Bank of America recently launched their new Asiana Visa Signature card, there was a lot of interest in it – so a full review is in order! Here are the card basics:

- Annual fee of $99 not waived

- Earns at the following rates

- 3x miles for every dollar you spend on Asiana Airlines purchases

- 2x miles for every dollar you spend on gas and grocery store purchases

- 1x miles for all other purchases

- Receive the following benefits annually:

- Two lounge invitations

- 10,000 bonus miles certificate

- $100 rebate on Asiana ticket purchase

- 200,000 mile cap per year

- No foreign transaction fees

Application Information

Keep in mind, this is a brand new card so very little application information is available. Please share your data points in the comments at the end of this post.

What Credit Score Is Required

- Share datapoints in the comments

Common Reasons For Denial:

- Please share your denial reasons in the comments

What Credit Bureau Does Bank of America Pull For The Asiana Credit Card?

It depends on what state you live in, you can find out more information by clicking here.

What Credit Limit Will I Receive?

| Minimum Credit Limit | Highest Reported Credit Limit | Average Credit Limit |

|---|---|---|

| N/A | N/A | N/A |

Card Benefits

This card comes with three main benefits (as well as no foreign transaction fees which is becoming standard for most travel cards):

- Two lounge invitations

- 10,000 bonus miles certificate

- $100 rebate on Asiana ticket purchase

Let’s take a look at each benefit in some more detail

10,000 Bonus Miles Certificate

Unlike other programs that automatically deposit miles into your account, this benefit is a little bit more complicated. Every year in the month of your anniversary date (due to this wording, I believe you don’t get this in your first year. But this comment on Flyertalk says you get it in the first year as well) you’ll receive a certificate that is good towards:

- Asiana Airlines international or Korea domestic air ticket

- Cabin class upgrade (upgradable ticket must be purchased to use this)

- Excess bag allowance (for U.S. departure flights only, you must present the certificate and your card at the time of redemption)

To use the certificate for Asiana award travel or cabin class upgrades, you must fax the certificate to the Asiana Reservation center at 213-380-1688. The name on invitiation, certificate and Asiana Airlines credit card must also match. Blackout dates might also apply (I’m unsure what these blackout dates are). You may also be issued a 1099 tax form for the value of this certificate, although they do say it has no cash value so I’m also unsure if they’ll actually send out this form or not.

Basically how this certificate is that you fax it along with the flights you want and it’ll reduce the cost of that flight by 10,000 miles. It’s only available on Asiana Awards and not Star Alliance partner awards. If your flight/upgrade/bag excess is less than 10,000 miless then you’ll lose the remaining value.

$100 Rebate On Asiana Ticket Purchase

This isn’t an instant $100 discount, but a rebate. When you purchase an Asiana Airlines ticket you’ll receive a rebate of $100, to receive the rebate you must book through Asiana Airlines (e.g no third parties) and use your Asiana Airlines credit card. The $100 rebate will post within 1-2 billing cycles. You’ll be able to use this benefit in the first year your a cardholder. According to this comment on Flyertalk this credit is based on a calendar year, so you could use it twice (e.g now and then again in January 2017) and only pay the one annual fee.

You can also use it to pay fuel surcharges on award tickets.

Two Asiana Lounge Invitations

Every year in the month of your anniversary date you will receive two lounge invitations. You must present the lounge invitations along with your credit card to the Asiana check in counter to receive your complimentary pass. These passes are only valid for Asiana lounges operated in the U.S. It also seems like the lounge passes can only be used by the primary cardholder as you’re limited to one invitation per person per visit.

I’m unsure on if you’ll receive this in your first year or not, but I suspect you will.

Rewards Program

This card earns Asiana airline miles.

Earning Rewards

Standard Earning

This card earns at the following rates:

- 3x miles for every dollar you spend on Asiana Airlines purchases

- 2x miles for every dollar you spend on gas and grocery store purchases [Best credit cards for gas purchases & best credit cards for grocery store purchases]

- 1x miles for all other purchases [Best credit card for everyday purchases]

Sign Up Bonus

Current Sign Up Bonus

- August 29th, 2016 – Current: 30,000 Asiana miles after $3,000 or more in spend within the first 90 days of account opening

Sign Up Bonus History

This is a new card and has always had the same sign up bonus

Redeeming Your Rewards

Your miles can be used for award flights, seat upgrades and additional services (e.g lounge access and excess baggage). One of the nice things about Asiana is that you can pool you miles between up to five family members.

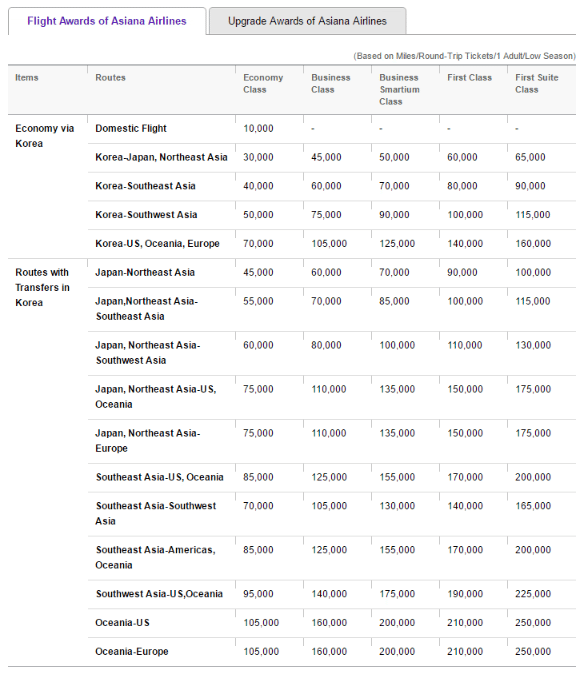

Asiana Award Chart

Here is the award chart for redeeming Asiana miles on Asiana. Remember you will need to book your award ticket on Asiana to use your 10,000 mile certificate.

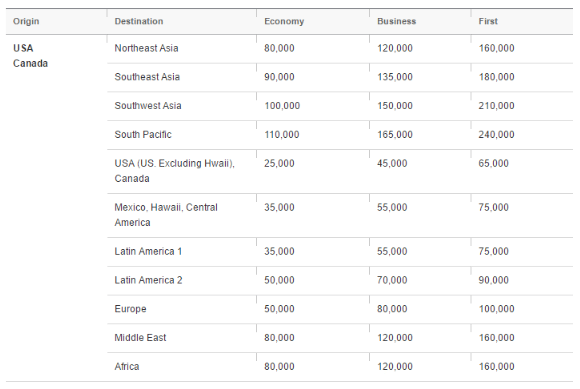

Star Alliance Award Chart

This is their award chart for flights through their Star Alliance partners.

Our Verdict

Bank of America cards are extremely popular at the moment because of the ability to combine multiple cards applied on the same day into a single hard inquiry. The downside to Asiana is the fact they charge heavy fuel surcharges. The other issuer is that 30,000 miles (really a minimum of 33,000 miles) isn’t enough for any awards apart from internal flights in the USA and Canada. The bright side is that you can pool miles with family members. The only transfer partner is SPG, so there aren’t a lot of options there either.

This is obviously a really attractive card for people that have paid flights with Asiana as it’ll earn 3x miles on those purchases and the $100 discount covers the annual fee. That being said, at the moment it would make more sense to cancel the card after the first year to free up credit limit space with Bank of America for additional cards. This is nowhere close to being a must have, but I hope Bank of America sticks with this 30,000 mile bonus and even offers slightly higher temporary bonuses in the future (like they have with the Alaska card).

This card makes the more sense when you’re already applying for another Bank of America card. Let’s also hope that the bonus on the business card is increased from 10,000 miles (with Alaska, this was also increased after the personal card originally had it’s bonus increased).

[Read: 20 Things Everybody Should Know About Bank of America Credit Cards]

We Recommend This Card For:

- People with paid flights with Asiana

We Don’t Recommend This Card For:

- People looking for non travel rewards

F.A.Q’s & Tips

We will add to this section over time.

I do not see any language restricting churning. Is this CC churnable?

Guys, new DP. When I used the 10k certificate, Asiana never even asked me for the code which was on the physical mailer, let alone asked for a fax. I think it was already synced up with my account.

Updated direct link from BofA’s Travel Credit Cards page

https://secure.bankofamerica.com/applynow/initialize-workflow.go?requesttype=c&campaignid=4016578&productoffercode=5V&locale=en_US

Thanks, updated

Hey Doc,

You have done it again. How you are able to unearth these gems from deep within the bowels of the banking systems credit cards offerings defies explanation. All of your readers owe you a debt of gratitude…and believe me that debt ought to be paid by a high category-earning credit card!

This Asiana card could be just what I need. 100K capacity for 2X on Grocery is very good actually. I eat a lot and need big Grocery Bandiwth! Not many other cards allow this caliber of usage. Rebates and mileage perks are solid too. Annual Fee is manageable. There are legit sweet spots on the award chart for US to Europe and US to Hawaii business class. Looks like I could be lying flat all across the globe just by going to the grocery store a lot of times per calender year.

Applying after January 1 may be very prudent. My only concern is taxes on these award flights and difficulty booking on the award redemptions.

Thanks for the kind words

Just got my card in the mail. When I applied, I read the 10,000 bonus miles certificate annually as every year I pay the annual fee, I’ll get 10,000 miles credited to my account. This is how my converted Barclays US Air/AA card is. But it is actually a certificate of 10,000 when I make an award redemption.

That sucks because I was originally thinking this would be a sock drawer card. And after 6 years I would have 80,000 miles (30k from the sign up and 50,000 from five years of the anniversary bonuses).

Since I can not redeem the certificate unless I’m booking something (and the certificate expires) this card is a lot less valuable to me now. After 5 years I’ll still have 30k 🙁

Does anyone know if the ticket purchase must be made through Asiana’s US ticketing office to generate the $100 rebate?

Hello.

Not sure if anyone would get the chance to read this but I recently was approved for this card.

It still has the 30,000-mile bonus offer.

The problem that I have at the moment was when I first applied, I made sure to include my existing Asiana Club card. I got the card today and it shows a completely different Asiana Club card number. I called BOFA and after wrestling on the phone for an hour was able to have someone understand the problem prompting them to send it to another department to make sure I get issues a new card (CC number would be the same) but Asiana club card would be updated (to mine).

Has anyone experienced this?

Also, my concern is that I’m reluctant to use the incorrect card NOW fearing that any dollars spent/miles earned would be credited to the wrong mileage number.

Would it be wise to wait till I get the new card with the correct mileage number?

Finally, once the miles rack up, do they automatically get accrued to the mileage card? Would I log-in to Asiana Club to see them or the BOFA account?

I just discovered this as I spent $3000 (yes, I know dumb). I called bofa and they said don’t worry about the number on the CC as the number in their system was correct. Like yourself, still hesitant about spending money on this card as well.

Don’t think there are many DPs on this card.

The 10k bonus is a bit convoluted, but any idea if they stack? Or do they expire after a year?

If you could pool them up each year, this card could be worth keeping for a few years. Otherwise no way.

Is BoA receptive to waiving the AF, giving a credit, or miles during a retention offer? $99 seems a bit high for only 30k bonus miles with a relatively high initial spend.

Really depends on how much spend you have on the card from what I’ve seen

Probably a good bonus if you have the Starpoints to boost it to a redemption. Otherwise, if I’m limited to 3 BoA cards bundled into one inquiry, I’d go with Alaska, Amtrak, and Virgin Atlantic.

I’d take this over the Atlantic card personally, that one requires too much spend. I’d rather put that spend towards more profitable MS.

The Atlantic gives 20k with 1 spend though. That’s almost $3000 less than Asiana. I agree the full bonus spend is very high, but I’d only go for that if I knew I has a large amount of unbonused spend in my future (eg home improvements).

Asiana miles much more valuable to me than Virgin Atlantic, but everybody is different!