This deal has now expired, bonus is now 40,000 points. View the best current credit card bonuses by clicking here.

The Offer

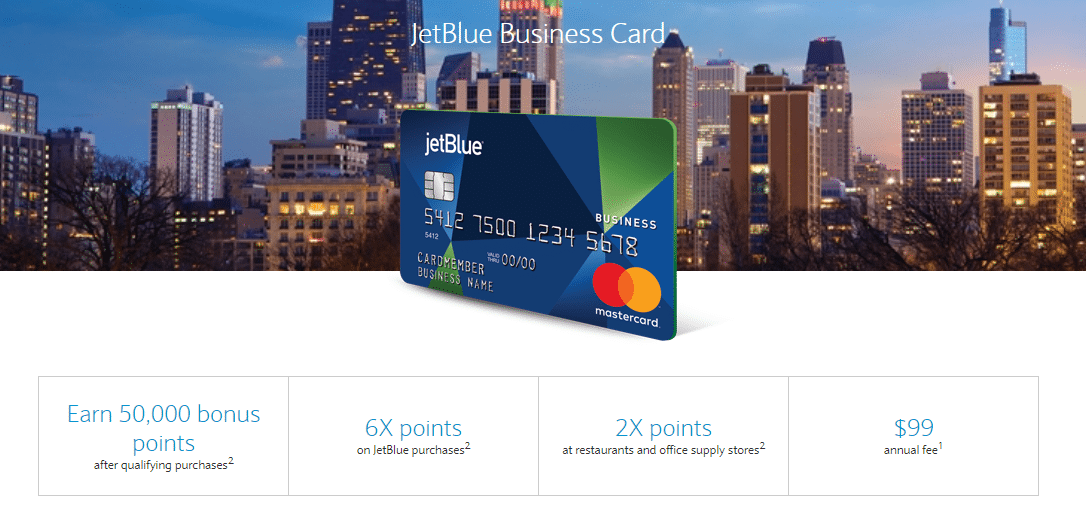

- Barclays has increased the sign up bonus on the JetBlue Business card to 50,000 points after $1,000 in spend within the first 90 days

Card Benefits

- Card earns at the following rates:

- 6x points per dollar spent on jetBlue purchases

- 2x points per dollar spent on restaurants and office supply stores

- 1x points per dollar spent on all other purchases

- 10% uncapped rebate on all points you redeem

- 5,000 anniversary points on card renewal

- Annual fee of $99

- No foreign transaction fees

- Free checked bag for you and up to three travelling companions when you use your jetBlue card to book a jetBlue flight

- Mastercard World Elite Benefits

Our Verdict

Previous high on this bonus was 40,000 points, standard bonus is 30,000 points. That being said the sign up bonus on the personal card has gone as high as 60,000 points. Barclays usually requests business documents as well, so that’s something to keep in mind. The nice thing is that this won’t report to your personal credit report. JetBlue award flights are tied to their cash price, more on that here.

We will be adding this to our list of the best credit card bonuses.. As always if you have questions regarding Barclays credit cards, read this post first.

Hat tip to davisecon

Applied and received JetBlue Business Card last October 2018. Each statement says points sent to JetBlue. After calls to both business car and the airline, I still don’t have the 50,000 points or credit for charges that amount to $12,000+. JetBlue supervisor said she would update me on progress every Monday—no call, no surprise. A dozen phone calls and no results. Will try to contact presidents office for each, and report to Better Business Bureau. Have cards with all other airlines, with never a glitch. Thoroughly disgusted.

Stupid question.. but worth asking

Have you checked if the loyalty account number you see when you login to Barclay’s website is the same as the one you see on JetBlue login?

The reason I am asking that the JetBlue personal card is the only card application which resulted in opening a brand new JetBlue account regardless of the fact that the original account number was provided at the time of the application. This happened on all accounts for the family members and friends. Resulted in the need to merge the accounts (as I wanted to keep the old one)… Never had problems with other Barclay cards (such as Wyndham), but this one no matter what you do – ended up with a new account… If that is the case simple merge would do.

I realize you probably already checked that, but was worth asking.

Good luck.

Looks like the bonus is down to 40k on this one now

Anyone is having problems entering 100 as percentage of ownership? The page simply does not allow that (although states that the permitted values are 0-100).

99 is allowed, but not 100, and I do not want to proceed with 99 as I know it will trigger their manual review and additional questions about another owner.

Applied to jetblue biz today 11/21, got “application being reviewed”. called recon and they told me i was denied due to # accounts (I’m at >10/24), and last applied to both jetblue+ personal and aviator last year november (have since cancelled jetblue+).

Wow. SO applied for this and went pending. Three weeks later, she received a call but did not answer. The next day, she got an approval email.

And I thought Chase was getting slow after taking two weeks to process my Ink Unlimited app.

If I signed up and got approved for 40k offer recently (i signed up a few months ago but took a while to go through) , will they match the 50k offer?

I was just denied for the card due to too many inquiries in last 6 months and too many new accounts in last 24 months: I am currently 2/6, 11/24, credit score 807.

14/24, C Corporation for 9 years.. Call ReCon and was told Declined due to too many accounts (personal credit) opened in past 24 months.

Wow – really seems like Barclay has a 6/24 rule now. This is getting rough.

Got instant approval. No additional documents needed.

sole proprietorship or corp? thanks.

Is this card churnable?

Answering myself

You will earn fifty thousand (50,000) bonus TrueBlue points after you spend $1,000 in Net Purchases on your Account within ninety (90) days of Account opening. This one-time bonus points offer is valid for first-time cardmembers with new accounts only. Existing cardmembers and existing accounts are not eligible for this offer. This is a limited-time offer and may be canceled at any time without notice. Please allow 4-6 weeks for bonus points to be deposited into your TrueBlue account after qualifying transactions have posted.

How strict is Barclays for approval?