The Offer

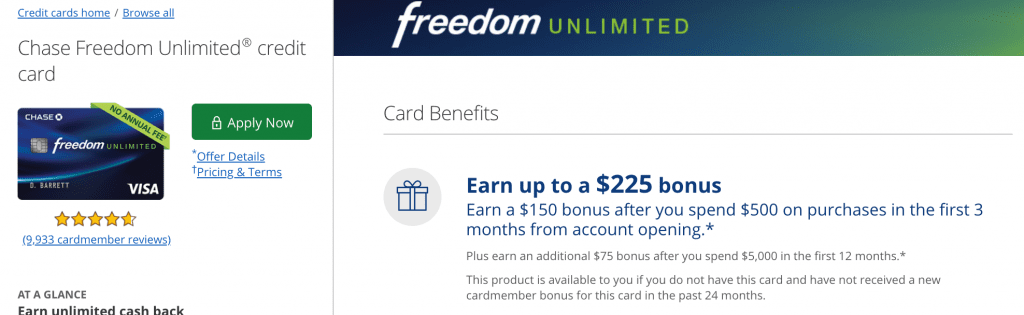

- Chase Freedom Unlimited now has a new sign up offer to get up to $225, broken down as follows:

- Get $150 bonus after you spend $500 on purchases within the first three months of card membership.

- Get an additional $50 or $75 bonus after you spend $5,000 on purchases within the first year of card membership. It sometimes shows $50 and sometimes shows $75. Refresh to find the $75 offer.

Card Details

- No annual fee

- Card earns 1.5% cash back on all purchases

- Chase 5/24 rule applies to this card

- Full review

Read: Chase Freedom Vs Chase Freedom Unlimited – Which Card Is Better?]

Our Verdict

Most readers won’t be eligible for this card due to the 5/24 rule. If you are eligible it might make sense to apply for another Chase card instead (e.g Chase Sapphire Preferred or Chase Sapphire Reserve) and then downgrade to this card at a later stage if you value the 1.5x points earning.

Offer is really worse than the $200 offer with $500 spend which became available a couple of months ago since this offer requires $5,000 in spend to get the $225 bonus. That said, if you plan on spending a lot on the card it could make sense. We’ve also seen a bonus of $300 on this card previously as well. As always if you have any questions about Chase, read this post first.

Hat tip to reader boomX

Hi Doctor. I just applied CFU and now only two card places are left ( based on 5/24 rule). Do you think it is better to apply chase freedom and CSP at current point?

(the other two cards I have are discover it and AME gold )

CSR might be better than the CSP. You can always downgrade to the CF from the CSR/CSP so I wouldn’t apply directly. Wait for a good co-brand offer as well.

I just applied to this card less than a month ago, do you think they would match me to this offer now?

no, i SM’d and called once. no dice from those greedy bastards i got mine in nov before black friday for 150 CB/500 spend in 3 months,after black friday they increased to 200 CB, and no budge. YMMV

Hey guys, I was wondering when I do go under 5/24 in 2020, should I apply for the unlimited for the bonus? I already have the Reserve bonus at 100k before, and I could always downgrade it to the unlimited that way it doesn’t affect my credit report. But, what I was thinking was downgrading the reserve to the old sapphire, and then apply for the unlimited. I already have the freedom. Does it make sense to apply for the FU? Eventually, I do want to buy a house but I don’t want it to affect my aaoa. Should I worry about aaoa? Thanks!

Just my personal take:

If you have to wait a year, I would move on to other cards for points or cash.

Yes, downgrade the CSR vs. cancelling it, seems to clearly be the better option.

Apply for the FU? again, you’d have to wait a year and even then, trying to get the Reserve, or any of the other better bonuses out there, would be best.

Your mortgage rate will depend on your credit score category, of which aaoa is just a small part of. Look up how to improve your credit score.

Oh and don’t move too much money around or open up cards some 6 months before going for a mortgage.

Oh. It’s the Chase Freedom Unlimited that has a $225 sign up. Not the Chase Freedom having an Unlimited $225 sign up.

On that additional $4500 spend, you’ll get an extra 1.67 UR/$, making it 3.17 UR/$. Could be useful instead of another regular non-MSR spend card if you are under 5/24, have no idea how to churn, like shiny blue cards, listen to Nickelback and probably pay interest on your credit card.

So if you never made it as a wise man?

Well, there is also 0% APR for 15 month. Instead of paying the balance in full while that lasts, put the money into a savings account (2% worth $100 per $5000 carried balance), CD (3% for 1Y), treasury bonds (2.6%, no-state-tax for 52W notes), or a RCA (5%), or to fund a new account bonus (+$100-$200).

Of course you need to pay taxes on that interest / bonus, and it is bad for your credit – although TBH, if your credit is generally fine, it doesn’t make much difference. I’ve lost approx 30-40 points for keeping a Discover It Miles at ~95% of my credit limit for a year, and there is no practical difference between 800 and 770 (not my scores, just example). High balances actually help getting accepted by Capital One.

So even with the $200/$500 bonus I would’ve probably spent $5000 anyway (probably even more..), so why not getting the extra $25 at that point.

chase is dead to me for CCs.

or, i’m dead to them.

i can’t imagine ever going back under 5/24.

i wonder if they’ll ever let us churners back in.

On a side note, Chase sent me an email that they are upgrading my CFU to visa signature so I am wondering if this card now comes as signature by default.

Your post says the $5,000 spend has to be in the first three months. It’s actually the first 12 months, according to the link.

Fixed, thanks

who here is eligible for a chase cc?

me. 🙂

Are you going to apply for this?

Not sure, have the ink preferred, and chase freedom.

Might make more sense to go for the sapphire.

me!

I am currently debating between Ink unlimited or United biz.

😉

Why not the CIP?

Got it in December.

Give me a month. But this isn’t worth it. If the Amex Green is $119 with Prime for a year, I might get that. Or if the AF is waived the first year and Prime is a benefit, though I still will want a sign up bonus to make it worth it.

Other than that, the BOA Cash Rewards and Premium Rewards is tempting, but I might wait a year or so.

My wife only applied to business cards in the last year or so. She’s at 2/24. (+10ish business cards)

I am.

I am. Just fell to 1/24, have a CSR / CIU / CIC. Maybe CIP next, if I can figure out how to handle $5k spend.

Me and my P2. We just dip our toes in the personal card waters and focus on biz cards to stay under 5/24. I would never blow a 5/24 slot on this when I could get something juicy like Arrival+ 70k points.

The one time last year when this card offered 3% CB for the first year. That was awesome. I wonder if its time for Chase to make this or the ink unlimited more compelling and take Amex BBP head on

Bitter I missed that one.