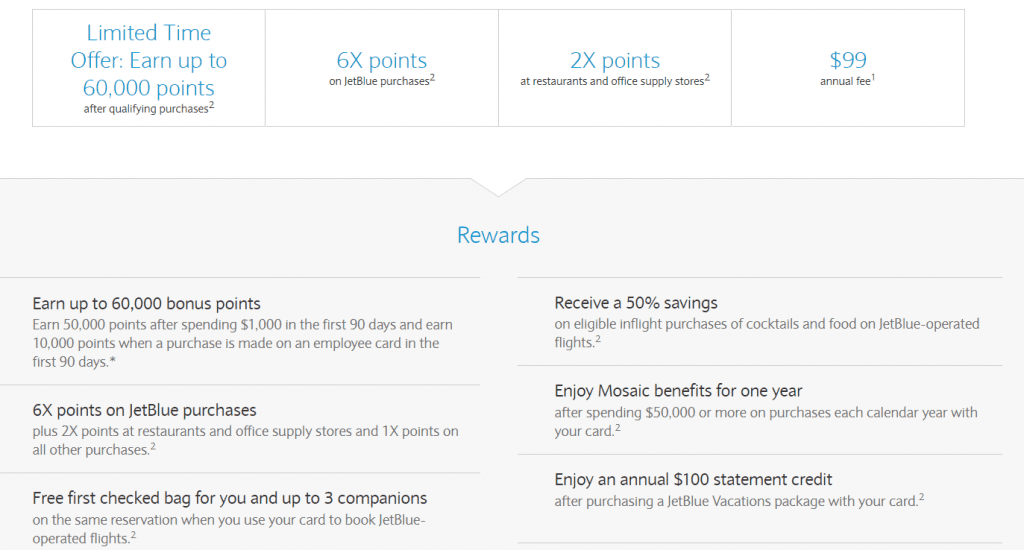

The Offer

- Signup for the JetBlue Business card and earn 50,000 points after spending $1,000 in the first 90 days. Earn an additional 10,000 points when a purchase is made on an employee card.

Card Details

- Full Review Here

- Card earns at the following rates:

- 6x points per dollar spent on jetBlue purchases

- 2x points per dollar spent on restaurants and office supply stores

- 1x points per dollar spent on all other purchases

- 10% uncapped rebate on all points you redeem

- 5,000 anniversary points on card renewal

- Annual fee of $99 (not waived the first year)

- No foreign transaction fees

- Free checked bag for you and up to three travelling companions when you use your jetBlue card to book a jetBlue flight

- Mastercard World Elite Benefits

Our Verdict

We’ve seen this offer before, but this is still the equal highest bonus we’ve seen on this card. Previous best bonus has been 50,000 points. Barclays does normally require business documents, but that has been requested less often recently. The upside to Barclays business cards is that they don’t report to your personal credit report, so won’t affect your 5/24 status.

JetBlue points are worth between 0.97¢ & 1.89¢ and award flight prices are tied to the cash rate. This bonus will be added to our best credit card bonuses. If you have any questions about this bonus or Barclays cards read this post first.

Hat tip to chowfuntime