around 5-6 months.

Our Verdict

The more standard business checking bonus from BofA is $200 (recently expired, hopefully it’ll renew soon). We saw a similar $2,000 bonus from BofA back in 2015. The downside of this offer versus the 2015 offer is that this one requires a $50,000 deposit of funds.

From the four auxiliary accounts, the credit card is the easiest (BofA business credit card options here). By opening a business checking and business credit card, you’ll get an impressive $1,000 bonus, so long as you can deposit $50,000 and spend $2,000 on the credit cards. And that’s on top of whatever the signup bonus for the credit cards is:

- $200 for Cash Rewards or Platinum Visa

- $250 for Travel Rewards

- 30,000 Alaska miles

- 15,000 Spirit miles

- 10,000 Aisana miles

Just be sure your credit card is linked to the checking account as numerous readers report that being an issue last time around. The linking is necessary both to get the bonus and to waive monthly checking account fees. Note that last time around it took 5-6 months to get the bonus (despite terms stating 90 days) which adds to the hassle of trying to keep the account fee-free that entire time.

Beyond the checking + card, some of the other accounts might be doable as well. I’m guessing an overdraft line of credit would qualify for the ‘line of credit’ option, and that might be a fee-free way of netting another $500. The ‘merchant services’ option requires $10,000 in settled payments so that won’t be easy or free, but it’s doable. The ‘term loan’ option might come with fees as well as interest on the loan. It’s likely that all the hard pulls will be combined into one for whichever products you open at the same time.

A $2,500 bonus is terrific, but the $50,000 deposit requirement makes it more difficult to do. My best guess is that you can just receive $50k total into the account within 90 days and that’ll work, even if not all is in the acccount at the same time. E.g. you can deposit a $10k check or ACH payment or direct deposit, then withdraw/use those funds, then deposit $10k again the next week, then withdraw/use those funds, and keep going until you hit $50k.

If you have any experience with this bonus, please share in the comments. We’ll add this bonus to our list of best business checking bonuses.

Hat tip to reader Matt

I received $1k for opening a business checking account and a credit card. I also received the $200 with the credit after 500 spend. I spent 2k on the card since that was the requirement for the $1k. I requested overdraft protection to try to get another $500 a few times, but it doesn’t seem like it took. It took a single visit in branch and quite a few phone calls and emails to establish the account. I also opened a personal account while I was in there. I just closed all the business checking and savings accounts. Person opening the account also decided to open an additional checking account and savings account which they said were no additional fees as long as you keep $100 in there. Met $50k requirement by transferring funds in and out from other accounts not at BoA.

opened this account and a cc back in mid Feb. I kept emailing the banker who opened the account for me since the beginning: making sure the promo code and everything looks good in their system; the cc spending requirement met; specially after 90 days, i started to email her every other week to check on the status on the bonus. it is like 6+ months since i opened the account and still no bonus. I went to the branch last week and she provided me her manager’s business card and advised me to email him directly. I emailed him just now and will wait for a respond from them.

90 days times two still no bonus. this is ridiculous.

The same old game they are playing! Never tell them you got the offer or heard on the net!

1. How did you propose this offer with the banker when she opened it? THIS is very important! Did they offered you this offer and told you it was ongoing and for everyone, non exclusive?

2. The banker who opened the account for you must help you and banker must call the redemption department and solve the issue! Why the manager is involved?

3. 90% of the time branches (bankers, managers etc) don’t care about emails!

I actually received a mail from them for this promo, the code is the same as the one here. They are ‘working’ on it with some department right now. I will give them another week and will ping them again. doesn’t sound like they are trying to get out of it, sounds like they are trying to get the bonus for me so far. 🙂

the banker and the manager at the branch respond to my emails quite quickly, but they usually called back instead of reply to the email.

anyway, i ll report back in a few weeks.

Recap: Only established Business (with minimum 2 years in business), not startups can open: Business Advantage Credit Line and Business Advantage Term Loan in NYC. And minimum revenue of Business should be $100,000. And Merchant Account is pain in the ass – anyone can open it but Google the reviews and fees associated with the account. It can cost you $300 overall in total fees processing $10,000 in transactions. Opened 2 Sole Proprietorship accounts in 2 different branches for 2 people. Checking account and then applied in 30 days for credit card, one credit card at the branch, and one credit card applied online. As I’ve been told this promotion is ongoing and it’s for everyone. They pull TransUnion for credit cards (NYC) – 750 score. In the time of credit card applications none of the credit bureau was frozen. For checking account they pulled all 3 bureaus – soft pull. Experian was frozen they told us to lift it, because it didn’t go through when they tried to submit application. Didn’t ask any questions about business! Only asked 6 business related questions when applied for credit card: how long in business, revenue, net, household income etc. the basic ones. Both people were rejected for credit card, following reasons: Have limited deposits with us (these people never had any bank of America accounts) THE MAIN: Less than 2 recurring credit card account (person only uses 2 cards for purchases out of 7-8 cards) They sent the letter later with offer – CD for 12 months with minimum $1,500 with no annual fees in order to be approved for the secured credit card. They applied, and were approved for credit cards. One banker messed up and opened the different type of checking account at the beginning. After 4 weeks we found out, He didn’t apologized and changed the product to Advantage Checking account. In order to get bonus we opened the case, because it was not our fault, so they sent us a bonus check! Banker even showed us a promo details, but still opened wrong account! For another person in another branch, banker forced us to open to open full package: bus checking, bus savings, 2 additional free checking accounts! Even though we stated we only want one account. And we think the other options are optional, he said no. After he opened all, I didn’t believe his crap, and spoke with Manager, manager said isn’t not true and manager closed all accounts next day, but kept advantage opened! same thing with this person, he didn’t get a bonus we opened the case via Marketing Redemption and they sent a check! I HATE THIS BANK, bankers who don’t know anything and being arrogant, poor knowledge of their product and ability to focus and open the proper accounts, poor customer service and support! BofA should be ranked soon as worst bank ever. I don’t want even mentioned online experience, they got no messaging system and not chat system – nothing. Only… Read more »

2/27/18 Opened checking & business credit card in branch asking for bonus

Got a letter with terms of bonus about a week later

4/6/18 Deposited funds from 2 outside banks to meet requirements

Pulled most back out a few days later

6/29/18 Bonus posted

7/5/18 Downgraded to fundamentals checking via phone

Is it best to wait 6 months to close?

02/26/2018 – Opened the Bofa business

account

– Deposited and withdrew money via

ACH using different banks for the

deposits (Bank A) and withdrawals

(Bank B)

05/22/2018 – Last deposit which put the

deposit total over $50000 mark

06/29/2018 – $1000 offer bonus hit the account

06/30/2018 – Closed the account at a branch

BofA is processing a $1k payment to my business checking today. Looks like ACH counts as deposit.

do you need to call them and or ask them about this? Since my bonus is no where to be found so far. when you completed their requirements?

thanks.

I received a letter in the mail back in February confirming my enrollment. Completed the deposits on 4/19.

Did you maintain the balance or withdraw it soon thereafter?

Ewejay, You already got $1K automatically added to your account?

Hate this bank. I will write my store maybe later on. I will close all accounts with them as soon as I will get all bonuses (usually I keep accounts and money as appreciation for promo)

For all three different accounts the Customer Service stated they don’t see any bonus attached to the accounts. They investigate it, and said their system is different than branch system, they don’t see what branch can see. What a bank. They told us all to stop by and from the branch escalate if needed, otherwise they don’t have any promo attached to any of the accounts. But the bankers attached codes for all accounts at time of opening.they act like they are separate entities!

Is there any reason to deposit 50K earlier then on 89th day? Could it help to get your bonus earlier as well?

Did anyone get bonus yet? What was your timeline?

BONUS NOT HONORED.

I just spoke with a higher up supervisor regarding this. He instantly knew of this code and said the promo is NOT honored without the paper mail of the targeted offer regardless if you used the promo code or not.

So those who have set $50k in their accounts can take this into consideration that you will NOT get your bonus.

You can call and wait and confirm with the department yourself.

Branch manager in NYC, said it’s ongoing promo for anyone. I will file CFPB if needed. I didn’t apply for credit cards yet. Why did you call? Did you meet ALL the requirements?

1. You don’t have to keep $50,000 (should only be total deposits of 50K within 90 days)

2. Later You need to keep 15K – to avoid the fees

3. You must wait approximately 180 days to get the bonus – after opening account and meeting ALL the requirements!

[A transfer done via ATM, online, or teller, or a transfer from a Bank of America consumer account or brokerage accounts such as Merrill Edge or Merrill Lynch account is not a Qualifying Deposit.]

I’m confused. How else am I supposed to deposit 50000 if I cannot do it via ATM/teller/ACH?

Thats talking about money coming from BOA or ML account.