Offer at a glance

- Maximum bonus amount:$100

- Availability: LA Financial Credit Union is proud to serve all who live, work, study, and pray in LA County.

- Direct deposit required: Yes, $500+ per month for three months

- Additional requirements: None

- Hard/soft pull: Unknown

- ChexSystems: Unknown

- Credit card funding: Unknown

- Monthly fees: $7, not avoidable

- Early account termination fee: None

- Household limit: None

- Expiration date: None listed

Contents

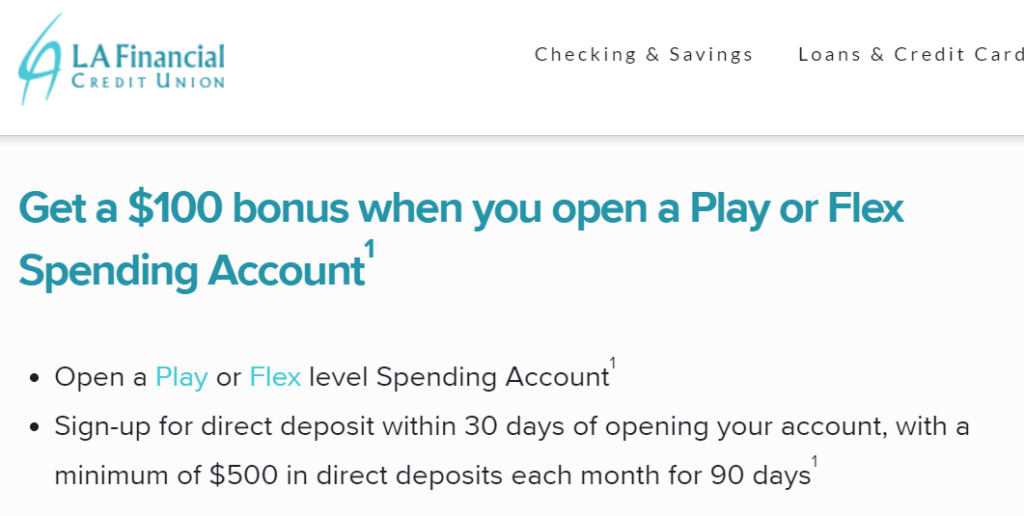

The Offer

- LA Financial Credit Union is offering a $100 bonus when you open a Open a Play or Flex level Spending Account and complete the following requirements:

- Sign-up for direct deposit within 30 days of opening your account, with a minimum of $500 in direct deposits each month for 90 days

The Fine Print

- Offer is only available to those not currently enrolled in a Play or Flex spending/checking account.

- To qualify for the $100 bonus, you must be eligible for membership and a checking account based on Credit Union approval, open a Play or Flex Spending account, otherwise known as a subscription checking account, and establish direct deposit within the first 30 days of account opening, with a minimum of $500 in direct deposits per month, for a qualifying period of 90 days.

- After 90 days of qualified activity, LA Financial Credit Union will post the $100 as a bonus to the member’s Primary Savings Account within 30 days.

- Only one $100 bonus is given per member when opening a new subscription checking account.

- Member referral bonuses are unlimited and paid separately from this program.

- Offer only eligible for LA Financial members in good standing.

- The offer is available for a limited time only and may be discontinued anytime.

- Member must be 18 years or older to qualify.

- A 1099-INT will be issued to members who receive this bonus for tax purposes.

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

Avoiding Fees

Monthly Fees

Flex has the lowest monthly fee at $7, this isn’t avoidable.

Early Account Termination Fee

I wasn’t able to find a fee schedule so unsure if there is any EATF.

Our Verdict

There is also a $100 referral bonus, if it stacks then it might be worth it. Otherwise not worth it due to the monthly fee.

Hat tip to Smurfit

Useful posts regarding bank bonuses:

- A Beginners Guide To Bank Account Bonuses

- Bank Account Quick Reference Table (Spreadsheet) (very useful for sorting bonuses by different parameters)

- PSA: Don’t Call The Bank

- Introduction To ChexSystems

- Banks & Credit Unions That Are ChexSystems Inquiry Sensitive

- What Banks & Credit Unions Do/Don’t Pull ChexSystems?

- How To Use Our Direct Deposit Page For Bank Bonuses Page

- Common Bank Bonus Misconceptions + Why You Should Give Them A Go

- How Many Bank Accounts Can I Safely Open Within A Year For Bank Bonus Purposes?

- Affiliate Links & Bank Bonuses – We Won’t Be Using Them

- Complete List Of Ways To Close Bank Accounts At Each Bank

- Banks That Allow/Don’t Allow Out Of State Checking Applications

- Bank Bonus Posting Times

Can fund up to $530 with a credit card. Did not complete application because this didn’t seem high enough to me for a potential Chex inqury.

You can apply with chex frozen if you are worried about chex pull. Are you in footprint or OOS?

Hi favo, just worried about a potential pull. I work in Los Angeles.

Can confirm Chex sensitive both online, (tried about a month ago), and also Chex sensitive in-branch, (just left the branch with a denial). Chex is LOL/24.