Deal has expired, but there is now a bonus for $100.

Offer at a glance

- Maximum bonus amount:

- Availability: You are eligible for membership in SMCU if you live, work, worship, or attend school in San Mateo County, the City of Palo Alto, or certain areas of San Francisco

- Direct deposit required: No

- Additional requirements: See below

- Hard/soft pull: Looks to be soft, hard pull in branch

- ChexSystems: Unknown

- Credit card funding: At least $3,000

- Monthly fees: Avoidable

- Early account termination fee: Unknown

- Household limit: One per mailing address

- Expiration date:

April 30th, 2017October 31st, 2017

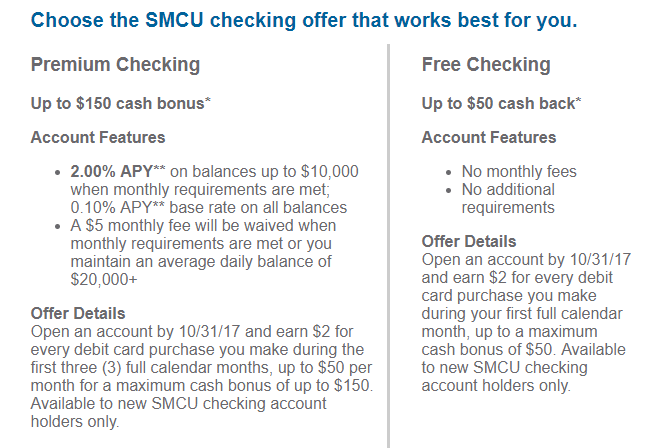

The Offer

- Open a new checking account with San Mateo Credit Union and receive a bonus of up to $150. Bonus is broken down as follows:

- Open a Premium checking account and earn $2 for every debit card purchase you make during the first three months, up to $50 per month.

- Open a free checking account and earn $2 for every debit card purchase you make during the first month

The Fine Print

- Open a new San Mateo Credit Union (SMCU) Premium or Free Checking account (no other account types are eligible) from 9/1/17 – 10/31/17.

- During the first three full calendar months immediately following the month in which the Premium account is opened or during the first single calendar month following the month in which the Free account is opened, each PIN or Signature-based purchase or payment initiated by the debit card(s) associated with the new account will earn a $2.00 cash bonus for the first 25 account-level transactions initiated, up to the maximum of $50 per month.

- Maximum payout is $150 for Premium account and $50 for the Free account.

- Additional purchases beyond the first 25 initiated transactions will not qualify for a cash bonus. ATM and ACH transactions are not eligible. I

- n the case of a joint account, purchases and payments from multiple debit cards will be added together.

-

Offer is not available for existing SMCU members who have an open checking account as of 8/31/17. SMCU employees, affiliates, and their families are not eligible. Offer may change or be discontinued at any time without prior notice.

-

Limit of one bonus-eligible checking account per individual and per mailing address.

-

Cash bonus for the month will be paid to the open, eligible checking account within 30 days after the qualification period ends. The account must have a positive balance at the time of payout to receive the bonus. Monthly fees may reduce earnings.

-

SMCU will classify the bonus as interest paid to the checking account where the bonus is credited. Any applicable taxes associated with the bonus are the responsibility of the SMCU account holder. To the extent required by law, SMCU will report the total value of this bonus to the IRS on Form 1099-INT for the tax year in which the bonus was paid.

-

You are eligible for membership in SMCU if you live, work, worship, or attend school in San Mateo County, the City of Palo Alto, or certain areas of San Francisco.

-

All memberships and accounts are subject to SMCU’s standard terms, conditions, and schedule of fees. The one-time membership fee of $10 to join SMCU will be waived as part of this special promotion. Depending on the selected checking account, a monthly fee may apply depending on certain account conditions. Ask an SMCU representative for details.

Avoiding Fees

They have a free checking account with no monthly fees to worry about. I wasn’t able to find a fee schedule so I’m unsure if an early account termination fee is charged or not.

Our Verdict

Bonus has been increased to $150 but requires 25 debit card transactions per month for three months rather than just a flat 15 debit card transactions. Makes the bonus a lot more difficult if you ask me. You can find some creative ways to meet the debit card transaction requirement here. Seems like soft pull online and hard pull in branch and they often require you to go in branch, it’s worth reading the comments on this one. For now it’s not added to the best checking sign up promo page

Useful posts regarding bank bonuses:

- A Beginners Guide To Bank Account Bonuses

- PSA: Don’t Call The Bank

- Introduction To ChexSystems

- Banks & Credit Unions That Are ChexSystems Inquiry Sensitive

- What Banks & Credit Unions Do/Don’t Pull ChexSystems?

- How To Use Our Direct Deposit Page For Bank Bonuses Page

- Common Bank Bonus Misconceptions + Why You Should Give Them A Go

- How Many Bank Accounts Can I Safely Open Within A Year For Bank Bonus Purposes?

- Affiliate Links & Bank Bonuses – We Won’t Be Using Them

- Complete List Of Ways To Close Bank Accounts At Each Bank

- Banks That Allow/Don’t Allow Out Of State Checking Applications

https://www.smcu.org/Landing-Pages/100-Checking-Offer

Anybody have any DP on when the bonus posts? Is it by month or is it all at the end of the three months? I just finished the first month (approved late oct) and made 25 amazon gift card reloads. Haven’t received anything yet though maybe I should wait a bit longer.

I opened the accounts online without any problem.I also funded $3k with CC- didn’t not see any limit though.

What card did you use?

Freedom.

Actually, I forgot to set its CA limit to 0, but the transaction shows as a purchase after it posted.

any referral for this CU?send me [email protected]

I opened online last week and received a letter asking me to go to the branch.

Looks like few things have changed since the initial DPs came in:

1. I was only able to fund $500 using CC.

2. The membership fee is not waived. It now says “Membership Account: Membership in San Mateo Credit union requires opening Share Savings Account with a minimum of $50 deposit. An additional non-refundable membership fee of $10 will be assessed at the time of funding your new account.”

Given that I have to appear in the branch, which would result in a HP and no-CC funding, I am planning to skip this offer.

1. Was that in branch or online?

It was online.

That’s odd, the fine print on the bottom of the offer page says that the $10 one time membership fee will be waived. I am a San Mateo county resident, I will try to apply online and fund $500 via CC. We’ll see how it goes. I’ll definitely screen shot that page.

Please let us know if you can fund more than $500 via CC.

Well I’m going to put this on hold. It says explicitly $500 limit. However, it’s Visa/MC only, and right now I’m only working on a minimum spend for an AMEX, so I’m going to hold off on applying for now.

@WR

I agree that its contradictory. On the landing page it mentions that the fees is waived but when going through the application process it mentions that the fee is mandatory and non-refundable. Maybe their workflow wasn’t updated as part of the promotion waiver.

Terrible experience with them so far after opening an account. Offer mentions $10 membership fee is waived but they charged it anyway. Haven’t received my debit card or anything in the mail after 2 weeks and the reps are clueless about it and tell me to go to a branch to sort it out. I have a feeling the bonus isn’t going to post automatically and you’re going to have pull some teeth for it.

I assume you opened it online. Would you share the following?

(1) Did you fund it via CC? If yes, is it treated as CA or purchase and how much did you load from you CC?

(2) Is this a hard pull or soft pull?

Thanks.

Guess I’m the guinea pig on this one. Went into a branch again. Though there were almost no customers there, still waited 20 mins for a banker. She then pulled my credit before I could even ask if there was a credit pull. lol.

Not sure how it’d be if approved instantly online, but in-branch: definitely a hard pull and cash-advance/debit funding only. Did get approved and confirmed the $100 bonus after 15 debit purchases in April.

WOW, hard pull!. Did they still allow you to fund the account via CC you provided online?

Also, I was wondering what information they tried to verify?

No, they didn’t let me fund from the cc I provided online. For me the verification was needed because I changed addresses last year. Would love to know if instant approvals are even possible though!

got a letter yesterday asking me to go to the branch.

DP called for more information as to how I can get approved and they said that basically they just needed to verify my ID and address and that the only way I can do that is if I were to go in branch. So looks like it’s not really chex related. Too bad I won’t be in the bay area any time soon to stop by their branches :/

honestly debating just driving there today, 6 hours lmao

I’m just gonna drive down for fun on Thursday, will update

Any update? It looks like no one reported to sucuccessfully opened the account yet.

Thanks for the update. Did you say you opened 8 new checking accounts recently. Were all these checking accounts opened in 2017 (in the last 2.5 months) ?

yes, I went a little overboard

Thanks for the DP. I have around 5 checking accounts opened in 2017, but your post gives little more confidence :).

I am waiting for a new CSP to arrive and will then use that for the sign-up. I live in the targeted area, so the drive will be less tedious for me, although CA-1 would be beautiful on such hot days like today 🙂

My wife is also trying to reach a sign-up bonus for a CC. I assume it would be ok for her to sign-up as well for the initial funding. I understand the $100 bonus would be issued only one per household but doesn’t hurt if both of us are able to use $3000 funding.

Just got a letter in the mail from them “unfortunately we are unable to accommodate your request fr membership based on chexsystems

your qualifile score 0577”

is that a bad score? lol I probably have about 8 new checking accounts this year

it lists a contact number and reference number so I’ll try giving them a call tomorrow.

I thought that we can safely open 10 new accounts every year, but maybe this bank is more chexsystems sensitive than average. And even that it is unclear if checking+savings at the same bank counts as 1 or 2. Maybe you should apply for a copy of your chexsystems report and see what you get 🙂

every credit union I work at tends to take chex pretty seriously compared to big banks