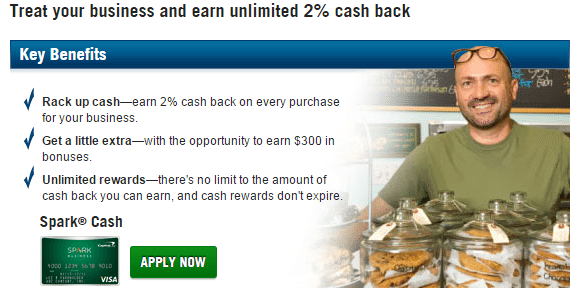

The Offer

- Capital One is offering a sign up bonus of $250 if you spend $5,000 within three months on their Spark Cash Business credit card.

- You’ll earn another $50 if you sign up one or more employee cards within the first 60 days of account opening

The Fine Print

- This card earns 2% cash back on all purchases

- Annual fee of $59 is waived for the first year

- Minimum redemption is $25 cash

Our Verdict

Usually this card only has a sign up bonus of $50 when adding a employee card (although this higher offer has been around for awhile), I’ve also heard reports of people being targeted for $500 bonuses so make sure you check for targeted offers from Capital One first.

The problem with this card is two fold:

- It has a relatively high spend of $5,000

- Capital One pulls all three credit bureaus (read my credit card application strategy as to why this is important)

The benefit is that the card earns 2% cash back on all purchases, this makes the high spend of $5,000 a bit less of an issue as long as you can meet it. I don’t think this card is worth keeping after the first year, as there are two cards that earn 2% cash back on all purchases with no annual fee (American Express Fidelity & Citi Double Cash) and a few cards that earn even more than that.

If you’re considering this card, I’d recommend looking at our page of the best cash sign up bonuses. There are three alternatives that spring to mind:

- Capital One Venture: 40,000 points ($400 in statement credit) after $3,000 in spend. Better option for those who are happy to have a hard pull done on each credit bureau.

- American Express SimplyCash: $250 after $5,000 in spend. The spend requirement is the same, but this card offers some 5% cash back categories and will only result in one hard pull

- Chase Ink Plus: 50,000 Chase UR points ($500 in cash) after $5,000 in spend. Again, spend requirements are the same and comes with 5% categories and only results in one hard pull. I’d recommend waiting until this bonus goes back up to 60,000 or 70,000 points first though.

I’m going to pass on this card for now, if I get targeted for a $500 offer then I’d probably snap it up quick smart. Capital One also offers a $250 bonus if you open a business checking account and Capital One 360 offers a $100 bonus for opening a business savings account. This card will be added to our best cash sign up bonus page.

Useful posts:

- Always check to see if you have any pre-approved or targeted sign up bonuses before applying, click here to check with Capital One.

- Capital One does not usually match you to a higher sign up bonus if you applied for something lower recently. That being said it’s always worth calling to ask.

- It should be possible to churn Capital One cards, it has been possible on the Venture cards in the past.

- Capital One does not offer expedited shipping on new cards.

- Requesting a credit limit increase is a soft pull with Capital One

- We’re currently unsure if Capital One combines credit pulls or not, please let us know in the comments.

- Click here for the most up to date Capital One reconsideration number.

- Here is a list of the best downgrade options for Capital One cards, although these are for personal and not business cards.

- Capital One does not allow you to reallocate credit limits between cards

- If you have any retention bonus data points to share, you can do so here.

Hat tip to Giddy For Points for mentioning this offer in our underrated credit card post

I just got the annual fee waived on my Spark card with a simple phone call. I has signed up one year ago when the bonus was $500.

Is the business version also good for people watching their average age of accounts or does capital one report to credit bureaus

I don’t think they would report Business cards.

I’ve been receiving targeted $500 signup bonuses for the last 6 months. I finally signed up for two cards, and my wife for 1 – my hesitation was the three hard pull issue. But I realized that was a silly concern since the vast majority of my pulls are on Experian (like many people). As such, I have lots of room on TU and EQ. Meeting min spend was nothing (although I did have a few fraud alerts on first usage on my $5K transactions, that I had to call in and clear – my advice is to call and let them note on your account that you plan to make a large charge before doing it).

Cap1 are nice to deal with. Cashback posts as soon as your charge posts, so it’s available immediately. And cashback can be redeemed in any amount at any time. No $25 min nonsense.

Plus the biggest benefit (which you thankfully don’t mention) is what makes my Cap1 Sparks and Venture cards my go-to 2% cards. As such, I’ll gladly pay the modest AF (assuming I can’t get it waived).

Do you actually have to have to business to get this card?