Update 4/30/19: Today is the last day for this deal according to Traveling For Miles.

Update 1/28/19: Deal is available again.

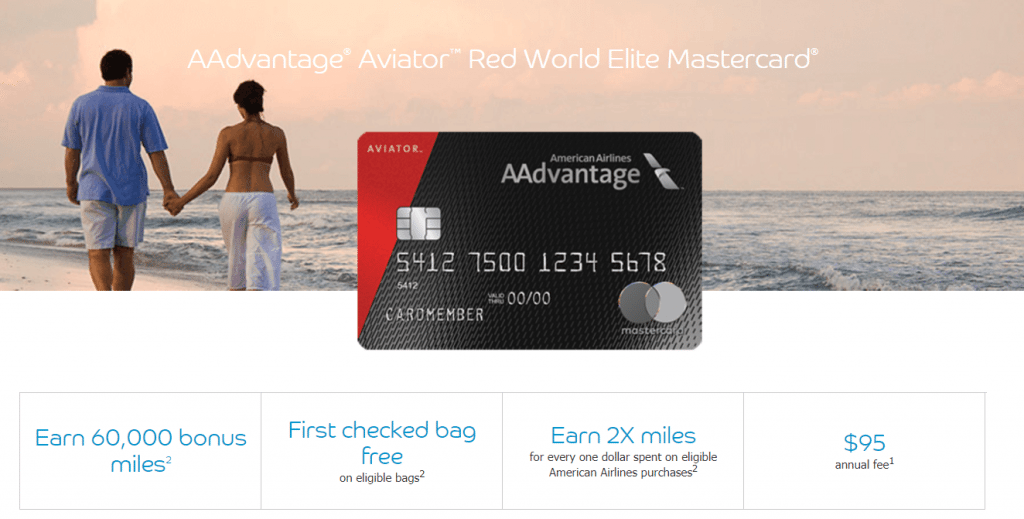

The Offer

- Sign up for the AAdvantage Aviator Red World Elite MasterCard and receive a signup bonus of 60,000 AAdvantage miles after you make your first purchase in the first 90 days and pay the $95 annual fee (60,000 points will post on the next statement after you pay the annual fee).

Card Details

- No foreign transaction fee

- Annual fee of $95 is not waived the first year

- First checked bag free, for the primary cardmember and up to 4 companions on eligible bags when traveling on domestic itineraries operated by American Airlines

- Group 1 boarding, for the primary cardmember on domestic itineraries operated by American Airlines

- 10% of your redeemed miles back, up to 10,000 per calendar year

- 25% inflight savings on food, beverages, and headsets on American Airlines-operated flights1

- Earn 2x miles on all eligible American Airlines purchases

- Earn 1x points on all other purchases

Our Verdict

Barclaycard just recently increased the sign up bonus from 40,000 miles to 50,000 miles. In the past it has been possible to get an additional 500 miles by using a flight attendants link & code, I suspect that will be updated to 60,000 + 500 miles but that hasn’t happened yet. This is probably the best offer on a card with no minimum spend (or that might go to the Avianca card with a 60,000 point bonus).

American Airline miles have been hard to use due to lack of saver award space but from what I’ve seen this has been improved somewhat, because of that and the fact that this is now 60,000 miles we’ll be adding it to our best credit card bonus list. Read through these things you should know about Barclaycard credit cards before asking any basic questions in the comments. For example it’s usually not possible to get matched to a higher sign up bonus, but you might have more success asking for a manager as front line representatives cannot complete these requests.