The Barclaycard Arrival Premier is now live. Keep reading for more information, sadly you’re unlikely to like what you’re about to read.

Card Basics

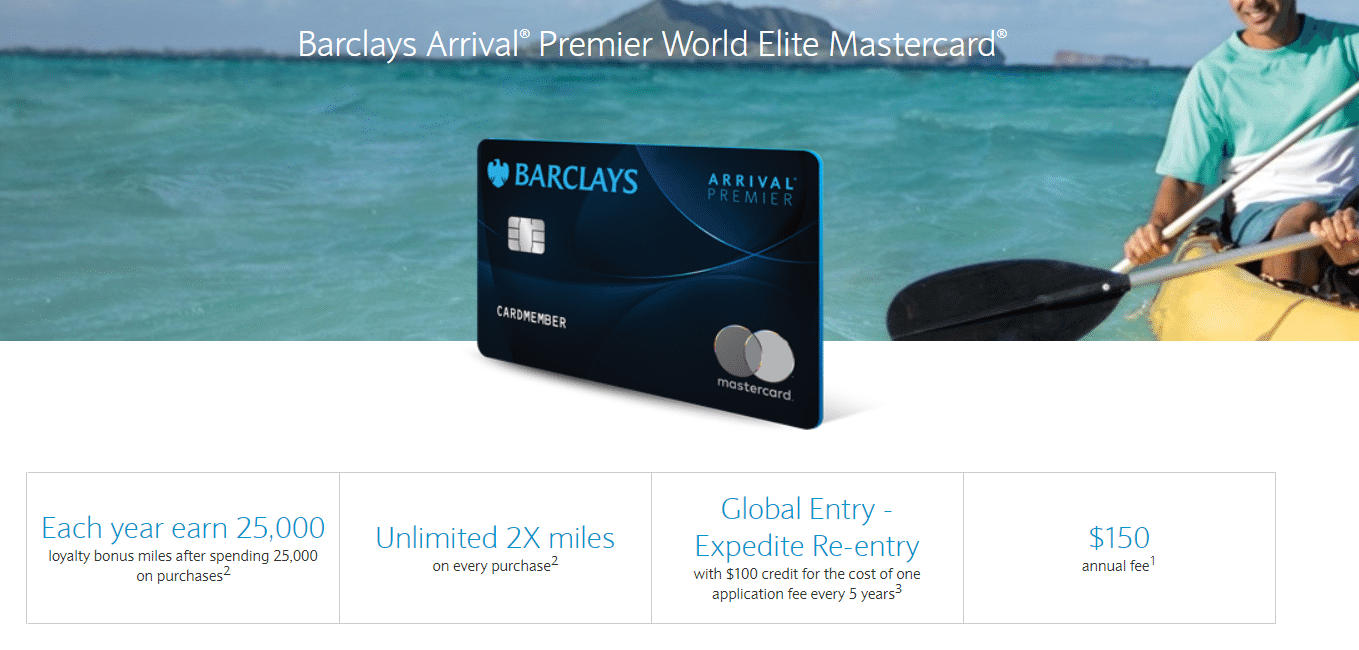

- No sign up bonus

- Card earns 2x miles per $1 spent

- Ability to transfer miles to Barclays travel partners

- $150 annual fee

- Annual spend bonuses:

- Spend $15,000 in a card membership year and get 15,000 bonus miles

- Spend an additional $10,000 and get an additional 10,000 bonus miles (total of $25,000 spend for 25,000 miles)

- Global Entry credit

- No foreign transaction fees

- Lounge Key access (basically just Priority Pass, but you have to pay for lounge access at $27 per entry)

- In early May existing Barclays Arrival/Arrival Plus cardholders will be able to convert to this product. Points earned on the Arrival/Arrival Plus do not carry over to this card

- Not currently available to existing Arrival/Arrival Plus cardholders: Unfortunately Arrival Premier is not available for instant approval at this time if you are an existing Arrival Plus or Arrival cardmember. Please check back in the next 30 days

Travel Partners

One of the most exciting things about this card in the lead up is the possibility to transfer the miles this card earns into other programs. The transfer partners are:

- Aeromexico

- Air France/KLM Flying Blue

- China Eastern

- Etihad

- EVA Air

- Japan Airlines (JAL)

- Jet Airways

- Malaysia Airlines

- Qantas

The transfer rate is 1.4 arrival miles = 1 miles with all of these programs apart from Japan Airlines. Japan Airlines requires 1.7 arrival miles per Japan airlines mile.

Other Redemptions Options

You can still redeem miles for 1¢ per point like you can with the Barclays Arrival/Arrival Plus products. This card does not carry the 5% rebate the Arrival Plus does.

Our Verdict

Overall it’s hard to see this for anything other than a massive disappointment. The nail in the coffin for me is the transfer rates aren’t 1:1. Keep in mind this card doesn’t come with a sign up bonus and also comes with a $150 annual fee.

At best you’re earning 3x miles per $1 and you have to spend exactly $15,000 or $25,000 for this to be the case. Let’s assume you spend $25,000 and earn 75,000 points, that’s either worth $750 or 53,571 miles. You’re basically earning 2.142 miles per $1 spent, best case scenario. You then still have to also pay a $150 annual fee and the annual fee isn’t offset by anything (e.g the card doesn’t really have any useful benefits). Worst case scenario you’re earning 1.42 miles per $1 spent and then paying $150 for the privilege. Actually if you want to transfer to JAL then it’s even worse as you’re earning 1.175 miles per $1 spent.

Keep in mind Chase offers the Chase Freedom Unlimited and this earns 1.5x points per $1 spent with no annual fee, the points are transferable as long as you have the Chase Sapphire Preferred, Reserve or Chase Ink Preferred. Even more damning is the American Express Blue Plus, that card earns 2x points per $1 spent with no annual fee and the points are transferable out of the box. Those cards also usually come with a sign up bonus of $150/$200. All of this is forgetting that the Barclays transfer partners are incredibly weak, they haven’t even partnered with any brands they offer co-branded credit cards with.

From a purely marketing perspective this card is simply to hard to understand for most people. You earn 2x miles per $1 spent, then those miles need to be transferred at uneven rates of 1.4 or 1.7 and then sometimes you get bonus miles for meeting spend requirements. Part of the reason the Chase Sapphire Reserve was so successful was that understanding the value was so easy.

I feel like a parent that has found out their child is doing drugs. I’m not angry Barclays, I’m just so very disappointed in you.

P.S. If you like our unbiased reporting on this and other cards, please considering retweeting this out or sharing it out elsewhere.

Big thanks to all the readers retweeting this! https://twitter.com/Drofcredit/status/981502621230886912. Means a lot to us

Kids doing drug reference is awesome

You should update this post to say that product conversions are not a thing.

Actually, for people spending $25,000 per year internationally this card is hard to beat. Comes out to flat 2.4% cash back. Very niche, but maybe this was their TA, who knows.

Yes, I think this is their direction. I’m probably in their “target market” and can get a lot of value out of this card now that the Amex SPG card is devalued. I live abroad full time and no other no-FX card with transferable currency offers a >1 mile per dollar earn ratio and the flexibility to use as cash equivalent (although various cards locked into a single program do, like the Virgin Atlantic card, Asia Miles card, Amex Biz Platinum for >$5K charges, etc.). Since I’m abroad and earn dollars into a U.S. bank account, the BB+ and Chase FU aren’t viable with FX fees. I have the CSR which is great for my travel and dining and lounge access.

I’m based in a location that has fantastic use for Qantas points, FlyingBlue, JAL, and Etihad (not Australia), so this card coupled with the Citi Prestige or Premier would really let me turbocharge my Qantas earnings, FB, and Etihad earnings as my first non-bonus category $25K would net over 2 miles per dollar, and all subsequent non-bonus spend 1.43 miles. Travel, entertainment, and dining can go on the Citi for the 2X/3X bonus. Plus Chip+PIN is good to have and MasterCard supposedly has a superior FX rate.

Plus, I think it’s a reasonable bet that they will eventually add more partners and offer retention bonuses and/or yearly/quarterly spending target bonuses as they do with other cards. Plus that Travel Stories thing in spare time can add up to an extra few thousand miles a year.

(Readers should post this take-down under any bloggers-for-sale who pump it) Your close had me humming Shinedown.

I hope they understand.

I’m not angry,

I’m just saying.

Sometimes goodbye is a second chance.

I think it’s smart for Barclays to offer a card that incentivizes big spend annually. I don’t think it’s that far from being a good card. WIth a 50K signup bonus, I’d sign up in a heartbeat AND keep it long term. If they simply added JetBlue AND/OR AA at a 1:1 I’d sign up immediately and keep it for the long term. Not super excited right now — but it’s closer than I think people give it credit for.

Doc, I thought you were joking lol It’s a pretty looking card, I’m curious how the back looks but that’s about it. It’s plastic for those wondering. I find it ironic they keep talking about “loyalty” but where’s the loyalty to existing accounts? We can’t (yet) convert and our Arrival points don’t transfer to Premier? Do they have millions of unbanked points? With these transfer rates, I wouldn’t do it anyway but so much for recognizing and rewarding loyalty. To be fair I guess they mean “loyalty” as of today William Charles@

William Charles@

Could be a decent option paying your mortgage with this on Plastiq as you can only pay via MC.

and… what’s the deal with the Arrival+ and Arrival Premier having separate redemption programs and not being able to transfer points if you are migrating from one card to another. As others have pointed out, I really don’t understand the targeted demographic on this card.

All of these banks are trying to get the demographic that Chase nailed with the CSR. Unfortunately for them, most of their “premium” products (like this turd of a card) fall short in almost every way.

As many predicted it’s DOA, Dead on Arrival. That’s all I can say.

I may be the only one here that doesn’t think this card is all bad. Yes, they really messed up with the transfer partners but if you spend exactly 15k or 25k it’s basically a 3x Venture. The main drawbacks I see are the high annual fee and no sign up bonus. Yes, you can probably get more from BB+ by transferring to partners but there is also value in how easy purchase erase points are to use. You get the same value every time. Also, remember this is a flat rate card. You get the 3x on every purchase. I still need to give it some thought but I may diversify my points by getting this along with my BB+.

I did the math and this card only worth it over other flat-rate/purchase erase cards if you spend 25k/yr. At 15k, you’re better off with a 2% cash back no AF card. So I guess the number of people that this card would make sense for is very limited.

We have finally found one of the people Barclays is marketing to. Good job Barclays.

Diversification is important when you have 200k/yr spend like I do. I did end up deciding not to go with it because I would only get getting $37.50 value per year over my Bank of America Premium Rewards. It’s not worth having another card just for that.

If you have 200k yearly spend why are you even considering a card like this? Nickel and diming it to make sure you spend exactly 25k so you can get your 2.4 percent back on travel reimbursement?

What nickel and diming? It’s not hard to spend near 25k. Just check your year to date spend once a month. And 2.4% isn’t bad. Higher than 2% flat rate cards. Only card I can see that’s higher is the premium rewards with platinum elite preferred rewards. I already max out my 2 BB+ so that’s not an option.

I am just saying I wouldn’t open a card to earn an additional 100 dollars with 25k spend. That is nickel and dime’n. I guess your 200k spend is your business spend or something. I can’t imagine someone with over 200k in net income making that much effort for 100 dollars.

It’s like a worst version of the Venture card. No way am I going to put that much spend on a card throughout the year to get the payoff similar to a sign up bonus. And points don’t transfer 1:1? Yeah, no.

This card will not be of much use in the beginning but it is a good start. New iterations will hopefully follow as Barclay finds out this rather unsuccessful. Hopefully new partners will be added as from the current list I find only FlyingBlue useful. The most interesting foreign partners are missing as of yet.

As Citi Thank you Premier gives you 3x for all travel including gas and 2x Dinning and Entertainment and give 1:1 transfer to Flying Blue, no annual fee the first year, 50k sign up bonus and 95 annual fee I am not seeing why anyone would pick this card. Even if you spent all 25k on 1 point items you would come out way a head on the Citi card the first year.

Worse case scenario with Citi you would have 75k Flying Blue points and pay no fees. Odds are you would have at least 90k in Flying Blue points.

This card 53k Flying Blue points and out 150 dollars. This card is for people who fail at math.