The Offer

Direct link to offer (note this might not show the offer displayed below, if it doesn’t try to open the link in incognito mode or a new browser until it does)

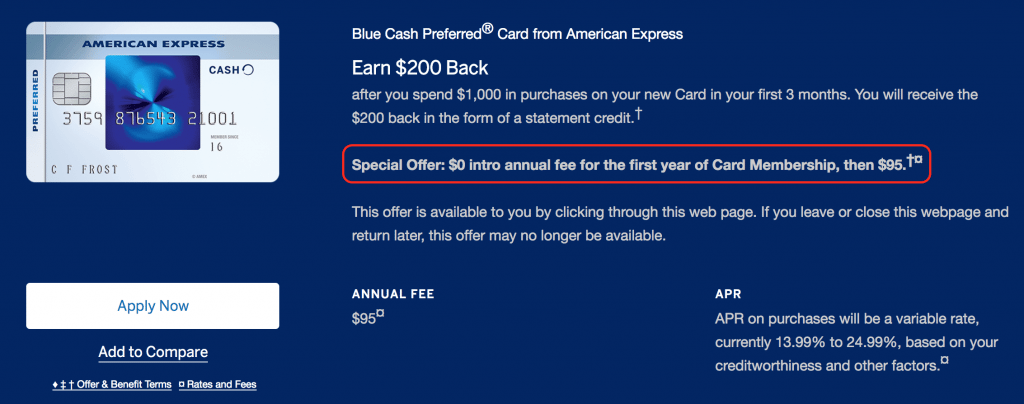

- Receive a sign up bonus of $200 on the Blue Cash Preferred after you spend $1,000 or more in your first three months. Annual fee of $95 is also waived the first year

Card Details

- Annual fee of $95 is waived first year

- Card earns at the following rates:

- 6% cash back at U.S. supermarkets (up to $6,000 in spend annually, then 1%)

- 3% cash back at U.S. gas stations and select U.S. department stores

- 1% back on all other purchases

- You can only get the sign up bonus on American Express cards once

Our Verdict

We have seen higher bonuses on this card before, they were a bit different in that they offered a bonus of $250 (without the annual fee waived) and then an extra bonus category offering 5%/10% cash back on up to another $200. For example:

- 10% on restaurants up to $2,000 in purchases

- 10% on amazon up to $2,000 in purchases

- 5% on travel up to $4,000 in purchases

- 10% on wireless up to $2,000 in purchases

I think those bonuses were better as this current bonus is basically just an extra $45 without the extra 10%/5% categories. Unfortunately none of those deals are offered anymore. I’d personally wait for a better bonus to come around as $250 + no annual fee seems weak when we’ve seen $300 on the no annual fee card. Because of that I won’t be adding this to the list of best credit card offers. As always if you have any questions about American Express credit cards I’d recommend reading this post first before asking questions in the comments.

Hat tip to US Credit Card Guide