This offer is dead and no longer available. Click here for the best credit card bonuses.

The Offer

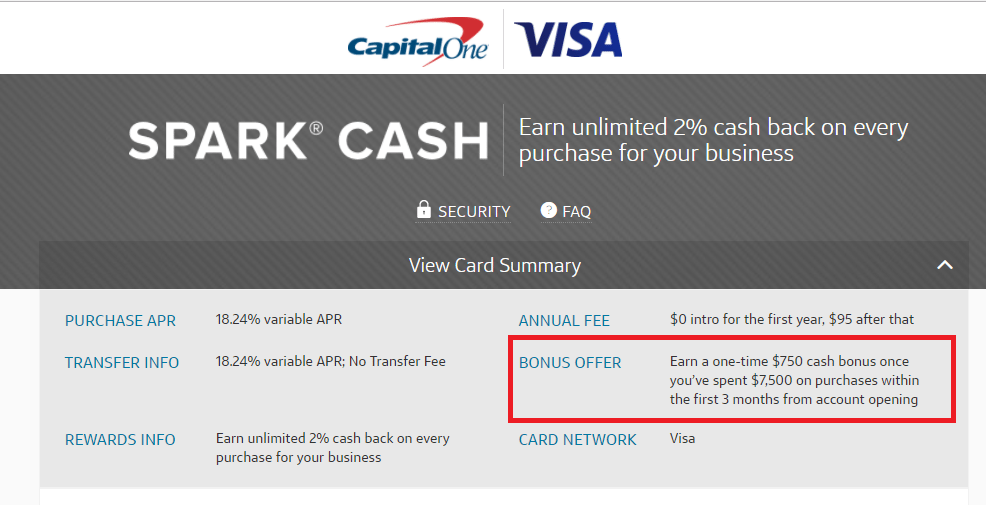

- Receive a sign up bonus of $750 after $7,500 in in spend within the first three months on the Spark Cash Visa for Business Card from Capital One

The Fine Print

- Card earns 2% cash back on all purchases

- Annual fee of $95 is waived first year

- No foreign transaction fees

Our Verdict

Public bonus on this card is $500 after $5,000 in spend. There is a targeted bonus for $1,000 after $10,000 in spend and there has even been a public bonus that was the same. I don’t think that $1,000 bonus was intentionally public and it looks like they are requiring offer codes for those $1,000 bonuses now so I’m not sure we will ever see such a high bonus on this card again. $750 is a big bonus, it’s 10% back on the $7,500 in spend but keep in mind the card also earns 2% cash back so it works out to be 12% on that $7,500 in spend.

That’s a great offer, the downside is that the card is issued by Capital One. The reason that’s an issue is that they pull all three credit bureaus. You can somewhat limit this by freezing your TransUnion or Experian reports and they will just pull Equifax and whatever one you didn’t freeze. Despite this issue I do think this is still a powerful bonus and hard pulls are becoming less of an issue for most people with other issuers cracking down on how often you can get a sign up bonus. Capital One business cards also report on your personal credit reports, this is important for anybody worrying about Chase’s 5/24 rule.

Because of all that I will be adding this to our list of the best business credit card bonuses. I’m also not sure how long this link will last, so might make sense to sign up sooner rather than later if interested.

If you have any questions about Capital One, please read this post first.

Hat tip to reader Heartlanta

Me and spouse both were approved. hope i can ms on.

I feel like capital one tightened things up with this offer and the 1k one. Bc I know someone who got denied for both yet no issue getting approved for for a venture

That was short lived.

Offer is gone now…

Link doesnt work anymore and offer ia gone…oh well waited to long on this one. Will have to wait till next off.

I have excellent credit scores. Only Cap One card i have was their sony cobrand card 5 yrs ago and still have it.

Can i apply for this business card and one of their personal card on same day? If approved would the inquiry be merged?

Pease advise

My wife was instantly approved; 4/24; 10+ years as a Cap One business checking customer. FICO – 810; Hope it doesn’t take that profile to get approved but wanted to share.

Sorry for my lack of knowledge but I have two questions.

(1) Is this card strictly for business or you can give any name as a business and go through the application without proving an actual business?

(2) If you are opening this card and have no actual business, where do you spend this much amount within certain months? I can meet 2000-3000 within two to three months without any problem but beyond that I don’t see myself spending these much. Appreciate your answers. Thank you!

You can meet the $10K spend requirement easily if you can find a bank or credit union that offers a maximum $5000 credit card funding for savings and checking account. .

1. As sole proprietor usually no docs needed, if business under your name!

2. People buying gift cards and then liquidate them, fund new bank accounts online, paying bills online even for future dates (let’s say I pay monthly $500 – I paid $1500 for 3 months in advance), etc….

Thanks for these informative posts about this new Cap One “Spark” card. (I read your other posts too). Two questions still:

1. Re. the limit of two personal cards at a time, noted the exclusion of co-branded cards… Would the latter include the GM card? (which CapOne took over in recent years from HSBC.)

2. About the pulling from all three credit bureaus, I confess to not comprehending just why is this an issue. I have a long “excellent” credit history…. 830+ realm, no issues, about at 5/24 (in no hurry for another Chase just yet), etc., etc. Each of the bureaus have very similar listings of cards I hold, have held, and my current balances and payment histories. I gather though I’m not understanding just why 3 pulls matters — if its for the same card? Maybe I’m looking at the wrong indicators… ? Be grateful for a restatement of just why this — the 3 pulls on a single application – matters. (thanks)

1. GM card would be considered a cobrand, yes.

2. Basically it means another hard pull will be shown on all three of your credit reports. Typically issues only hard pull one report. Having too many hard pulls can cause denials. So this can be considered by some as having the same impact as applying for three new cards (it’s obviously not that bad, but you get my point).

Hope that helps

Many thanks, Doc William for the reply and helpful clarification. Your comment alerted me that I’d inadvertently conflated Cards opened with hard pulls…. related perhaps, but separate indicators indeed. Thanks for the Credit Cards 101 reminder and important caution about this product. I comprehend now. (also helpful re. GM Card — have had it a long time….. 🙂 )

Glad to help

Denied with fico 730

Essentially everyone on here is around 750 or higher. Please give us more details, what we call data points. How many new cards do you have in the last 6, 12, 24 months?