The Offer

Direct link to offer (if the offer doesn’t load try refreshing or using a proxy. It’s possible they are split testing the two different offers)

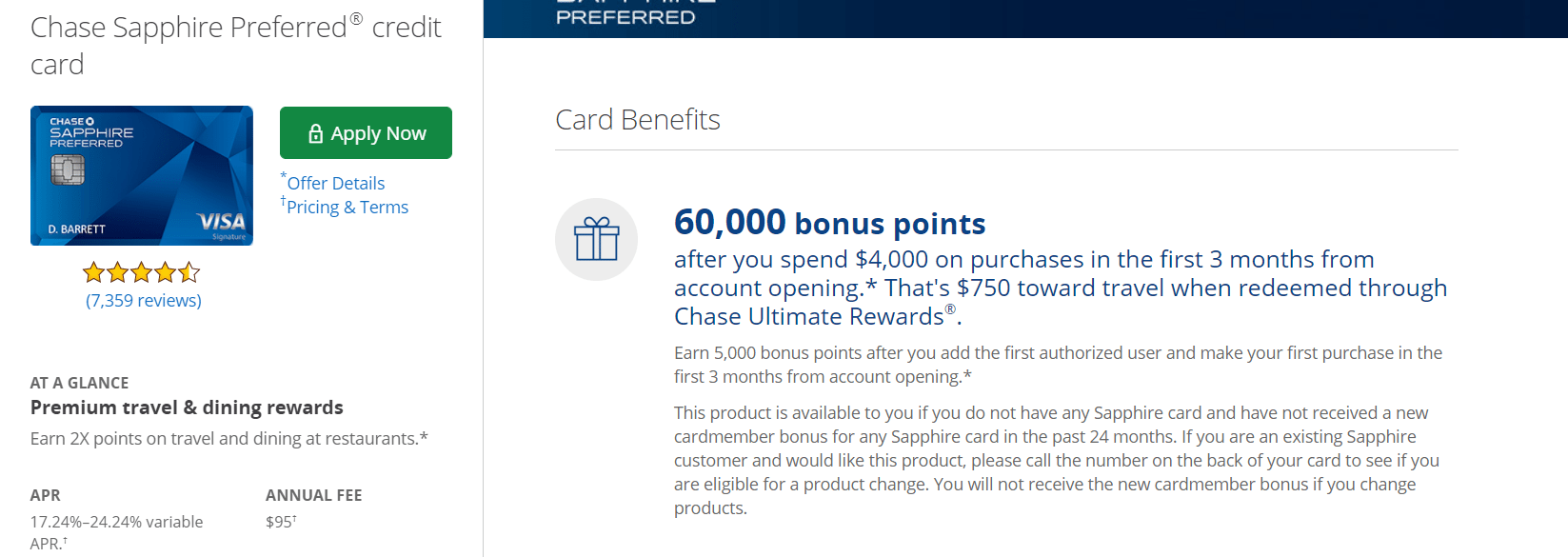

- Chase has increased the sign up bonus on the Chase Sapphire Preferred to 60,000 points after $4,000 in spend within the first three months. Annual fee of $95 is not waived in the first year

- You also get an additional 5,000 points after adding an authorized user and making your first purchase

Card Details

- Annual fee of $95 is not waived first year

- Card earns at the following rates:

- 2x points on dining at restaurants

- 1x points on all other purchases

- Get 20% off travel when redeeming points for airfare, hotels, car rentals and cruises through Chase Ultimate Rewards (basically making points worth 1.25¢ each)

- No foreign transaction fees

- Gives the ability to transfer all Chase Ultimate rewards points (including points earned on Chase Freedom, Chase Freedom Unlimited & Chase Ink Cash) to travel partners

- Read our full review here

- Chase 5/24 rule applies to this card

Our Verdict

Normally the sign up bonus on this card is 50,000 points with the annual fee waived. With this offer you’re basically paying $95 for 10,000 Chase UR points, they cash out at 1¢ so worst case scenario this offer is $5 better. Most people will get more than 1¢ due to the Chase travel partners though. Keep in mind it’s sometimes possible to get 60,000 points in branch with the AF waived, that offer is usually reserved for Chase Private Client members but sometimes others can get it as well. Sadly most people won’t be eligible due to the 5/24 rule. Also keep in mind the one sapphire rule (you can get around this somewhat by applying for multiple sapphire cards in one day) If you are eligible then this is a strong offer, although I’d try and see if you’re targeted for the in branch offer first.

If you have any questions about Chase, they are probably answered in this linked post. It includes things such as the Chase reconsideration number and how to check to Chase pre-approval offers. I will be adding this offer to our best credit card bonuses. Chase will generally not match sign up bonuses when the annual fee has changed (as is the case here), but it never hurts to ask.

Hat tip to ramonortiz55

Could anyone still get the 60K application page?

could anyone still get the 60K offer applicaiton page

You can get a referral link from rankt or CreditKarma to get the 50k / waived AF offer still, if that’s more your speed. If you’re cashing out instead of redeeming for travel at >1 cpp, this probably makes sense.

i applied january can i get them to match this offer?

Does anyone know how long you have to wait until you apply for a new Chase P. if you are approaching the annual fee on your fist card? Will the rules change for the people that got a different offer on this card even with the 5/24?

Update : Got shot down.

CSR: Your account is not eligible for the offer you requested, therefor the original offer of 50k will remain on your account.

Worth a shot.

How did they reply back? i saw one DP that seems to suggest that SM does not know of the higher 60k public bonus.

Dear ___,

We’re happy to review your request for a sign up bonus

offer of 60,000.00 points.

____, your account is not eligible for the new offer you

requested. The original offer you applied for will remain

on your account. The offer is:

– Earn 50,000 bonus points after you spend $4,000.00 on

purchases in the first 3 months from account opening.

– Earn 5,000 bonus points after you add the first

authorized user and make a purchase in the first 3 months

from account

opening.

Wow, how did the public offer go up to 60K!

Edit: Oh wait – the AF is not waived.. That makes sense….

Double dipped CSR/CSP earlier this month for gf.. sent a SM asking to match CSP bonus with this one, will report back..

Am thinking of doing the same. Just to confirm, if we double dip, not only should you get approved for both, you should also get both bonuses, correct?

Correct

Would double dip work if I’m 4/24 or only if I’m 3/24?

It will work in both cases.. but it is recommended to do it while on 4/24 so you can get 3 Chase cards before going 5/24, one at 3/24 and then two at 4/24..

Could you please help me understand how to double dip? I’m currently 2/24. Really appreciate. As for the 5/24 rule, am i correct the it refers to the opened account not the hard pull right?

Correct.. and not that it matters but as a precaution I would meet minimum spend on both cards on the same day and with same merchant..

Oops, didn’t read other comments. Will try to match right now.

Can you be sure to let us know your outcome. As I will do too. Thanks.

I was approved for the 50k offer two weeks ago, sent a SM last week asking for a match. Said no, and the offer was only available for CPC apps only.

yeah, u never know. The Chase Ink+ was one example. Most people who applied online for 60k asked for the 70k match but many were told that the 70k match was in branch only. ppl who did do in branch were able to get the match but no one who applied online did. It took about a week of a lot of ppl SMin they finally gave in and gave everyone who applied online the 70k match.

Im rooting for you all! :]

Hey Doc, signed up for the 50k offer last week and just got the card. Anyway they would match to this offer through SM? Ive done it in the past with SW cards.

Chase will generally not match sign up bonuses when the annual fee has changed (as is the case here), but it never hurts to ask

Added that to the post since people keep asking