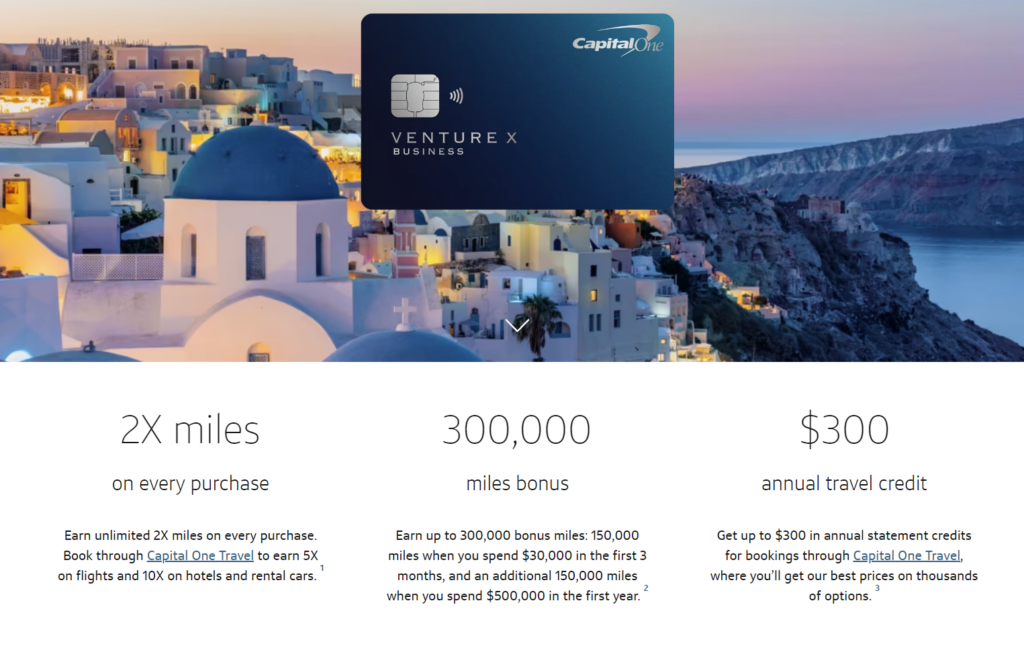

The Capital One Venture X Business card is around for almost a year, yet still requires applying directly through a business relationship manager. Interestingly, Reddit user fezud reports that they’ve changed the details of the signup bonus. Here is the new bonus offer:

- Earn up to 300,000 bonus miles: 150,000 miles when you spend $30,000 in the first 3 months and another 150,000 miles when you spend $500,000 in the first 12 months.

- Previously the signup bonus was a bit lower at 250,000 points, but had a spend requirement of ‘just’ $50,000.

$500,000 is the highest spend I’ve ever heard of, insane! It’s not even a great bonus for that amount of spend. I suppose that someone who anyway spends a ton on their card might find this bonus interesting since the card has a nice regular earn rate of 2x per dollar as well.

I was approved with an obvious churner’s profile. I’m 14/24 and have roughly 14 HPs in the past 2 years and 7 HPs in the past year.

Found a local rep, chitchatted about my business for 10 minutes, and he emailed me the application to complete.

SUB isn’t fantastic, but the first tier is doable–effectively 7x on $30k spend. Something to work on while I’m in between Amex SUBs since I’m stuck on 10 charge and 5 credits right now. I’m also stonewalled on the personal side for Cap1 so we’ll see how much I enjoy the “perks” of the Biz Venture X and if I find value in the 2x on everything compared to something like my BoA Premium (2.625%), my Citi DC (2x TYP).

Someone in a buying group chat found me a rep last year for the Spark Cash. I tried to use that same rep for the Venture X and he said Cap 1 makes you use local reps now, so he set me up with someone in my geographic region.

Just got approved P1 and P2!

jk — this spend is ridiculous.

The larger the bonus spend requirement is relative to the bonus amount, the closer the total value of the bonus tends towards zero. Ex: A $500 bonus with a $3000 spend requirement (assuming no ongoing rewards) gives you a return of 16.66%. But a bonus of $10,000 requiring say, 10 million in spend (also assuming no ongoing rewards) gives you a return of 0.1%.

This bonus doesn’t appear to make any sense to me because even if you meet both bonuses, you will be receiving 2.6 points per dollar combined (bonus + standard earnings) for the first $500K in spend. Even if you somehow could manufacture spend this much, there are cashback credit cards from other issuers with better earning ratios.

I really don’t know who Capital one is trying to target here. Any business that needs to spend that much isn’t gonna want this type of card product. They are going to be using a corporate credit card. And any business that would want to get this card is’t gonna be able to meet the bonus. But maybe this is exactly what capital one wants. They want to create a product segment for which a target customer doesn’t exist so they can make money off of people who don’t understand math.

First, spend bonus is not relative at all like you think it is. Some people will always aim for the higher bonus regardless of spend since we can hit that threshold relatively easily and you can only get a bonus “once” (ie amex biz cards 200k MR 50k spend vs 100k 10k spend). Yes, you can apply for more (or get the employee card bonus) but there is still a limit to that.

Second, 2.6% is better than any other card out there (disregarding the 2.625 with my boa biz card that has a very low limit) for general spend

Third, this is the only other charge card other than amex biz gold or biz plat that has a “no limit” which has proven invaluable in times of large purchases in a short term. Having another card network that has that capability will be very useful to me.

I personally disagree. I know I’ve chimed in here lot, I promise I have nothing to earn by pushing it. To blanket say there’s no use case isn’t accurate.

I’ll take the 2x on transferrable points with uncapped spend. Would I love 3x or 4x, sure, but it’s not realistic. If you have a specific recommendation that offers better than 2x, I’d honestly love to hear. I’ve thoughts about the Bank of America, but for a business account I cannot hit the 75% bonus to make their cards better than this one

I regularly put 200k+ on this card and that’s only limited by the balance they allow me to carry.

They aren’t targetting people who churn bonuses. They are targeting someone who wants to put all spend on one card and not mess with categories. A lot of businesses can put north of $2M on a single card in a year and they won’t think twice about trying to “optimize” that spend by opening multiple cards for the SUB.

It’s hilarious when people can’t think outside of the world of credit card bonuses. We’re a very small minority that obsesses over optimizing spend. Normal people don’t cringe at getting 2.3x for $470k worth of spend (the 2nd tier of the bonus). They just think it’s a cool benefit of a card that gives them unlimited spend.

$500,000 in spend would have to include quite a few transactions above $5,000. I’ll stick with the Ink Premier.

Maybe, but that is cash and these are transferable points that can deliver outsized value. Also, annual fee on this is effectively $0.

Couple grocery trips oughta do it.

No problem, Lovey. Signed, Thurston Howell III

Brb let me swipe my card for this house purchase

challenge accepted

I guess someone at Marketing didn’t get the memo. “What’s in your wallet?” Apparently not this damn card!

It’s accurate (crazy $500k), got a call from my BRM and I was disappointed that was the new offer. Kind of a crazy second tier, but I’m happy just knocking out the first tier.